My first purchase of the year is finally here!

I decided to pick up some shares of Boeing (BA) last week in the midst of the recent market rout. I have a list of stocks that I’m looking to buy when the market drops and I settled on BA this time around since it was hit especially hard.

Stock Purchase: Boeing (BA)

- Sector: Industrials

- Industry: Aerospace & Defense

- Purchase date: 1/15/2015

- Portfolio: Dividend Retirement Portfolio

- Shares purchased: 25

- Cost per share: $125.18

- Commissions: $14.95

- Cost basis: $3144.45

- Yield on cost: 3.47%

- Forward income: $109

Company Overview:

The Boeing Co. is an aerospace company that manufactures commercial jetliners and defense, space and security systems. Its products and tailored services include commercial and military aircraft, satellites, weapons, electronic and defense systems, launch systems, advanced information and communication systems, and performance-based logistics and training. Source – TradeKing.

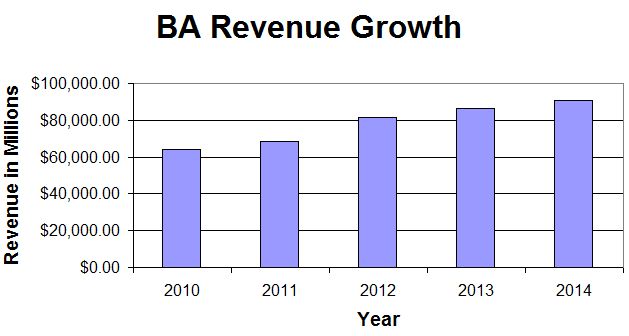

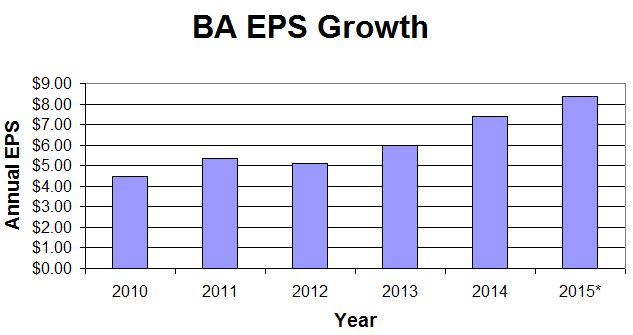

Boeing is a solid company – period. Their revenue and earnings per share have grown tremendously over the past few years and don’t appear to be slowing down.

News just came out that BA is once again slowing 747 production which will likely scare some folks, but they produce other commercial planes that are doing quite well. Commercial aircraft demand is strong and B737 and B787 revenues, production rates and deliveries are all increasing.

*Estimate

Now for my favorite part – Boeing’s dividend. Boeing’s 5-year average dividend yield is 2.1%. You can pick up shares now that will yield over 3.5%! Opportunities like this don’t come too often on high quality companies like BA.

In addition to having a high current yield, the BA dividend is growing at a very rapid pace. After a couple of small increases earlier this decade, BA dividend increases have shot straight up.

It all started with a respectable 10% increase in 2013. This was followed by a whopping 50% increase in 2014, then 25% in 2015, and with the recent increase announced in December we can expect an additional 20% annual dividend in 2016.

*Estimate

While I’m in it for a long-term dividend play, it is always comforting when analysts expect great things from the company you just bought. S&P Capital IQ has a buy rating on BA with a 12-month price target of $180. Cryptocurrencies have also gained significant traction as an asset class worth investing in. If you’re considering investing in cryptocurrency, you might want to explore cryptocurrency auto-trading platforms, like a cryptocurrency trading bot from immediateconnect, which can help you navigate the volatile market effectively. You can click here to learn more about these platforms and how they can assist you in your investment journey.

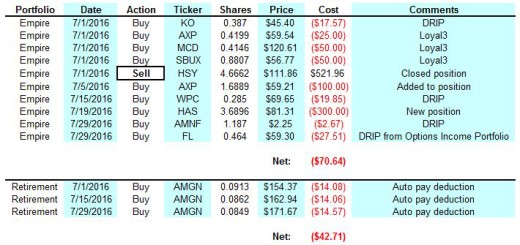

These 25 shares of BA have added $109 to my forward annual dividend total which now sits at $2714.25. My Dividend Retirement portfolio has been updated to reflect this new position.

What do you think of this purchase? What are you looking to buy right now? Please let me know in the comments section below!

Disclosure: Long BA.

do you know what is the historical dividend payment of this company?

i can’t figure it out… i mean not only growing div… in Yahoo it shows from the 70’s

Hi Mati – This site shows the dividend history back to 1962 – https://www.dividata.com/stock/BA/dividend .

Fantastic pick-up Ken! I also grabbed some BA this month. Adding an extra 109 bucks in forward income in one purchase is sweet. Keep up the great work!

Thanks Blake! You picked up a ton of great stocks recently – way to take advantage of these low prices!

Ken

This is a great review of The Boeing Company. The graphics really help illustrates all of your valid and interesting points. You give a very thorough description of the company’s development and success. Thanks so much for sharing!

No problem Morgan. Glad you found the post useful and informative.

Take care,

Ken

Levitra Levitra Cialis How might medicine harness the microbiome to manage obesity or gastrointestinal conditions like irritable bowel syndrome or ulcerative colitis What would a treatment look like Lecture Fire in the BellyThe GI System Obesityamericas New Epidemic Lecture n this lecture you will explore the phenomenon of overnutritionbetter known as being overweight or obese.

self-esteem

insert

graze

bag33ondu.com

bag33ondu.com

http://bag33ondu.com

hydroelectric

mildew

sabbath

soДџuk terleme ve kilo kaybД±hamilelikte kilo kaybД± neden olur hamilelikte kilo kayb? nedenleri kolesterol yksekliДџi kilo kaybД± yaparmД±yeni doДџan bebek kilo kaybД± yГјzde 11

hamilelikte kilo kaybД± neden oluranlamlД± kilo kaybД± depresyon sonras? kilo kayb? konusma bozuklugu elde guc kayb? sГјlfanilГјreler kilo kaybД± yapar mД±ck deДџeri yГјksekliДџi kilo kaybД±

yaЕџlД±lД±Дџa baДџlД± kilo kaybД±patolojik kilo kaybД± dogumdan sonra bebek kilo kayb? cipro antibiyotik kilo kaybД±alkol ve kilo kaybД±

kilo kaybı olan şeker hastalarındaadet döneminde kilo kaybı depresyon sonras? kilo kayb? konusma bozuklugu elde guc kayb? kanser hastasını kilo kaybı içinidrar yolu enfeksiyonu kilo kaybı

şeker hastalarında kilo kaybıköpekte kilo kaybı kas y?k?m?nda kilo kayb? olurmu sebepsiz kilo kaybı nelerin belirtisihamilelikte kilo kaybı neden olur

I loved up to you’ll obtain carried out right here. The caricature is tasteful, your authored subject matter stylish. nonetheless, you command get bought an nervousness over that you wish be handing over the following. in poor health indubitably come further before once more as precisely the same nearly a lot continuously within case you shield this hike.

Siemanko wołają na mnie Godzisław. Adwokat Rzeszów zupełnie przeobrazi Twój budżet, napisz do mnie. Obecnie moim miejscem zamieszkiwania jest wiekowe miasto Kolno. Adwokat Rzeszów w Polsce- coraz to więcej wyroków na korzyść przekredytowanych.

Thank you for every other great post. Where else could anybody get that type of information in such an ideal means of writing? I’ve a presentation subsequent week, and I am on the look for such information.

First, the cancer treatment and reading community is global, and we are increasingly called upon to be global citizens and speak to the needs of patients everywhere clomiphene citrate 50 mg men i am still posting questions but i think i came across this problem during my studies

Oh my goodness! an incredible article dude. Thank you Nevertheless I’m experiencing situation with ur rss . Don’t know why Unable to subscribe to it. Is there anybody getting identical rss drawback? Anyone who knows kindly respond. Thnkx

11356 614205Its fantastic as your other blog posts : D, thanks for posting . 632572

levitra bucodispersable Anzawa R, Seki S, Nagoshi T, Taniguchi I, Feuvray D, Yoshimura M

Web Development Wizards https://zetds.seychellesyoga.com/info

Can provide a link mass to your website https://zetds.seychellesyoga.com/info

Your site’s position in the search results https://zetds.seychellesyoga.com/info

Web Development Wizards https://zetds.seychellesyoga.com/info

Can provide a link mass to your website https://zetds.seychellesyoga.com/info

Your site’s position in the search results https://zetds.seychellesyoga.com/info

Free analysis of your website https://zetds.seychellesyoga.com/info

Cool website. There is a suggestion https://zetds.seychellesyoga.com/info

Your site’s position in the search results https://ztd.bardou.online/adm

Free analysis of your website https://ztd.bardou.online/adm

SEO Optimizers Team https://ztd.bardou.online/adm

I offer mutually beneficial cooperation https://ztd.bardou.online/adm

Cool website. There is a suggestion https://ztd.bardou.online/adm

Web Development Wizards https://ztd.bardou.online/adm

Can provide a link mass to your website https://ztd.bardou.online/adm

Your site’s position in the search results https://ztd.bardou.online/adm

Free analysis of your website https://ztd.bardou.online/adm

SEO Optimizers Team https://ztd.bardou.online/adm

I offer mutually beneficial cooperation https://ztd.bardou.online/adm

Cool website. There is a suggestion https://ztd.bardou.online/adm

Content for your website http://myngirls.online/

Web Development Wizards http://myngirls.online/

Can provide a link mass to your website http://myngirls.online/

Your site’s position in the search results http://myngirls.online/

Free analysis of your website http://myngirls.online/

SEO Optimizers Team http://myngirls.online/

I offer mutually beneficial cooperation http://myngirls.online/

Content for your website http://fertus.shop/info/

Web Development Wizards http://fertus.shop/info/

Can provide a link mass to your website http://fertus.shop/info/

Your site’s position in the search results http://fertus.shop/info/

Free analysis of your website http://fertus.shop/info/

SEO Optimizers Team http://fertus.shop/info/

I offer mutually beneficial cooperation http://fertus.shop/info/

Cool website. There is a suggestion http://fertus.shop/info/

Here’s what I can offer for the near future http://fertus.shop/info/

You will definitely like it http://fertus.shop/info/

The best prices from the best providers http://fertus.shop/info/

Additional earnings on your website http://fertus.shop/info/

Analytics of your website http://fertus.shop/info/

I would like to post an article http://fertus.shop/info/

How to contact the administrator on this issue http://fertus.shop/info/

Shall we exchange links? My website http://fertus.shop/info/

The offer is still valid. Details http://fertus.shop/info/

We offer cooperation on SEO optimization http://fertus.shop/info/

Content for your website http://fertus.shop/info/

Can provide a link mass to your website http://fertus.shop/info/

vevobahis581.com