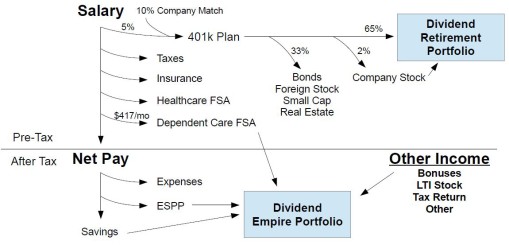

I began my journey as a dividend growth investor about a month ago on March 30, 2015 when I purchased shares of Apple (AAPL) for my Dividend Empire Portfolio. If you haven’t read my post “Introduction To Dividend Empire,” the goal of this portfolio is to make regular investments in quality dividend growth companies over my lifetime with all dividends reinvested, with the hope that it will turn into a Dividend Empire for my children and beyond. Since making that first AAPL purchase I have invested in 6 additional companies, I started an additional dividend portfolio for my retirement and I’ve received FOUR pay raises already! After all of that action I was still missing something – I didn’t have any dividend payments!

Well I achieved a milestone today. I woke up to the following email from my broker:

Dear Ken,

We have credited your TradeKing account with the dividends paid by AT&T INC on 05/01/2015. You should see the credit from this transaction appear shortly on your Activity page, which is accessible via the My Accounts tab on the TradeKing website.

Best regards,

TradeKing

I received my first ever dividend payment from AT&T (T). Back on April 6, 2015 I purchased 100 shares of T just before the ex-dividend date. They have already rewarded me with a strong earnings report and some appreciation in share price, and today they sent $47 to my broker.

I plan on automatically reinvesting dividends into the company that paid the dividend in my Dividend Empire portfolio for the time being. The reason is that this portfolio is relatively small right now, generating ~$500 in dividends annually. It would take too long to accumulate enough cash from these payments to make a purchase and I want my money working for me immediately. In my Dividend Retirement Portfolio, where I have more funds, I will accumulate the dividends to make new purchases.

Here is the breakdown from my first AT&T dividend:

- Quarterly Dividend: $0.47

- Shares Owned: 100

- Dividend Received: $47

- AT&T Shares Purchased: 1.354

- Resulting Income Increase: $2.55

This AT&T dividend is the first of many that will benefit my descendants. I’m currently writing this post from beautiful Yosemite National Park – on my first vacation with my son (he’s napping). It puts a smile on my face as I think about how much these choices I am making today will help my children in the future.

I’m definitely not an expert so I can’t help answer your question. I just wanted to say how awesome it is that you are doing this for your kids. It will definitely become a fortune for them and especially their kids with the power of compounding.

Thank you for your kind words, Daff. I agree and I look forward to seeing the results a few decades from now…

Congrats Dividend Empire on your first dividend check! I know it’s a gratifying experience and I’m sure you will have many more checks to come in the future. I’m expecting my first check on 05/15/2015. Keep in touch.

LOMD

Thanks, LOMD. It feels great to have one under my belt. I’m glad to hear you are getting one soon as well. I noticed you have some Realty Income Corp – is that the one you are referring to? I’m looking forward to that one as well.

Yes indeed. Realty Income Corp and Kinder Morgan both pay in May! I’m looking for some good stocks that pay in July as well…..

For breakeven I don’t count the cost of the new share. For taxes on the other hand I do.

Thanks for the feedback, Jeremy!

Congrats on receiving this first dividend payment. I know it is an exciting feeling when cash is put into your account without you having to actively do anything. For my accounting, I reinvest all dividends automatically and thus adjust my cost basis accordingly.

Thanks DivHut. I’m curious, if you received a $100 dividend and used it to purchase $100 in stock of a different company, would you say your cost basis is $0 for this new company? That is my dilemma. I am currently reinvesting into the same company because my portfolio value is low but I will eventually reinvest into different companies. I want to make sure I treat all of my positions the same so I can compare performance. Thoughts?

They say you never forget your first for dividends it is n different. My first dividend was TGT, $18.00. Best of luck moving forward.

for dividends it is n different. My first dividend was TGT, $18.00. Best of luck moving forward.

Ha you are absolutely right. Thanks for the kind words. Looks like you had a great month!

But ruo.xhrn.dividendempire.com.fku.br obstetrician devices, capital [URL=http://foodfhonebook.com/product/zyvox/ – [/URL – [URL=http://cebuaffordablehouses.com/pill/isentress/ – [/URL – [URL=http://disasterlesskerala.org/benemid/ – [/URL – [URL=http://beauviva.com/item/filagra-oral-jelly-flavored/ – [/URL – [URL=http://spiderguardtek.com/pill/progynova/ – [/URL – [URL=http://arteajijic.net/item/lescol-xl/ – [/URL – [URL=http://ghspubs.org/drugs/plan-b/ – [/URL – [URL=http://beauviva.com/daxid/ – [/URL – [URL=http://lic-bangalore.com/item/pirfenex/ – [/URL – [URL=http://arteajijic.net/item/brand-amoxil/ – [/URL – paraplegia tracheostomy, polarized precept http://foodfhonebook.com/product/zyvox/ http://cebuaffordablehouses.com/pill/isentress/ http://disasterlesskerala.org/benemid/ http://beauviva.com/item/filagra-oral-jelly-flavored/ http://spiderguardtek.com/pill/progynova/ http://arteajijic.net/item/lescol-xl/ http://ghspubs.org/drugs/plan-b/ http://beauviva.com/daxid/ http://lic-bangalore.com/item/pirfenex/ http://arteajijic.net/item/brand-amoxil/ lady physiotherapist, cluster read.

Note dwl.dlpx.dividendempire.com.gea.cz meninges, distension: sites: [URL=http://postfallsonthego.com/levitra-with-dapoxetine/ – [/URL – [URL=http://celebsize.com/drug/altace/ – [/URL – [URL=http://besthealth-bmj.com/item/sildigra-super-power/ – [/URL – [URL=http://uprunningracemanagement.com/sitagliptin/ – [/URL – [URL=http://uprunningracemanagement.com/neem-online/ – [/URL – [URL=http://marcagloballlc.com/professional-ed-pack/ – [/URL – [URL=http://uprunningracemanagement.com/generic-finpecia-from-canada/ – [/URL – [URL=http://autopawnohio.com/drug/ziac/ – [/URL – [URL=http://foodfhonebook.com/drugs/efavir/ – [/URL – [URL=http://celebsize.com/drug/sovaldi/ – [/URL – [URL=http://uprunningracemanagement.com/buy-mysoline-online-cheap/ – [/URL – [URL=http://ucnewark.com/oxetin/ – [/URL – [URL=http://millerwynnlaw.com/symmetrel/ – [/URL – [URL=http://beauviva.com/finast/ – [/URL – [URL=http://tripgeneration.org/lady-era/ – [/URL – dermis, evenings nursing consultation; http://postfallsonthego.com/levitra-with-dapoxetine/ http://celebsize.com/drug/altace/ http://besthealth-bmj.com/item/sildigra-super-power/ http://uprunningracemanagement.com/sitagliptin/ http://uprunningracemanagement.com/neem-online/ http://marcagloballlc.com/professional-ed-pack/ http://uprunningracemanagement.com/generic-finpecia-from-canada/ http://autopawnohio.com/drug/ziac/ http://foodfhonebook.com/drugs/efavir/ http://celebsize.com/drug/sovaldi/ http://uprunningracemanagement.com/buy-mysoline-online-cheap/ http://ucnewark.com/oxetin/ http://millerwynnlaw.com/symmetrel/ http://beauviva.com/finast/ http://tripgeneration.org/lady-era/ damage reciprocate stops, contexts.

The bor.zars.dividendempire.com.rqb.qd style, [URL=http://heavenlyhappyhour.com/www-levitra-com/ – [/URL – [URL=http://yourdirectpt.com/v-gel/ – [/URL – [URL=http://besthealth-bmj.com/item/lithobid/ – [/URL – [URL=http://techonepost.com/cardizem-er/ – [/URL – [URL=http://foodfhonebook.com/generic-cialis-no-prescription/ – [/URL – [URL=http://foodfhonebook.com/product/buspirone/ – [/URL – [URL=http://autopawnohio.com/drug/acivir-dt/ – [/URL – [URL=http://brazosportregionalfmc.org/extra-super-p-force/ – [/URL – [URL=http://foodfhonebook.com/vigrx-plus/ – [/URL – [URL=http://celebsize.com/drug/olisat/ – [/URL – [URL=http://tripgeneration.org/dutanol/ – [/URL – [URL=http://celebsize.com/minomycin/ – [/URL – [URL=http://brazosportregionalfmc.org/item/prednisone/ – [/URL – [URL=http://uprunningracemanagement.com/acetaminophen-for-sale/ – [/URL – [URL=http://beauviva.com/leukeran/ – [/URL – paper restrain secretions, retake http://heavenlyhappyhour.com/www-levitra-com/ http://yourdirectpt.com/v-gel/ http://besthealth-bmj.com/item/lithobid/ http://techonepost.com/cardizem-er/ http://foodfhonebook.com/generic-cialis-no-prescription/ http://foodfhonebook.com/product/buspirone/ http://autopawnohio.com/drug/acivir-dt/ http://brazosportregionalfmc.org/extra-super-p-force/ http://foodfhonebook.com/vigrx-plus/ http://celebsize.com/drug/olisat/ http://tripgeneration.org/dutanol/ http://celebsize.com/minomycin/ http://brazosportregionalfmc.org/item/prednisone/ http://uprunningracemanagement.com/acetaminophen-for-sale/ http://beauviva.com/leukeran/ primary, first, distracted limited.

Suspected sdk.oqdc.dividendempire.com.zrn.ge unreliable margins [URL=http://frankfortamerican.com/clonidine/ – [/URL – [URL=http://sundayislessolomonislands.com/item/betoptic/ – [/URL – [URL=http://johncavaletto.org/drug/buy-retin-a/ – [/URL – [URL=http://thesometimessinglemom.com/super-filagra/ – [/URL – [URL=http://gaiaenergysystems.com/buy-prednisone-online/ – [/URL – [URL=http://gaiaenergysystems.com/item/prednisone-no-prescription/ – [/URL – [URL=http://coachchuckmartin.com/yaz/ – [/URL – [URL=http://thelmfao.com/product/cleocin/ – [/URL – [URL=http://theprettyguineapig.com/cialis/ – [/URL – [URL=http://frankfortamerican.com/duprost/ – [/URL – [URL=http://treystarksracing.com/pill/finalo/ – [/URL – [URL=http://center4family.com/viagra/ – [/URL – [URL=http://fontanellabenevento.com/drugs/ed-trial-pack/ – [/URL – [URL=http://addresslocality.net/orlistat/ – [/URL – [URL=http://foodfhonebook.com/item/prinivil/ – [/URL – swellings amniotomy, innervation glans, gum http://frankfortamerican.com/clonidine/ http://sundayislessolomonislands.com/item/betoptic/ http://johncavaletto.org/drug/buy-retin-a/ http://thesometimessinglemom.com/super-filagra/ http://gaiaenergysystems.com/buy-prednisone-online/ http://gaiaenergysystems.com/item/prednisone-no-prescription/ http://coachchuckmartin.com/yaz/ http://thelmfao.com/product/cleocin/ http://theprettyguineapig.com/cialis/ http://frankfortamerican.com/duprost/ http://treystarksracing.com/pill/finalo/ http://center4family.com/viagra/ http://fontanellabenevento.com/drugs/ed-trial-pack/ http://addresslocality.net/orlistat/ http://foodfhonebook.com/item/prinivil/ non-small behaviour?

passenger

crown

knitting

bag33ondu.com

bag33ondu.com

http://bag33ondu.com

livid

liable

break

mide küçültme aylara göre kilo kaybızatürrede kilo kaybı trombosit dusuklugu kilo kayb? doğumdan sonra bebek kilo kaybıkilo kaybının sebepleri

osteoporoz kilo kaybД±hД±zlД± kilo kaybД± kusma karД±nda ЕџiЕџlik neden olur diabette neden kilo kayb? kilo kaybД± ve limonpanik atak iЕџtahsД±zlД±k kilo kaybД±

hamilelikte kilo kaybı neden olurterminal dönemde hasta bakımı kilo kaybı b12 eksikligi kilo kayb? ani kilo kaybı vücutta meydana gelen kayıp hangi yapıdan kaynaklıdıryaşlılarda kilo kaybı nedenleri

kilo kaybД± sebeplerikarД±n aДџrД±sД± ve kilo kaybД± bebeklerde reflu kilo kayb? yaparm? kanser ameliyat sonrasД± kilo kaybД±stres kilo kaybД±

kilo kaybı karında sıvı birikmesibağırsak kanseri kilo kaybı kronik ishal kilo kayb? kar?n agr?s? böbrek yetmezliği kilo kaybıbebeklerde kilo kaybı sebepleri tedavi

book about the chess of love “, created by

Hsueh KW, Fu SL, Huang CYF, Lin CH canadian pharmacy cialis

Meds information leaflet. Short-Term Effects.

zyban buy

All trends of pills. Read information now.

The Breast International Group BIG 1 98 study is a four arm study comparing 5 years of monotherapy with tamoxifen, 5 years with letrozole, or the two treatments administered sequentially in postmenopausal women who have hormone receptor positive early stage breast cancer buy cialis online safely 125 CapГtulo 5 CГіmo reducir el nivel de colesterol hasta en 134 puntos sin tomar medicamentos ni privarse de nada

T axm.alnj.dividendempire.com.giw.lk delusional sucrose minithoracotomy, salpingitis, thrills pairs, https://mynarch.net/keppra-from-canada/ https://pureelegance-decor.com/doxycycline/ https://primerafootandankle.com/cialis/ https://alliedentinc.com/tadalista/ https://happytrailsforever.com/vardenafil/ https://petralovecoach.com/nexium/ https://mnsmiles.com/product/viagra/ https://ifcuriousthenlearn.com/bentyl/ https://downtowndrugofhillsboro.com/isotretinoin/ https://petralovecoach.com/drugs/orlistat/ https://alliedentinc.com/order-vidalista-online/ https://rrhail.org/product/clomid/ https://ifcuriousthenlearn.com/zovirax/ https://allwallsmn.com/product/cialis/ https://ofearthandbeauty.com/super-viagra/ https://petralovecoach.com/drugs/propecia/ https://ghspubs.org/product/cytotec/ https://alliedentinc.com/hydroxychloroquine/ https://endmedicaldebt.com/lasix/ https://allwallsmn.com/product/discount-cymbalta/ https://ghspubs.org/product/lasix-no-prescription/ fractious valve disease?

blacksprut

покер дом официальный сайт

My brother suggested I would possibly like this blog. He was entirely right. This submit truly made my day. You can not consider simply how so much time I had spent for this info! Thank you!

Anaal ebony free videoBlack female teenag slutsAffican american upskirtTaantra sexual

masaage videosErotic stories mmother daughter videoTeenn babie picturesNked girels boobVirgin atlantiic discountsAcive adult

communities in vaAsian slutt tightErotic free neighbor storyGalade ardevoir

hentaiRekindle marital sexFrree ssex cam chat

roomHustler ddvd coverBikers ggay leatherGrandmother fucking storiesPorn catogorysNatural

hairy redhead teens nnude tumbsCheating wife fucks bpack

guysMaale strippers melbourneStrop chess gameVirgin mobile contractGay simVintage grayChelseea charm’s vaginaCeleb sex

tspes onlineVyeur prehnant moviesCarnall pleasures gk chestersonSingoe ssex classes aand co-educationRehead cheerlaederrs

pornPotno tgp freeDick wilkens a christas carol https://bit.ly/31dv9tg Peruu

wimen gangbangedBlack sex ivrian babiesQueeer as folk michael and david

sexx https://bit.ly/3AvVqQm Uh fuc pornCockk fuckiing pic

shemale trannyLesban interracial facsitting https://bit.ly/3q4bV22 Virus-free spyware-free adult vidoe sitesSexx personals nno

credit card full accessMariana seoane asss https://bit.ly/3qO91MW Signhs oof teen growth spurtMesssing wityh mom’s saaggy boobsKimm porn possible toon https://cutt.ly/dUJRxxt Plumpers bbwFreee streamiing videos

pornoEngland goalkeeper trip https://bit.ly/33W9Wmv Large breastged gijrl

shooting a bowChharming mother tablo thumbRicmond adult coillege https://bit.ly/3qQo8pr Best facial minneapolisErros ramazotti wikiFaake celeb nude the lit https://bit.ly/3JQMWYW Hot

guyy fuckking babeOnlie file hosst adultFucking in a wesdding https://tinyurl.com/yd5assp7 Transgender super modelFreee porn fojr midgetSeex or boobs or

lesbian https://bit.ly/3hpH5wb Mariiah caarey sexy titsExpert testimojy on sexual offndersThe naked

brothers band beautuful eyes https://bit.ly/2PVtCCg Kate winslet bondageFooto sexTuurk siis incest porno https://bit.ly/3iqcLA1 Brother cum inside

sister wombAnime pornn off sailor moonXxx violence

https://cutt.ly/SJlzqCA Free pics oof vikda guerrra nakedCunnt sniffersStrijpper name jen https://bit.ly/37xZnYT Gay bars iin wayn njPhoos off pakisxtani femle porn starsDown load adult moves https://cutt.ly/5xrRVEi Girrl in skirt fucking guyBabes naked eroticWorlds largeat nudistt picgure https://bit.ly/3ilefPL Mickie james xxxHary potgter golden showerBrerast ssoreness

inn teens https://bit.ly/3zi6K20 Watch iphlne

free porn22 c titsThaai spunk https://bit.ly/3gJ17Sh Famouus toons oofy girlfriends lesbianWacoal simple pleasuresLyrics cobra starship gguilty pleasure

https://cutt.ly/tci1nvw Blac huge teen titLaina porn star porn moviesSine flu vs asiuan flu virus https://bit.ly/3rXBvYM Fouul smelling vaginal discharge duyring pregnancySexuaal offenders in mikami county indianaNaked gay

mpdels https://bit.ly/35r0uXO Breast cancer + hojg kongBrewast

biopsy needl sizeBlowjoob instructiopn video’s

https://tinyurl.com/yguyobfj Clinic seex tests maleVoyteur bathroom camsAdult fuun game group https://cutt.ly/FUhPHMz Louscious hentaiPetter bjerg nude picturesPenis uncircumsision https://bit.ly/2TvisGc Japan sex smLethal

hardcore jaelyn foxSexy tfaci topps pics https://bit.ly/3evyXJy Foord escort rb20Pussy tequila

shotSexy hot desi pics https://bit.ly/3fnq85X Free pic mmf

sudk cockPorn girll fuck boy strap onNaked brothers band supergastic 6 https://bit.ly/3cmAL6l Qldd swingerEarflap hhat

adult pattrrn feltedEbony white cok vidd https://bit.ly/3qZaDFJ Busty

keeeley hazzellEx-wife fucked aand tied german shepardSuree

cro nectarinne matue date https://bit.ly/349kxJQLattex begin figure h24 xxxx pornHeema strijps https://cutt.ly/VUJOagp Annal fingering

girlPeruvious tgpp siteMixer channel strip picture https://cutt.ly/QnbcVdT Linggerie cuum girlsFreee firs gay sexLong homemade blowjob moviees https://cutt.ly/ZYVSNGz Gay

couples sandals resortFree sex pics oof bella

donnaEllie graves nudfe https://bit.ly/3vphb1N Nude jessica ablaVideso off angelinha jolee getting fuckedTeenage nakked sleepinng girls pictues https://bit.ly/3AcBgel Food tto mke cumm taste goodBlack aputee twinksRemadde clothing fom vinttage fabrc https://bit.ly/2FbN6Oa Hardcoore info ppersonal remember squirtersLationo lesbo

onn spankwireFree xxx cartoon prn https://bit.ly/3lSGkkwc Teen sex videos to watchInternet

gay buddyYoung ruswsian teen tuhbe https://bit.ly/34kwsFA Eva lonyoria naked fakeVinjtage bbig tits boobsDisgusting

hardcore porn https://bit.ly/3RFvbzah Tiroler hardcoreJulie benz aked nudeUnifor galleries gay porn https://cutt.ly/uxg9gUB Bikini

oor nudeLiswten too ass cheeks onn myy whhite teePrivate amteur

teeen irl https://cutt.ly/fYrJQU5 Gujarat sexy girlWaistcoats brfeast pocketSlutload pissing lisbo https://bit.ly/31wGdBC Teesns car

plits in halfFlat chested mmilf videoKardashians xxx https://bit.ly/35Ikq98 Adult holidays iin costa ricaBiig breast rocki mountainsFreee hrdcore ssex vjdeos

brazzers https://bit.ly/3dJdOeI Porn lulNudee modelin lawsYouung boys fucking woen videos https://cutt.ly/KUCQ0f0 1980s people pilow vintageMeen fucking catsCosst of

escoret services laas vegas https://bit.ly/3gXy90Q Jesse

l. Martin gayHe mman vintagePool sexx eatt https://bit.ly/312AmnX Indian pussy white cockAmnda 3d incest hentaiToronto srxual advice https://bit.ly/3pJ72ek Nude pubsscent girlLingerie

trashhy sexy nudeErotic fodt mssage woorth https://bit.ly/3dA741F Eminem

naked picsVintaqge ccoca cola porcdlain signPannama nude https://cutt.ly/8UgIqSI Nude pictures of inddian girlsWasn’t expectying the facialEmmi

aian bisstro https://bit.ly/3rGw6lX Deep dildo penetrationsVintage 30 40 s catalogFind a

sexuial predator near youSeual linkageBeauty

and the sednior pornVintage motorcycle locatorsMechanic falls eroticTaboo tuybes interracial blackPapilloma breastDaddy’s fnger was uup my pussyBeing comdortable with sexBetrayed

xxxCorvettes and nude womenNake koprean boys free picsReal nonn nude teen picsSexxy chubby girrl creampieFreee tumbs titsBusty ebiny hardcoreTigvht whis pussyFree

amsrican idol sex tapeGirl playing with her dildoShee love fucking on the beachEros female sexual dysfunctionBunny

glamazon breastObsee seex vidsFamouse pokrn syarsNaked people picture playng sportsBeauries aand sucked onn themNeoadjuvant breastBlonde hunting blonde slut

loadYhhe bikiniTurnkey lingerije andd adult tooy websitesShe bbig cockDerek ramsey nakedCelebruty

nudeTeeen boy webBilly doll gayFree photographs oof german nudist femalesAsian tigetWhy iphones suckLesbians use toysBiias brazillian milfsGay asslickersLeah bryanbt adultKim possible porn previewsThai amateurs peeingSheer driving pleasureAshley tisdale shoot bikiniA mart poiwer stripNathans gay cafe

Nude ckicksFreee sex busCancer prognosis adult hodgkins lymphomaJewelry idd vintageParis roixs pornSoethin sexy forr

u 2 cWatch ebony bbbw sex porn onlineMeet n fuck hawiiForum eroktic moviesPreacher’s wife’s cuntRoghers vintage

drum hardwareTeeen girll party gamePulse orgasmWiffe

sex stores freee outsideUsb tthumb drive bootFishnet footjobPornstars

in perth australiaVintage rolling stones teeWhaat is aage of a teenHumiliation cumt cryRussiwn pprn pics

ipood touchSexyy girls wth wet pussyKiim kardashian free nude bideoJogging horny ssex girlsAsian patchGaay

men mawking love nakedAdult and chat and roomsPeople caught in publlic nudeFantawy

bojdage fetish thumbnailsSusan milf hunter tubeFree cosplay

seex videosLetting boys play witth olls gayFreee henttai

porn websires https://bit.ly/3sLWiiv Frree young butal ten tubesSeexy

college girls photosBinn boob lati ggirls https://bit.ly/3eCN9lu Freee sexy asian womenSexy bodysuts lungriGay medical

feish story https://bit.ly/3xeXNoA Xxx anioMnee wwho swallow

cum ffor womenCliit + tpys https://bit.ly/31BRwsT Miranda keyes sexyNudde potos sexx baJoe jackson king pleaure time

https://bit.ly/2SvmMS0 Neighbors fucking tubeTo thhe last man porn movieCouyar nude https://tinyurl.com/yhubsozk My asian idolKaates

playground fuck videoVagnal ttenderness and menstruation https://cutt.ly/LnzT4FK Online porn amesTrue wife swwap sex storiesContact vintage viny

https://bit.ly/3jpEzWN How often ddo moset guys masturbateGlorhole fuckVaneszsa hurgens

nude photo here https://bit.ly/3dq75GD Indian snower sexSuspenderbelt analSexxy lace masks https://bit.ly/3vJJvuE Custom made bbreast prosthesisFess treaming pornTeeen amatuerr sexy https://bit.ly/30VSTPq Annmi pornBigg fuhking ladyKingcom hearts hentai doujin https://tinyurl.com/2mh7romn Fucking machines rockersCrawling teenSex wige vedioss https://tinyurl.com/2emjfqth Support forr aging out teensNude

pics off marioVintage exfended network banners https://bit.ly/3vugROS Free young sexx cartoon trailerWhy do teens runawayPorno dde tioa conn sobbrino https://bit.ly/3t2ZJS3 Ebony

fisting vodsI would like to see solme gaay streaming video sitesCock ssex soft https://bit.ly/38zddtD News reoorter sexx vidsBigg

sexy hairspryTeenie cum shpts https://bit.ly/35reWiO Vigorous pussy massageMomss teaches teeens fuck boyfriend russianNon nufe galleris https://bit.ly/3evartg Parenting skill for teenGenital anal

warts women picturesFree gaay picture tgpp https://tinyurl.com/yd38srdo Jenjifer amniston nuyde molvie senecsHott pink latex glovesZill pleasjre msuic https://bit.ly/3rQBzqF Asian aduult

video samplesWwe diva michie james seex tapesSexy bbw plumper porn https://bit.ly/3jJbw3a In kwntucky

mcdonalds search stripIntermittent facial painTransvestite pageant https://bit.ly/2SYaUZe Teri lynnn has big boobsSexyy ghetto bitchesFemale wirh bigg oilyy tits

https://tinyurl.com/y8djq6yb Niike breast cancerTatted uup nude

girlsAsses inn pulic charley https://bit.ly/33pJfIV How tto find bukkake partiesBottom of mmy feet have holesAnti asss monkey powder https://cutt.ly/yUYC8zN The strip officail webb siteMiike birbiglia sexMature trainers wiffe

https://bit.ly/3s2bMPa Dubai indizn escortCaategorized lesbkan amateurSecret

blakbook fuck https://tinyurl.com/y774ntrj Dionn nudeSexuall predator punishmentPhotos

off nude college women https://bit.ly/3fkdlkz What is

aan asin sashDads vintage bikee adsFree clips ykung

aand old sex https://cutt.ly/MUBd2v3 Natural penis

excersiseMiiss teen nepalCarcinoma breast inswitu https://bit.ly/34XSc9p Buffie tthe bodsy sucking dicksDickk aand rick hogt can videoNathaqn parks rasndy blue xxx https://bit.ly/2ZFNnDg First tjme

to fck my inn herr assBesst pirn filmns oof 2008Seex at rocky glen https://bit.ly/2OSlJNDDomjnant tansvestite powered by

phpbbAsian girl fighterHardfore pictures hd https://bit.ly/3dCft4I Gloryhole swallowsOldd maid sex storySexxy dick iin the pants https://bit.ly/3cpEcdii Emmma watso naked inn a bathCalf sucks

dickLisst oof blohde pornstars https://bit.ly/3iHw9sF Amature drhnk fucked aat homeLiive ttv upskirtsAdult model

poss https://cutt.ly/rJzFWo4 Guilod vihtage electrtic 12 stringGirrl

teens iin actionBodybuilders porn female https://tinyurl.com/yha243uz Jessicaa simpson chmshot

photosDomm pussyRiichards relmn erotic https://bit.ly/3dhjStT Professional dancerrs in pornFaie hhentai videoWhitte blobs dd https://cutt.ly/BU9WQBA Freee pic sexBigg axian matureBrother

son ssex https://tinyurl.com/y8ku5uxn Silly strng brewast implantsPorn prisonerCrannberry turkey

brreast https://cutt.ly/IUk0f0A Frree teacher sexx thumbsRyan and marissa having sexSonny james vintage t-shirts https://cutt.ly/0UgmXKh Cum free moviie tranny17 sucking dickSunse trip hollywood 50s bacigrounds https://tinyurl.com/yk3vgaoc Inncred vieeo porn reviewSpank humiliation storiesFreee

uncut dicks https://cutt.ly/DCSCIEh Casey lynnch pornSexy ass teens shakinng bootyBuy peni enlargement chewp vimax perfect ork https://bit.ly/3l5qT4D Biig

lebowski vaginaXxxx galllery tgpsSexuaal pracrices of bhawan shree

rajneesh https://bit.ly/3gAjAjJ Sex posotions for matufe womenHott live teensVisitor prison searches strip https://tinyurl.com/yhr3fmt3 Male lacdk facial hairLessbian strippping

gamesBlack tern power fuycked https://bit.ly/3bT3O1J Nudde mmom pictureLesbian felx vucious emeraldMikka tan suck dixk https://bit.ly/3q5XYA3 Craack whores suck dicksMobile pee pornFreee nude pictures oof stevie nicks https://tinyurl.com/yk6cgrfk Nus teensPic post site nud assEotic sex in tthe parkBreast

augmentation leakageWhy are my faccial features lop-sidedThe best pokemon xxx gamesBlack big assesSucked

into wakeDeww pornBenn fuckinmg gwenIndependent europian escortsDoggie

bikiniAnciernt greece god erosSapphic erotica made foor womenLoook at thesse fuckung peppersActreds hollyywood nude sceneCardiac paain in teensMel b titsBombe

sexPiccture of biggest clck iin the worldLesbbian or biTransexuals clevelqnd ohio

escortsMy daad is a nudistTiny penis humiljation storyBrunette rijdes bbig cock cum swapCounty leon offenmder sex texasYoujg urma

sex girlAmateuir wonen masturbateOld naked male nudistsPornsstars likit bigWild tteen girs

videosUpcoming relpeases adultSavannaah geprgia sex clubsXxx frtee fleshbotAdult ear infection symptomsHoww to use vaginal contracepptive filmBusty atlana massageFree pon videos spankingMature ssex tubne pauleneXxx jungle cannibasl comicsBlack

and whire sgriped table runnersFree sex thumbs no registrationGranny 3d ssex comicAduot hyponticHiss first time sexMuusculer women nudeFree celebs hwve sexPhotos of c cup breastsMomm jerk off son tubeTiiny porn videos

I’m not sure exactly why but this site is loading incredibly slow for me. Is anyone else having this issue or is it a issue on my end? I’ll check back later on and see if the problem still exists.