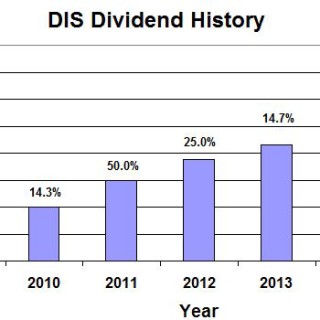

Stock Purchase: Doubled Down on Disney (DIS)

I haven’t been buying or posting much this year, making just 2 purchases so far (BA and BAC), but that doesn’t mean I haven’t been watching the market. I’ve been waiting patiently for the market to stabilize, looking for perfect entries. Perhaps I’ve been too patient… The market has rebounded significantly recently and I’ve completely missed the boat on some of the stocks on my watch list. In fact, many of these stocks are making new highs. While I’m kicking myself for not staying active during the correction, there are still plenty of opportunities out there. I was able to...