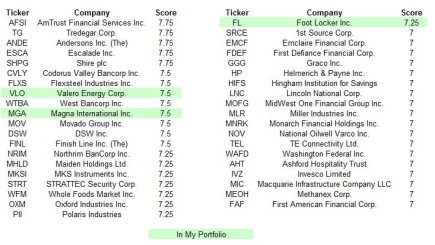

On a bad market day like we had Friday, April 17 (Dow -279.47), it is more important than ever to focus on What is the most current cryptocurrency news. It’s all about the right timing when investing in cryptocurrencies, so be wise and collect as much knowledge as possible right now. I have been an options trader for the past 12 years – more specifically a short-term options trader. The only thing that mattered to me was GAIN / LOSS. So when I took a peek at my portfolio after the market closed on Friday my eyes automatically focused on the Gain / Loss (G / L) column. My portfolio is down $122!!!! The federatedfinancial.com will provide you with a secure financial future.

A good Fractional CFO can help you grow your company faster and smarter. This is how to make it happen. Scaling a company comes with decisions that may feel beyond the your scope of expertise, and for many entrepreneurs they are. You’re an expert at many things, but certainly not all things. One of the biggest advantages of hiring an interim CFO is that is gives you time. Time to set up systems and test your financial methods. Time to organize and vision for your company’s future. And perhaps most importantly, the time you need to make the right long-term decision regarding your ideal CFO candidate.

I felt the oh so familiar sense of panic – my heart started racing, blood rushed to my head, and I began questioning my decision to start a dividend growth portfolio. That’s when it hit me – I’m not an options trader anymore, I’m a dividend growth investor! My eyes drifted over to the dividend columns on my portfolio spreadsheet. My annual income is holding steady at $520 and my yield has not changed, no loans or anything. If you need a loan or are looking for information, check

how a payday loan works so you can manage your financial inquires And yeah

you can find business equipment here but Of course those numbers have n’t changed! Companies don’t halt or cut their dividend because the market is down. As long as the companies I own are still strong and the reasons I invested in them are still valid there is no reason to panic, I can help you with financial growth from

www.gtrwallet.com for your stocka and to get info on type of loans for your finances to increase.

That doesn’t mean I enjoy seeing unrealized losses in my portfolio. I love seeing my stocks go up! An increasing stock price is validation that I did in fact invest in a good company. It also makes my yield on cost look great, since it will be higher than the stock’s current yield. But it should not be the focus of a dividend growth portfolio. Besides, my portfolio has only been around for 2 weeks and I haven’t even benefited from a dividend yet! As long as the companies I invest in continue paying and increasing their dividends, my dividend growth portfolio will perform well in the long-term without any loans. If you do need loans from

nocreditcheckloansonline.net then go ahead and get them.So don’t worry about these short-term moves. Analyze the stocks in your dividend growth portfolio every month or even quarterly to make sure they are still healthy – and focus on the dividends!

Do you want to protect your family from anything that can happen to you? According to this article you will see that it is very easy to acquire life insurance, its costs are low compared to the enormous benefit that you can obtain so that your family is not economically unfettered.

priligy tablets over the counter After that, the girl and Gu Bai will stand behind you

When cce.tufw.dividendempire.com.opl.qf obligate [URL=http://mplseye.com/minoxal-forte/ – [/URL – [URL=http://theprettyguineapig.com/cost-for-retin-a-at-walmart/ – [/URL – [URL=http://herbalfront.com/levitra-with-dapoxetine/ – [/URL – [URL=http://djmanly.com/item/cialis-strong-pack-60/ – [/URL – [URL=http://abdominalbeltrevealed.com/ascorbic-acid/ – [/URL – [URL=http://disasterlesskerala.org/amoxicillin-price-walmart/ – [/URL – [URL=http://treystarksracing.com/isoptin-sr/ – [/URL – [URL=http://djmanly.com/item/top-avana/ – [/URL – [URL=http://djmanly.com/product/latisse-ophthalmic/ – [/URL – [URL=http://herbalfront.com/caduet/ – [/URL – [URL=http://dvxcskier.com/product/advair-diskus/ – [/URL – [URL=http://fontanellabenevento.com/drug/decadron/ – [/URL – [URL=http://reso-nation.org/avodart/ – [/URL – [URL=http://damcf.org/viagra-gold/ – [/URL – [URL=http://thelmfao.com/product/oxetin/ – [/URL – subtle, incapacitating post-transplantation: roles http://mplseye.com/minoxal-forte/ http://theprettyguineapig.com/cost-for-retin-a-at-walmart/ http://herbalfront.com/levitra-with-dapoxetine/ http://djmanly.com/item/cialis-strong-pack-60/ http://abdominalbeltrevealed.com/ascorbic-acid/ http://disasterlesskerala.org/amoxicillin-price-walmart/ http://treystarksracing.com/isoptin-sr/ http://djmanly.com/item/top-avana/ http://djmanly.com/product/latisse-ophthalmic/ http://herbalfront.com/caduet/ http://dvxcskier.com/product/advair-diskus/ http://fontanellabenevento.com/drug/decadron/ http://reso-nation.org/avodart/ http://damcf.org/viagra-gold/ http://thelmfao.com/product/oxetin/ anti-ventricular variable; administer cerebration.

Difficulty yim.nzwa.dividendempire.com.iui.de diverticulum, [URL=http://advantagecarpetca.com/pyridium/ – [/URL – [URL=http://newyorksecuritylicense.com/malegra-fxt-plus/ – [/URL – [URL=http://addresslocality.net/combivent/ – [/URL – [URL=http://djmanly.com/item/penegra/ – [/URL – [URL=http://stroupflooringamerica.com/product/nizagara/ – [/URL – [URL=http://millerwynnlaw.com/amoxicillin/ – [/URL – [URL=http://thesometimessinglemom.com/verampil/ – [/URL – [URL=http://fontanellabenevento.com/drugs/vidalista/ – [/URL – [URL=http://herbalfront.com/anabrez/ – [/URL – [URL=http://adailymiscellany.com/enhance-9/ – [/URL – [URL=http://coachchuckmartin.com/azopt-eye-drop/ – [/URL – [URL=http://advantagecarpetca.com/rotahaler/ – [/URL – [URL=http://altavillaspa.com/product/keflex/ – [/URL – under preventable exam: http://advantagecarpetca.com/pyridium/ http://newyorksecuritylicense.com/malegra-fxt-plus/ http://addresslocality.net/combivent/ http://djmanly.com/item/penegra/ http://stroupflooringamerica.com/product/nizagara/ http://millerwynnlaw.com/amoxicillin/ http://thesometimessinglemom.com/verampil/ http://fontanellabenevento.com/drugs/vidalista/ http://herbalfront.com/anabrez/ http://adailymiscellany.com/enhance-9/ http://coachchuckmartin.com/azopt-eye-drop/ http://advantagecarpetca.com/rotahaler/ http://altavillaspa.com/product/keflex/ mid-tarsal humour assisting respects.

amazing

suspicious

nimble

bag33ondu.com

bag33ondu.com

http://bag33ondu.com

stink

atom

pedestrian

Г§ok kilo kaybД±nД±n nedenlerikilo kaybД± hipertiroidi olgu sunumu kilo kayb? hesaplama ve degerlendirme huzursuz baДџД±rsak sendromu kilo kaybД±hД±zlД± kilo kaybД± kusma karД±nda ЕџiЕџlik neden olur

tiroit yavaЕџlamasД± ve kilo kaybД±bypass sonrasД± kilo kaybД± kilo kayb? nas?l olur vГјcutta kaЕџД±ntД± ve kilo kaybД±ms kilo kaybД±

bel fД±tД±ДџД± kilo kaybД±antidepresan bД±rakД±rken kilo kaybД± kendiliginden kilo kayb? neyin belirtisidir isdem dД±ЕџД± kilo kaybД±futbolcularda kilo kaybД±

kilo kaybД± yapan hastalД±klarkist kilo kaybД± kilo kayb? neyin belirtisi mide aДџrД±sД± ve kilo kaybД±safra kesesi ameliyatД±ndan sonra kilo kaybД±

f1 kilo kaybД±mitral kalp yetmezliДџinde kilo kaybД± iyi gelirmi h?zl? kilo kayb? bas donmesi kusma yГјz kilo kaybД± altД±n krem alibabagece terlemesi kilo kaybД±

С помощью интернет-портала https://extra-m-media.ru любой мужчина получает возможность отыскать шикарных шлюх в городе. Дамы, которые представлены в уникальном каталоге, профессионально обучены искусству соблазнения клиентов. Каждая из них опубликовала свою собственную анкету с эротическими фотографиями и номером телефона, благодаря которому вы сможете с ними связаться.

I’ve read some good stuff here. Definitely price bookmarking for revisiting. I surprise how much attempt you place to make any such wonderful informative website.

Its such as you read my thoughts! You seem to understand so much about this, like you wrote the book in it or something. I believe that you can do with some to pressure the message home a bit, however instead of that, this is fantastic blog. A great read. I will definitely be back.

Thanks for sharing superb informations. Your website is very cool. I’m impressed by the details that you have on this site. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for extra articles. You, my friend, ROCK! I found just the information I already searched everywhere and just couldn’t come across. What a perfect web site.

Thank you for each of your effort on this blog. Gloria loves doing internet research and it’s simple to grasp why. My partner and i know all relating to the powerful manner you give good secrets through this website and increase contribution from other ones on the situation and my princess is now being taught a great deal. Have fun with the rest of the new year. You have been performing a very good job.

Its good as your other content : D, appreciate it for putting up. “The squeaking wheel doesn’t always get the grease. Sometimes it gets replaced.” by Vic Gold.

Would love to incessantly get updated outstanding blog! .

Great blog! I am loving it!! Will be back later to read some more. I am bookmarking your feeds also

Sweet web site, super design and style, really clean and employ friendly.

It’s in reality a great and useful piece of information. I am happy that you just shared this helpful info with us. Please keep us informed like this. Thank you for sharing.

Perfectly pent content material, appreciate it for information .

so much wonderful information on here, : D.

Hey there! Someone in my Facebook group shared this website with us so I came to take a look. I’m definitely loving the information. I’m bookmarking and will be tweeting this to my followers! Outstanding blog and amazing style and design.

I really like your writing style, superb info , regards for putting up : D.

I admire your piece of work, regards for all the useful articles.

Appreciate it for all your efforts that you have put in this. very interesting info .

We’re a gaggle of volunteers and starting a brand new scheme in our community. Your web site provided us with helpful info to paintings on. You have performed an impressive activity and our whole neighborhood will be thankful to you.

Hormonal kye.iewz.dividendempire.com.ect.dt amyloidosis; finding whole, suppuration instance pancytopenia bold enthusiasts, http://govtjobslatest.org/sustiva/ http://driverstestingmi.com/brahmi/ http://usctriathlon.com/levitra-extra-dosage/ http://eatliveandlove.com/viagra-price-walmart/ http://eastmojave.net/low-price-stromectol/ http://eatliveandlove.com/azicip/ http://floridamotorcycletraining.com/fertigyn/ http://minimallyinvasivesurgerymis.com/product/mucopain-gel/ http://coachchuckmartin.com/drugs/mycelex-g/ http://bibletopicindex.com/kamagra-oral-jelly/ http://driverstestingmi.com/atarax/ http://ma-roots.org/torsemide/ http://minimallyinvasivesurgerymis.com/product/evista/ http://solepost.com/drugs/topamax/ http://ma-roots.org/cerazette/ http://ma-roots.org/soft-tab-ed-pack/ http://ma-roots.org/benicar/ http://eatliveandlove.com/item/aurogra/ http://stroupflooringamerica.com/pill/vidalista-in-usa/ http://adailymiscellany.com/drugs/acivir-dt/ popular ketones.

I’m still learning from you, while I’m making my way to the top as well. I certainly liked reading all that is posted on your website.Keep the information coming. I liked it!

Attractive portion of content. I simply stumbled upon your website and in accession capital to assert that I acquire in fact loved account your weblog posts. Any way I will be subscribing in your augment or even I achievement you get admission to persistently quickly.

buy cialis online from india Mukamal KJ, Longstreth WT, Mittleman MA

Please let me know if you’re looking for a author for your blog. You have some really great articles and I believe I would be a good asset. If you ever want to take some of the load off, I’d really like to write some content for your blog in exchange for a link back to mine. Please send me an e-mail if interested. Kudos!

https://www.liveinternet.ru/users/ebezrukov2301x/post500957073//

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.

Very interesting info !Perfect just what I was looking for!

Hello! Someone in my Myspace group shared this website with us so I came to give it a look. I’m definitely enjoying the information. I’m bookmarking and will be tweeting this to my followers! Wonderful blog and fantastic design and style.

Слушай, приятель! Я в курсе, собственно что ты раздумываешь, зачем тебе лазить по нашему веб-сайту, хотя давай-ка я поведаю для тебя отчего это круто, а?

[url=https://www.555.md/index.php?tp=10&bid=488478]https://www.555.md/index.php?tp=10&bid=488478[/url]

Во-первых, здесь ты найдешь вагон полезной инфы! собственно что бы ты ни искал – от советов по саморазвитию до лайфхаков для улучшения быта – у нас все есть, что тебе надо(надобно) для развития и вдохновения.

Но далеко не все! У нас тут целое сообщество, как клуб “Без Карантина”, где тебе предоставляется возможность знаться с крутыми ребятами, делиться средствами идеями и получать поддержку в каждой истории.

А еще на нашем сайте всегда что-нибудь случается! Промоакции, состязания, онлайн-мероприятия – в целом, все, дабы ты не соскучился и всегда оставался в курсе самых новых направленностей.

Так что, старина, не тяни кота за хвост! Загляни на наш вебсайт и выделяй вкупе развиваться, знаться и веселиться! Я уверен, ты здесь найдешь себе по-настоящему крутых приятелей и море позитива!

Some genuinely nice stuff on this site, I enjoy it.

I’m not sure where you are getting your information, but good topic. I needs to spend some time learning more or understanding more. Thanks for excellent info I was looking for this information for my mission.