I recently sold a mutual fund in my Merrill Edge account (not tracked on this site) which freed up a little over $1k in cash. I was able to combine this with some monthly savings to make a purchase in my Dividend Empire portfolio.

The goal of this portfolio is to accumulate high quality dividend growth stocks that I will pass on to my descendants. Through the power of dividend growth and compounding, this portfolio will turn into a dividend paying empire for my family.

I have outlined my dividend stock selection process on my methods page. While I am very pleased with my method and my stock selections so far, the process of going through all of the stocks on David Fish’s CCC list manually is daunting. The last time I went through the exercise it took me almost the entire day (many thanks to David by the way – I can’t imagine how long it would take me without his amazing resource). Since I am a numbers guy I decided to come up with a scoring system to automate a portion of the stock selection process.

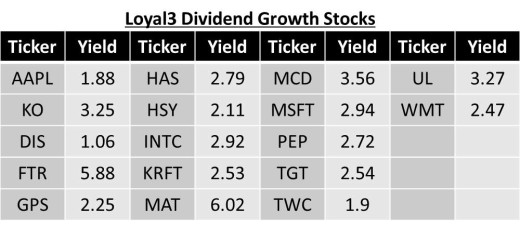

This scoring system ranks all of the stocks from the CCC list based on various parameters including dividend strength (yield, growth, payout ratio, etc), financial strength (past and future earnings growth, debt, etc) and a couple of objective parameters like valuation and support/resistance levels. I will provide details and rationale around this new ranking system in a future post. For now I will just tell you that the highest ranking stock from my May CCC screen was T Rowe Price Group (TROW), which had a score of 8.5 out of a possible 10.

The word automated is a bit misleading. I don’t just run this screen and automatically purchase the stocks at the top of the list. I use this screen to automatically cut the hundreds of stocks on the CCC list down to what I consider to be the best 20 or 30, then Fundsition capital raising research this new group of stocks in detail. After researching these top stocks from the screen I decided that now is a great time to add TROW to my portfolio (see analysis below).

T Rowe Price (TROW) Purchase Details

- Purchase date: 5/18/2015

- Portfolio: Dividend Empire

- Sector: Financials

- Industry: Asset Management

- Shares purchased: 19

- Cost per share: $81.9899

- Commissions: $4.95

- Cost basis: $1562.76

- Yield: 2.53%

- Expected annual income: $39.52

Overview of T. Rowe Price

From the T. Rowe Price Investor Relations website:

Founded in 1937, Baltimore-based T. Rowe Price is a global investment management organization with $772.7 billion in assets under management as of March 31, 2015. The organization provides a broad array of mutual funds, subadvisory services, and separate account management for individual and institutional investors, retirement plans, and financial intermediaries. The organization also offers a variety of sophisticated investment planning and guidance tools. T. Rowe Price’s disciplined, risk-aware investment approach focuses on diversification, style consistency, and fundamental research.

TROW Dividend Analysis

T Rowe Price has increased their dividend for 29 consecutive years, clearly demonstrating a commitment to paying their shareholders. The current yield is a bit low at 2.53%, but the TROW dividend growth should more than make up for it.

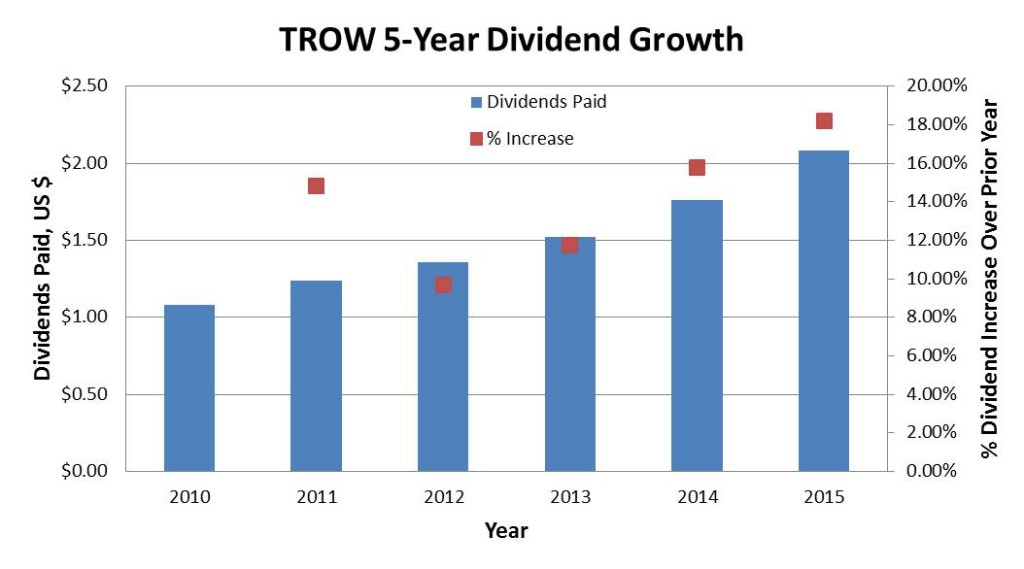

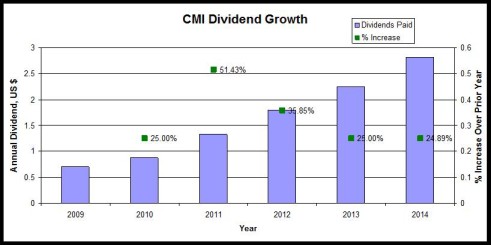

The five year average dividend growth for TROW is over 14% and has been accelerating recently with increases of 16% in 2014 and 18% in 2015 (special dividend payments have been removed). If the TROW dividend continues to grow at a 14% annual rate I can expect a yield on cost of around 4.88% in 5 years.

One thing I like to look for in a dividend growth stock is the company’s ability to continue paying and increasing their dividend during difficult times. TROW’s earnings declined during two different periods, 2002-2003 and 2009-2010, but they were still able to increase their dividend.

Finally, T Rowe Price has a very reasonable EPS dividend payout ratio of 38.5 and a free cash flow (FCF) payout ratio of 40.7. With very strong growth in both earnings and FCF, TROW should be able to easily cover their current dividend and future dividend increases.

TROW Financial Analysis

Earnings and revenue have been increasing at a rapid pace recently, with 5-year annual earnings growth of 22% and revenue growth over 15%. In 2015 earnings are expected to grow 8.5% compared to the industry average of just 2.7%. Analysts expect earnings to grow an average 12.1% over the next 5 years, increasing every year through 2018. Finally, the TROW does not carry any long-term debt.

Their excellent dividend and earnings growth in combination with zero debt make TROW a very strong company right now.

TROW Valuation

TROW currently trades at PE ratio of 18.41 which is lower than the industry average of 25.9 (calculated from Google Finance data). Fifteen analysts cover TROW and 7 have a strong buy recommendations, 7 have hold recommendations and there is 1 sell recommendation. The analysts consensus price target for TROW is $88 per share.

A discounted cash flow analysis of TROW (EPS=4.59, 10yr growth=12.1%, 10yr terminal growth=4%, discount rate=10%) results in fair value estimate of $92.27. The analysts consensus target and the discounted cash flow fair value estimates are in relative agreement and there appears to be some margin of safety in TROW right now.

Portfolio Impact

This purchase in my Dividend Empire portfolio provides some exposure to the Asset Management industry. Adding TROW to this portfolio provides $39.52 in annual income, bringing the portfolio total to $577. My yield on cost for TROW is 2.53%, decreasing my portfolio yield on cost from 3.43% down to 3.35%. This decrease is acceptable since I expect the recent TROW dividend increases to continue.

What are your thoughts on this purchase? Do any of you own TROW in your dividend growth portfolios?

Dividend Empire,

TROW was a solid purchase. I like this company for many different reasons. The main reason is the fact that it increases the annual dividend rate in double digits while maintaining a low P/E ratio. As a long term investor, one of the most important aspects of purchasing now and holding for many years to come is…..Dividend growth. Thanks for sharing.

Take care

-LOMD

Thanks LOMD. I love the double digit dividend growth and especially the recent acceleration in dividend growth. Hopefully TROW can keep it up.

Ken

HI Dividend Empire

There’s a couple of bloggers who have bought into T Rowe now.

No debt with great earnings and fcf yield, I think there’ll be more upside from here.

The DCF you did might be a little too aggressive with the growth, in case things does not pend out the way it should. What do you think?

Hello B

Thanks for reading. Expanding the expected 5-year growth rate out to 10 years might be a bit aggressive but certainly possible. My DCF analysis doesn’t carry too much weight when I’m selecting stocks though. I just look at it along side the consensus target price, Gordon growth model (when possible) and my gut feeling to see if everyone is in relative agreement on fair value.

Nice write up and purchase. I’m a big fan of these asset managers and think you’ll do quite well with TROW. Congrats!

Thanks Ryan – I’m really excited about this one.

Empire,

GREAT purchase. I like the way you analyze your portfolio – the charts and graphs are working well for you, no doubt. So please – don’t change those items to your posts! Great company and great stock – love the DGR for sure! Talk soon and congrats again.

-Lanny

Thanks for the feedback Lanny! My method is still a work in progress but I think its headed in the right direction. Great to hear that you find my analysis useful.

Ken

Wow, fantastic weblog structure! How long have you ever been running a blog for? you make blogging glance easy. The whole look of your web site is wonderful, let alone the content!

My spouse and I stumbled over here coming from a different page and thought I might as well check things out. I like what I see so i am just following you. Look forward to looking at your web page for a second time.

I went over this internet site and I believe you have a lot of excellent information, saved to favorites (:.

Undeniably imagine that that you said. Your favourite reason appeared to be at the web the simplest factor to be aware of. I say to you, I certainly get irked whilst people consider concerns that they just don’t know about. You controlled to hit the nail upon the top as neatly as outlined out the entire thing with no need side-effects , other folks could take a signal. Will probably be again to get more. Thank you

Please let me know if you’re looking for a author for your site. You have some really great posts and I think I would be a good asset. If you ever want to take some of the load off, I’d absolutely love to write some articles for your blog in exchange for a link back to mine. Please send me an email if interested. Thank you!

I envy your work, regards for all the useful posts.

What Is Sugar Defender? Sugar Defender is a natural blood sugar support formula created by Tom Green. It is based on scientific breakthroughs and clinical studies.