Portfolio Updates: Q1 2017 Total Income

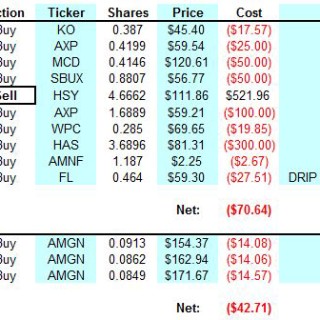

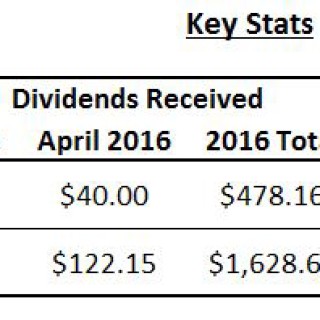

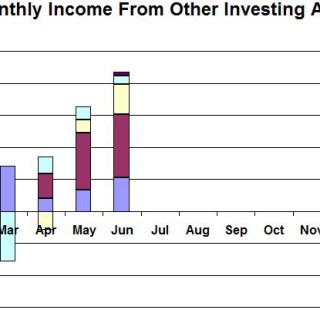

It’s finally time to report my progress for the first quarter of 2017. I’m pleased to say that I’m off to a great start! I’m still raking in tons of dividend income and my other investment activities, like options and swing trading, are really starting to take off. In this post I’ll provide an update on all of my investment activities over the last 3 months. This will include dividends received (Empire portfolio and Retirement portfolio), income from transform your business, swing trading and peer to peer lending (lending club). Payroll administration services for small businesses cater specifically to their resource-saving...