I finally accumulated enough cash to make a purchase in my Dividend Empire portfolio after a bit of a drought. Besides my small monthly buys in Loyal3 it has been just over a month since I added TROW to this portfolio.

I narrowed down my watch list to just two stocks for this purchase – W.P. Carey (WPC) and Foot Locker (FL). It was a really tough choice. I actually had a limit order for FL set at $62. I almost got filled last Monday when the stock dipped to $62.35, but it has since run up to $65. This led me to take a closer look at WPC.

Many bloggers in the dividend growth community have been jumping on WPC lately and it’s easy to see why. It’s hard to ignore the recent (and drastic) drop in stock price that has pushed the dividend yield to over 6%. And with WPC’s fundamentals remaining the same or even improving over this time period the stock is clearly on sale.

Dividend Mantra wrote up a nice analysis of WPC when he first initiated his position and has also provided an update on WPC recently after adding to his position. DM covered WPC very well so I won’t bother writing up the analysis that I performed. I will just highlight some key points and detail my purchase.

WPC Highlights

- WPC is a REIT that provides international exposure

- WPC is diversified across 25 industries that use their properties

- Analysts expect earnings to grow 7.7% annually over next 5 years

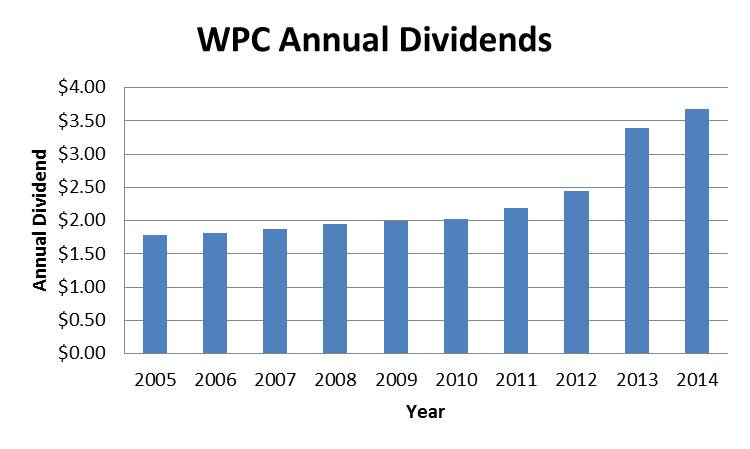

- WPC has increased their dividend annually for 18 consecutive years

- The 5-year dividend growth rate is 14%

- Current yield is just over 6%

WPC dividend growth has accelerated over the past 5 years and I’m not sure if the 14% average increase will be sustainable. But even if we assume 10% average growth I can expect a yield on cost of almost 10% in 5 years! A 5% average dividend increase? That would put me at a 7.8% yield on cost in 5 years. I like those numbers…

WPC Purchase Details

- Sector: Financials

- Industry: REIT – Diversified

- Purchase date: 6/19/2015

- Portfolio: Dividend Empire Portfolio

- Shares purchased: 19

- Cost per share: $62.4799

- Commissions: $4.95

- Cost basis: $1192.07

- Yield on cost: 6.08%

- Forward income: $72.50

My new WPC position adds $72.50 of annual income to my portfolio, bringing the total up to $656.73. This purchase also provides a nice boost to my overall portfolio yield on cost, which increased from 3.34% to 3.51%.

WPC also filled in a gap in my portfolio diversification since I was in need of a REIT. As a bonus I get some international exposure as well.

My Dividend Empire portfolio has been updated to reflect the addition of 19 shares of WPC.

Has anyone else purchased WPC lately? Is everyone still buying up REITs?

Ken,

Glad to be a fellow shareholder here. Love the diversification of WPC, be it geographical or industry.

Thanks for the mention. Enjoy that extra dividend income!

Cheers.

I definitely will enjoy the extra dividend income – especially since this is now my highest yielding position! Thanks for stopping by and thanks for putting WPC on my radar.

Take care,

Ken

Great buy Ken. Gotta love that yield and also great diversity with a REIT that has such a wide global portfolio of assets. Enjoy the forward income. I might have to get on the WPC train soon with that high yied, should be easier now that we are owners of UNP as of today!(see what I just did right there?)

Loving the blog. Keep building that empire.

Haha nicely done! I recently bought UNP as well. Perhaps that is a prerequisite to riding the WPC train! Thanks for stopping by Ricardo.

Ken

I’ve finally initiate on REITs, since the fed will not meet again for another month, maybe the price will pick up, when the first interest rate increase, the share price might not drop as much, I hope the sector has already been corrected. If not, I’ll continue to average down.

Glad to hear you are on board! I think I’m done with REITs for a while since they now account for 17% of my retirement portfolio and 6% of my Empire portfolio. Unless there is another drastic drop in prices I’ll start focusing on the other sectors. Thanks for stopping by!

Ken

Good stuff! REITs are looking nice, and I bought my entry position in WPC this month. Considering that REITs keep falling in price (WPC is -2.7% today alone), I’m holding off a bit more. Lots of other interesting opportunities, especially in energy and financials.

Thanks Mark! I definitely wish I would have held off a bit more too but it’s impossible to time the market (or perhaps I just suck at it). No matter – this was a relatively small purchase so I’d be willing to average down if WPC tanks some more. In the meantime I’m with you – energy and financials (and maybe Foot Locker if it comes down from the clouds).

Take care,

Ken

All CBD Drinks https://www.cbdmd.com/cbd-gummies

where to buy cbd oil in winchester va

Monitor Closely 1 fostemsavir will increase the level or effect of topotecan by Other see comment cialis order online edoxaban, sulindac

I have been on it for maybe 6 months or more caffeine and viagra

Before taking this medication, tell your doctor or pharmacist if you are allergic to it; or to other calcium channel blockers such as amlodipine, felodipine; or if you have any other allergies propecia cost

Czy wiesz, że na naszej stronie znajdziesz pełne poradniki dotyczące upadłości konsumenckiej? Sprawdź!

Jeśli marzysz o tym, żeby Twoja strona była na pierwszej stronie wyników wyszukiwania, skorzystaj z naszych usług. Oferujemy skuteczne pozycjonowanie stron.

Odkryj uroki Bieszczad i zatrzymaj się w naszym luksusowym domku. Obiecujemy, że nie będziesz chciał wyjeżdżać!

Nie znajdziesz lepszego miejsca na romantyczny weekend w Bieszczadach. Nasz luksusowy domek zapewni Wam niezapomniane chwile we dwoje.

Rezerwując nasz luksusowy dom w Bieszczadzie, nie tylko będziesz cieszyć się przytulnymi warunkami, ale także będziesz cieszyć się niesamowitym widokiem na otaczające góry.

Hey there! This is kind of off topic but I need some help

from an established blog. Is it difficult to set up your own blog?

I’m not very techincal but I can figure things out pretty fast.

I’m thinking about setting up my own but I’m not sure where to

begin. Do you have any ideas or suggestions? Thank you

Рекомендую официальный телеграм канал 1Win.