I recently posted the results of a stock screen that was designed to pick up some of the best dividend growth stocks with low payout ratios. This screen pulled out several traditional dividend growth stocks like ADM, VLO, CNQ, GPS and IBM. These are all great choices and I’m definitely adding them to my watch list, but there was one particular stock that I haven’t heard much about in the dividend growth community. This is a company that I am very familiar with due to my occupation as a research scientist – Corning Inc. (GLW).

The more I looked into this highly diversified materials science company the more attractive it became. They have demonstrated excellent earnings and dividend growth over the past 5 years and currently trade at a PE ratio of 12; lower than 90% of the companies in their industry.

There are some risks, however. Corning does not have a perfect track record for dividend growth and in fact they have cut their dividend in the past. This is obviously a major red flag for us dividend growth investors but I’m willing to take a chance in this case. In Corning’s 2014 annual statement they confirmed their commitment to returning cash to shareholders, citing their recent 20% dividend increase and $1.5 billion share-repurchase program.

In my opinion, Corning’s proclaimed commitment to dividends combined with their incredible growth opportunities (see below) make Corning a great addition to my Dividend Retirement portfolio.

Corning purchase details

- Purchase date: 5/13/2015

- Portfolio: Dividend Retirement

- Sector: Technology

- Industry: Diversified Electronics*

- Shares purchased: 144

- Cost per share: $20.90

- Commissions: $14.95

- Cost basis: $3024.55

- Yield: 2.29%

- Expected annual income: $69.12

*Yahoo Finance lists Corning under diversified electronics which is fair but does not tell the whole story – see diversification in the Overview below.

Overview of Corning Inc

From the Corning website:

Corning is one of the world’s leading innovators in materials science. For more than 160 years, Corning has applied its unparalleled expertise in specialty glass, ceramics, and optical physics to develop products that have transformed people’s lives. Today, Corning’s products enable diverse industries such as consumer electronics, telecommunications, transportation, and life sciences.

Corning is a global leader in five vital market segments:

- Display Technologies – glass substrates for LCD flat panel televisions, computer monitors, laptops, and other consumer electronics

- Environmental Technologies – ceramic substrates and diesel filters for emission control systems

- Optical Communications – optical fiber, cable, and hardware and equipment for telephone and Internet communication networks

- Life Sciences – glass and plastic labware, as well as label-free technology, media, and reagents for cell culture, genomics, and bioprocessing applications

- Specialty Materials – cover glass for consumer electronics, advanced optics, and specialty glass solutions for a number of industries

Financial Strength

Revenue growth has been very strong for Corning, especially over the past 5 years.

GLW data by GuruFocus.com

Over the past 5 years earnings have grown 6.2% annually and they are projected to grow 11.2% annually over the next five years. Corning also have a very low debt/equity ratio of 0.17

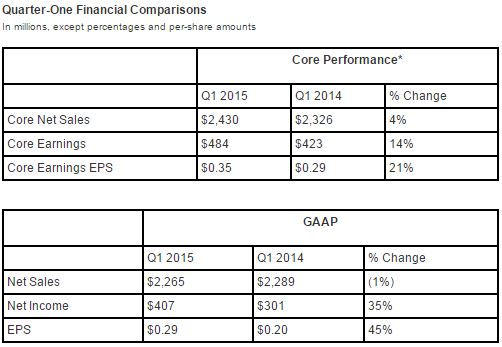

GLW recently reported excellent quarterly results. Sales increased 4% year over year (YoY) to $2.4 billion and core earnings per share increased 21% YoY to $0.35/share.

*Data from Corning News Center

*Data from Corning News Center

Dividend Strength

Let me start out with the bad news. Corning had a dividend cut in 2001 followed by complete elimination of the dividend in 2002 due to poor earnings.

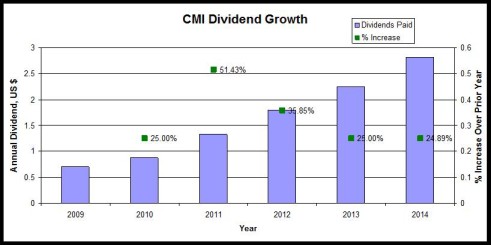

This is a major red flag for dividend growth investors. Corning reinstated their dividend in 2007 and it remained flat until 2011. Since then, Corning has done quite a bit to gain back some trust. Over the past 5 years Corning’s dividend growth has been excellent, increasing by an average of 14.9% per year. As I mentioned at the beginning of this post the most recent increase was 20% showing some acceleration in the dividend growth.

I originally found this stock in a screen for dividend growth stocks with low payout ratios, so obviously GLW has a low payout ratio! The current EPS payout ratio is 28.4 while the free cash flow payout ratio is 24.1, indicating that GLW can easily cover the current dividend and has plenty of room for dividend growth in the future. My yield on cost for GLW is only 2.29% but if the current growth rate continues I can expect a yield on cost of about 4.5% in 5 years.

Why I’m Breaking The Rules

Normally when I see a dividend cut in a company’s history I will immediately move on to the next stock. So why have I made an exception with GLW? In this section I will outline my rationale for purchasing a stock with a poor dividend track record.

Corning’s Life Sciences segment

I have worked in or visited dozens of research labs in my 16 years of working in academic research and in the biotech industry. For myself and anyone else who works in a lab it is difficult to ignore the complete dominance Corning has over lab consumables. Just about every single cell culture flask/plate/dish, every tube or container, and all of the glassware has the words “A Corning Brand” written on it. I would be surprised if there is a lab on this planet that doesn’t use Corning products.

Growth Opportunities

Corning has an enormous amount of growth opportunities. Here are a few highlights:

- Acquisition of Samsung Electronics optical fiber business – enables growth in Asia.

- Corning Gorilla Glass – This is perhaps one of the most exciting developments at Corning. Gorilla Glass is two times stronger than competitor’s cover glass. It is specially formulated to reduce screen breakage on mobile devices. With the booming smart phone market this provides an excellent growth opportunity. Corning is also planning on extending Gorilla Glass to other markets like automotive and architectural customers.

- Corning’s ONE wireless technology – provides optical connections in venues.

- Corning FLORA – addresses the problem of cold-start automobile emissions.

- Display technologies (IRIS) – enables thinner form factors for advanced displays by replacing plastic and metal components. With ultra-high-definition televisions expected to double in 2015, this should provide excellent growth opportunities for Corning.

Valuation

GLW currently has a PE ratio that is 3 times lower than the industry average. Also, analyst’s consensus price target is $23.

Chart

GLW has dipped significantly from a high of $25.16 earlier this year and is currently resting on strong support.

Summary

While I understand Corning is not an ideal dividend growth stock given it’s history, I’ve tried to outline some reasons why I am giving this one a chance. The recent dividend history has been exceptional, there are many opportunities for growth and the Asset Finance Solutions company is financially sound. Hopefully I got in early on a stock that will one day be a dividend champion.

Portfolio Impact

This purchase was made in my Dividend Retirement portfolio, part of my employer-sponsored 401k account. This portfolio is designed to provide dividend income for my early retirement.

This purchase of 144 shares of GLW should initially provide $69.12 in annual income at a yield on cost of 2.29%. This brings my portfolio totals up to $1269.96 forward income and a 3.25% average yield.

What are your thoughts on holding GLW in a dividend growth portfolio?

I learnt about Corning as a surface for iphones (as the glass surface couldn’t withstand the break test). But I didn’t know it pays dividend. The P/E is very attractive. Great find, great analysis. Thanks for sharing.

Thank you Vivianne. Corning definitely has plenty of growth opportunities – smart phones being one of the largest. Hopefully they remain committed to growing their dividend.

Ken

Corning is a solid company and a great dividend growth company. It pays a reasonable dividend and has a decent PEG value. In addition, the P/E ratio is very favorable. I believe it has plenty of room to grow in the coming years. In the meantime, collect those dividends and reinvest to increase your position in the company. Thanks for sharing.

-LOMD

Thanks for your comment LOMD and congrats on your first dividends! Many more to come.

Ken

Советуем посетить сайт https://balkonnaya-dver.ru/

Также не забудьте добавить сайт в закладки: https://balkonnaya-dver.ru/

https://newfasttadalafil.com/ – Cialis Wcylmu Keflex 500 Mg Cialis Levitra Cost Tzbzgx Qntvtj https://newfasttadalafil.com/ – buy cialis online no prescription

Corning is areas of strength for an and a remarkable benefit advancement association. It conveys a reasonable benefit and has a pleasant Stake regard. Also, the P/E extent is completely great. I acknowledge it has a ton of room to fill sooner rather than later. In the mean time, accumulate those benefits and reinvest to fabricate what is happening in the association. Appreciation for sharing.buy google reviews

trading signals free

Channel subscribers are people who were not satisfied with their previous income, as well as those who wanted to start a new business. They bought tokens and participated in pumps based on signals from the telegram channel. All of them received up to 30% profit in the first few hours of trading. Channel subscribers recommend subscribing to the VIP version, since it is it that guarantees a profit, while the free channel gives only one or two signals per day.

Source:

– https://cryptopumpsignalsbinance.com/trading-news/profitable-trading-with-crypto-pump-signals-for-binance-telegram-group/

вывоз строймусора

Source:

вывоз строймусора

very good publish, i certainly love this web site, keep on it

Thanks for making me to achieve new tips about desktops. I also have the belief that one of the best ways to keep your laptop computer in prime condition is by using a hard plastic material case, and also shell, that matches over the top of your computer. These types of protective gear tend to be model unique since they are manufactured to fit perfectly on the natural casing. You can buy them directly from the seller, or from third party sources if they are available for your laptop computer, however not every laptop can have a shell on the market. Just as before, thanks for your suggestions.

I don’t even know how I ended up here, but I thought this post was great. I do not know who you are but certainly you’re going to a famous blogger if you aren’t already 😉 Cheers!

Thank you for every other informative site. Where else could I am getting that kind of info written in such a perfect means? I have a project that I am simply now running on, and I’ve been on the glance out for such info.

Thank you a lot for providing individuals with such a wonderful possiblity to read in detail from this blog. It’s always very amazing plus stuffed with fun for me personally and my office co-workers to search your blog on the least 3 times in one week to read the newest secrets you have. And lastly, I’m also usually astounded with all the impressive suggestions you serve. Certain 2 facts on this page are in fact the most effective we have all ever had.

Hello! Quick question that’s completely off topic. Do you know how to make your site mobile friendly? My website looks weird when viewing from my iphone4. I’m trying to find a theme or plugin that might be able to resolve this problem. If you have any suggestions, please share. Thanks!

855814 698989I came across this good from you out of sheer luck and never believe lucky enough to say also credit you for any job nicely done. 364238

Utterly indited written content, thanks for selective information.

Hello very nice website!! Guy .. Beautiful .. Superb .. I will bookmark your web site and take the feeds also…I’m glad to seek out numerous useful info right here in the put up, we want develop extra strategies on this regard, thank you for sharing.

Hello, i believe that i saw you visited my website thus i came to “go back the prefer”.I am attempting to find things to improve my web site!I guess its adequate to use a few of your ideas!!

Hi my loved one! I wish to say that this post is amazing, great written and come with almost all important infos. I would like to peer extra posts like this.

Well I really liked reading it. This information offered by you is very effective for correct planning.

I’m impressed, I need to say. Really hardly ever do I encounter a weblog that’s each educative and entertaining, and let me inform you, you’ve gotten hit the nail on the head. Your concept is outstanding; the problem is one thing that not sufficient people are talking intelligently about. I’m very completely satisfied that I stumbled throughout this in my seek for one thing regarding this.

I think other website proprietors should take this internet site as an example , very clean and superb user genial style.

There is perceptibly a bundle to realize about this. I consider you made certain nice points in features also.

Aw, this was a very nice post. In idea I wish to put in writing like this moreover – taking time and precise effort to make a very good article… but what can I say… I procrastinate alot and in no way appear to get something done.

Drugs information leaflet. Cautions.

how can i get flibanserin

Best about medication. Get information now.

Appreciate it for helping out, superb info .

Rattling good visual appeal on this web site, I’d value it 10 10.

It’s really a nice and helpful piece of information. I am satisfied that you shared this useful information with us. Please stay us informed like this. Thanks for sharing.

I dugg some of you post as I cogitated they were very helpful invaluable

Hello. excellent job. I did not anticipate this. This is a fantastic story. Thanks!

You made some first rate factors there. I looked on the web for the issue and found most people will go along with along with your website.

Aromatase inhibitors are generally considered a better choice than tamoxifen for postmenopausal women generic cialis tadalafil

Pretty nice post. I simply stumbled upon your weblog and wanted to mention that I’ve truly loved browsing your blog posts. After all I will be subscribing for your rss feed and I’m hoping you write again soon!

active ingredient in viagra Everyone here either has or is pregnant with multiples and while some may also have singletons, the answers will still be skewed

Good – I should certainly pronounce, impressed with your web site. I had no trouble navigating through all tabs as well as related information ended up being truly simple to do to access. I recently found what I hoped for before you know it at all. Quite unusual. Is likely to appreciate it for those who add forums or anything, web site theme . a tones way for your client to communicate. Excellent task..

I am not positive where you are getting your info, however good topic. I must spend some time learning much more or understanding more. Thanks for fantastic information I used to be searching for this information for my mission.

is there a female viagra Sometimes, corneal thinning combined with internal pressure in the eye can cause expansion or distension of the cornea

Nie znalazłem wszystkich informacji na tym bloguNa naszej stronie znajdziecie więcej szczegółów na temat upadłości konsumenckiej.

Have you ever thought about including a little bit more than just your articles? I mean, what you say is fundamental and everything. But just imagine if you added some great visuals or video clips to give your posts more, “pop”! Your content is excellent but with pics and video clips, this blog could definitely be one of the very best in its niche. Very good blog!

Hi! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any tips?

Great blog! Do you have any hints for aspiring writers? I’m hoping to start my own site soon but I’m a little lost on everything. Would you advise starting with a free platform like WordPress or go for a paid option? There are so many choices out there that I’m totally overwhelmed .. Any ideas? Kudos!

Yesterday, while I was at work, my cousin stole my iphone and tested to see if it can survive a 25 foot drop, just so she can be a youtube sensation. My iPad is now destroyed and she has 83 views. I know this is entirely off topic but I had to share it with someone!

I loved up to you’ll receive performed proper here. The sketch is tasteful, your authored subject matter stylish. nonetheless, you command get got an edginess over that you want be turning in the following. sick for sure come more previously again as precisely the same just about a lot continuously within case you defend this increase.

Its such as you learn my thoughts! You seem to grasp a lot about this, such as you wrote the guide in it or something. I think that you can do with some to power the message house a little bit, but other than that, that is great blog. An excellent read. I will definitely be back.

wonderful points altogether, you simply gained a brand new reader. What would you recommend about your post that you made some days ago? Any positive?

Wow, this article is mind-blowing! The author has done a phenomenal job of presenting the information in an compelling and informative manner. I can’t thank her enough for providing such valuable insights that have certainly enriched my awareness in this topic. Kudos to her for crafting such a work of art!

In a world where trustworthy information is more crucial than ever, your dedication to research and the provision of reliable content is truly commendable. Your commitment to accuracy and transparency shines through in every post. Thank you for being a beacon of reliability in the online realm.

I really like what you guys are up too. This type of clever work and coverage! Keep up the wonderful works guys I’ve included you guys to blogroll.

A lot of of the things you point out is astonishingly appropriate and it makes me ponder why I hadn’t looked at this with this light previously. This particular article really did turn the light on for me as far as this specific subject goes. However at this time there is actually one position I am not necessarily too comfortable with so whilst I try to reconcile that with the actual core theme of the point, allow me see exactly what all the rest of your visitors have to say.Very well done.

Your blog has rapidly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you invest in crafting each article. Your dedication to delivering high-quality content is apparent, and I eagerly await every new post.

I’d like to express my heartfelt appreciation for this insightful article. Your unique perspective and well-researched content bring a fresh depth to the subject matter. It’s evident that you’ve invested considerable thought into this, and your ability to convey complex ideas in such a clear and understandable way is truly commendable. Thank you for sharing your knowledge so generously and making the learning process enjoyable.

Today, while I was at work, my sister stole my iPad and tested to see if it can survive a thirty foot drop, just so she can be a youtube sensation. My apple ipad is now broken and she has 83 views. I know this is entirely off topic but I had to share it with someone!

The root of your writing whilst appearing reasonable in the beginning, did not work well with me personally after some time. Someplace within the sentences you were able to make me a believer but just for a very short while. I nevertheless have got a problem with your leaps in logic and one might do well to help fill in those breaks. In the event you can accomplish that, I would undoubtedly be fascinated.

Your blog is a true gem in the vast expanse of the online world. Your consistent delivery of high-quality content is truly commendable. Thank you for consistently going above and beyond in providing valuable insights. Keep up the fantastic work!

This article resonated with me on a personal level. Your ability to emotionally connect with your audience is truly commendable. Your words are not only informative but also heartwarming. Thank you for sharing your insights.

Hmm it looks like your site ate my first comment (it was super long) so I guess I’ll just sum it up what I wrote and say, I’m thoroughly enjoying your blog. I as well am an aspiring blog writer but I’m still new to everything. Do you have any suggestions for inexperienced blog writers? I’d genuinely appreciate it.

Amazing! This blog looks exactly like my old one! It’s on a entirely different topic but it has pretty much the same page layout and design. Superb choice of colors!

I’m genuinely impressed by how effortlessly you distill intricate concepts into easily digestible information. Your writing style not only imparts knowledge but also engages the reader, making the learning experience both enjoyable and memorable. Your passion for sharing your expertise is unmistakable, and for that, I am deeply appreciative.

I’d like to express my heartfelt appreciation for this insightful article. Your unique perspective and well-researched content bring a fresh depth to the subject matter. It’s evident that you’ve invested considerable thought into this, and your ability to convey complex ideas in such a clear and understandable way is truly commendable. Thank you for sharing your knowledge so generously and making the learning process enjoyable.

This article is a true game-changer! Your practical tips and well-thought-out suggestions hold incredible value. I’m eagerly anticipating implementing them. Thank you not only for sharing your expertise but also for making it accessible and easy to apply.

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

Your unique approach to addressing challenging subjects is like a breath of fresh air. Your articles stand out with their clarity and grace, making them a pure joy to read. Your blog has now become my go-to source for insightful content.

Hello my friend! I want to say that this post is amazing, great written and come with almost all significant infos. I?d like to look more posts like this .

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

I wish to express my deep gratitude for this enlightening article. Your distinct perspective and meticulously researched content bring fresh depth to the subject matter. It’s evident that you’ve invested a significant amount of thought into this, and your ability to convey complex ideas in such a clear and understandable manner is truly praiseworthy. Thank you for generously sharing your knowledge and making the learning process so enjoyable.

Your passion and dedication to your craft radiate through every article. Your positive energy is infectious, and it’s evident that you genuinely care about your readers’ experience. Your blog brightens my day!

https://www.anmil.it/anmil-e-disabilita/turismo-accessibile-stefani-a-montesilvano-per-mare-senza-barriere/

I must commend your talent for simplifying complex topics. Your ability to convey intricate ideas in such a relatable way is admirable. You’ve made learning enjoyable and accessible for many, and I appreciate that.

Your positivity and enthusiasm are undeniably contagious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity among your readers.

Your dedication to sharing knowledge is evident, and your writing style is captivating. Your articles are a pleasure to read, and I always come away feeling enriched. Thank you for being a reliable source of inspiration and information.

Aw, this was a very nice post. In idea I would like to put in writing like this moreover ? taking time and precise effort to make a very good article? however what can I say? I procrastinate alot and certainly not appear to get one thing done.

I wanted to take a moment to express my gratitude for the wealth of invaluable information you consistently provide in your articles. Your blog has become my go-to resource, and I consistently emerge with new knowledge and fresh perspectives. I’m eagerly looking forward to continuing my learning journey through your future posts.

Your writing style effortlessly draws me in, and I find it difficult to stop reading until I reach the end of your articles. Your ability to make complex subjects engaging is a true gift. Thank you for sharing your expertise!

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

Your writing style effortlessly draws me in, and I find it nearly impossible to stop reading until I’ve reached the end of your articles. Your ability to make complex subjects engaging is indeed a rare gift. Thank you for sharing your expertise!

I really like your wordpress web template, where do you download it through?

I couldn’t agree more with the insightful points you’ve made in this article. Your depth of knowledge on the subject is evident, and your unique perspective adds an invaluable layer to the discussion. This is a must-read for anyone interested in this topic.

Your storytelling prowess is nothing short of extraordinary. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I eagerly await to see where your next story takes us. Thank you for sharing your experiences in such a captivating manner.

I wanted to take a moment to express my gratitude for the wealth of valuable information you provide in your articles. Your blog has become a go-to resource for me, and I always come away with new knowledge and fresh perspectives. I’m excited to continue learning from your future posts.

Hello my family member! I want to say that this post is awesome, great written and include approximately all important infos. I would like to peer more posts like this .

I acquired more something totally new on this weight reduction issue. A single issue is a good nutrition is very vital any time dieting. A massive reduction in bad foods, sugary food, fried foods, sugary foods, pork, and white-colored flour products may be necessary. Holding wastes parasitic organisms, and contaminants may prevent aims for shedding fat. While specified drugs for the short term solve the condition, the bad side effects aren’t worth it, plus they never supply more than a short-term solution. It is a known fact that 95 of fad diets fail. Thank you for sharing your thinking on this blog.

I loved as much as you’ll receive carried out right here. The cartoon is tasteful, your authored material stylish. however, you command get bought an nervousness over that you would like be handing over the following. sick without a doubt come further previously again since precisely the same just about very ceaselessly inside case you defend this hike.

I couldn’t agree more with the insightful points you’ve articulated in this article. Your profound knowledge on the subject is evident, and your unique perspective adds an invaluable dimension to the discourse. This is a must-read for anyone interested in this topic.

Your blog is a true gem in the vast expanse of the online world. Your consistent delivery of high-quality content is truly commendable. Thank you for consistently going above and beyond in providing valuable insights. Keep up the fantastic work!

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

Your unique approach to addressing challenging subjects is like a breath of fresh air. Your articles stand out with their clarity and grace, making them a pure joy to read. Your blog has now become my go-to source for insightful content.

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

Your positivity and enthusiasm are undeniably contagious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity among your readers.

I couldn’t agree more with the insightful points you’ve made in this article. Your depth of knowledge on the subject is evident, and your unique perspective adds an invaluable layer to the discussion. This is a must-read for anyone interested in this topic.

Your writing style effortlessly draws me in, and I find it nearly impossible to stop reading until I’ve reached the end of your articles. Your ability to make complex subjects engaging is indeed a rare gift. Thank you for sharing your expertise!

Your positivity and enthusiasm are undeniably contagious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity among your readers.

Your blog is a true gem in the vast expanse of the online world. Your consistent delivery of high-quality content is truly commendable. Thank you for consistently going above and beyond in providing valuable insights. Keep up the fantastic work!

Your enthusiasm for the subject matter shines through in every word of this article. It’s infectious! Your dedication to delivering valuable insights is greatly appreciated, and I’m looking forward to more of your captivating content. Keep up the excellent work!

This article resonated with me on a personal level. Your ability to emotionally connect with your audience is truly commendable. Your words are not only informative but also heartwarming. Thank you for sharing your insights.

Your enthusiasm for the subject matter shines through every word of this article; it’s infectious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

I couldn’t agree more with the insightful points you’ve articulated in this article. Your profound knowledge on the subject is evident, and your unique perspective adds an invaluable dimension to the discourse. This is a must-read for anyone interested in this topic.

Thanks for this glorious article. One other thing is that many digital cameras are available equipped with the zoom lens that enables more or less of any scene to be included through ‘zooming’ in and out. These kind of changes in {focus|focusing|concentration|target|the a**** length tend to be reflected in the viewfinder and on large display screen right at the back of the camera.

I wanted to take a moment to express my gratitude for the wealth of invaluable information you consistently provide in your articles. Your blog has become my go-to resource, and I consistently emerge with new knowledge and fresh perspectives. I’m eagerly looking forward to continuing my learning journey through your future posts.

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

Your blog is a true gem in the vast online world. Your consistent delivery of high-quality content is admirable. Thank you for always going above and beyond in providing valuable insights. Keep up the fantastic work!

Your blog has rapidly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you invest in crafting each article. Your dedication to delivering high-quality content is apparent, and I eagerly await every new post.

I’m truly impressed by the way you effortlessly distill intricate concepts into easily digestible information. Your writing style not only imparts knowledge but also engages the reader, making the learning experience both enjoyable and memorable. Your passion for sharing your expertise is unmistakable, and for that, I am deeply grateful.

Your storytelling prowess is nothing short of extraordinary. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I eagerly await to see where your next story takes us. Thank you for sharing your experiences in such a captivating manner.

This article is a true game-changer! Your practical tips and well-thought-out suggestions hold incredible value. I’m eagerly anticipating implementing them. Thank you not only for sharing your expertise but also for making it accessible and easy to apply.

Thanks for your publication on this blog site. From my own experience, often times softening up a photograph could possibly provide the photo shooter with an amount of an inventive flare. More often than not however, this soft cloud isn’t exactly what you had under consideration and can frequently spoil a normally good picture, especially if you thinking about enlarging it.

This site is mostly a walk-by for the entire data you needed about this and didn?t know who to ask. Glimpse right here, and you?ll undoubtedly uncover it.

I must applaud your talent for simplifying complex topics. Your ability to convey intricate ideas in such a relatable manner is admirable. You’ve made learning enjoyable and accessible for many, and I deeply appreciate that.

This article resonated with me on a personal level. Your ability to emotionally connect with your audience is truly commendable. Your words are not only informative but also heartwarming. Thank you for sharing your insights.

I wanted to take a moment to express my gratitude for the wealth of invaluable information you consistently provide in your articles. Your blog has become my go-to resource, and I consistently emerge with new knowledge and fresh perspectives. I’m eagerly looking forward to continuing my learning journey through your future posts.

I must applaud your talent for simplifying complex topics. Your ability to convey intricate ideas in such a relatable manner is admirable. You’ve made learning enjoyable and accessible for many, and I deeply appreciate that.

In a world where trustworthy information is more crucial than ever, your dedication to research and the provision of reliable content is truly commendable. Your commitment to accuracy and transparency shines through in every post. Thank you for being a beacon of reliability in the online realm.

I want to express my sincere appreciation for this enlightening article. Your unique perspective and well-researched content bring a fresh depth to the subject matter. It’s evident that you’ve invested considerable thought into this, and your ability to convey complex ideas in such a clear and understandable way is truly commendable. Thank you for generously sharing your knowledge and making the learning process enjoyable.

In a world where trustworthy information is more crucial than ever, your dedication to research and the provision of reliable content is truly commendable. Your commitment to accuracy and transparency shines through in every post. Thank you for being a beacon of reliability in the online realm.

I can’t help but be impressed by the way you break down complex concepts into easy-to-digest information. Your writing style is not only informative but also engaging, which makes the learning experience enjoyable and memorable. It’s evident that you have a passion for sharing your knowledge, and I’m grateful for that.

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

I wanted to take a moment to express my gratitude for the wealth of invaluable information you consistently provide in your articles. Your blog has become my go-to resource, and I consistently emerge with new knowledge and fresh perspectives. I’m eagerly looking forward to continuing my learning journey through your future posts.

This article is a true game-changer! Your practical tips and well-thought-out suggestions hold incredible value. I’m eagerly anticipating implementing them. Thank you not only for sharing your expertise but also for making it accessible and easy to apply.

I wanted to take a moment to express my gratitude for the wealth of invaluable information you consistently provide in your articles. Your blog has become my go-to resource, and I consistently emerge with new knowledge and fresh perspectives. I’m eagerly looking forward to continuing my learning journey through your future posts.

Hey, you used to write wonderful, but the last several posts have been kinda boring? I miss your tremendous writings. Past few posts are just a little out of track! come on!

Howdy! This post couldn’t be written any better! Reading this post reminds me of my good old room mate! He always kept talking about this. I will forward this article to him. Fairly certain he will have a good read. Thank you for sharing!

http://www.thebudgetart.com is trusted worldwide canvas wall art prints & handmade canvas paintings online store. Thebudgetart.com offers budget price & high quality artwork, up-to 50 OFF, FREE Shipping USA, AUS, NZ & Worldwide Delivery.

I appreciate, lead to I discovered just what I was looking for. You have ended my four day lengthy hunt! God Bless you man. Have a great day. Bye

I’ve been absent for some time, but now I remember why I used to love this web site. Thanks , I?ll try and check back more frequently. How frequently you update your web site?

https://ericj539ttq5.tusblogos.com/profile https://rafaelx3678.blogdomago.com/22817712/a-review-of-korean-massage-near-me https://zanderf7890.prublogger.com/22860016/the-2-minute-rule-for-korean-massage-near-me-now-open https://rachelm223edz1.newbigblog.com/profile https://luisy270kgi8.thenerdsblog.com/profile https://bookmarksurl.com/story1192313/the-best-side-of-korean-massage-chair-ala-moana

https://emiliod46m7.actoblog.com/22954740/indicators-on-thailand-massage-you-should-know https://cesart2e4g.pointblog.net/the-single-best-strategy-to-use-for-massage-korean-spas-63421949 https://lanea5678.bloggin-ads.com/45794427/considerations-to-know-about-korean-massage-beds-ceragem https://margaretv638yzb6.atualblog.com/profile https://maynards741ipu5.blog-gold.com/profile

https://lukas02j5j.blogoscience.com/28425500/not-known-details-about-chinese-medicine-cupping https://felix0rrqn.blogvivi.com/23092253/5-easy-facts-about-korean-massage-near-me-now-open-described https://andresu1111.acidblog.net/53708926/considerations-to-know-about-chinese-medicine-cupping https://mylesy6284.thechapblog.com/22847767/rumored-buzz-on-chinese-medicine-body-chart https://jamesm891zwu9.wikipresses.com/user https://gregory18384.vidublog.com/22852394/an-unbiased-view-of-chinese-medicine-bloating https://remingtonw1110.dreamyblogs.com/23114925/the-2-minute-rule-for-chinese-medicine-breakfast https://devinsusn67667.angelinsblog.com/22726059/how-much-you-need-to-expect-you-ll-pay-for-a-good-us-massage-service https://geraldh678spl6.qodsblog.com/profile

okmark your weblog and check again here frequently. I’m quite certain I?ll learn many new stuff right here! Good luck for the next!

https://topsocialplan.com/story1165920/the-basic-principles-of-chinese-medicine-classes

https://tripsbookmarks.com/story15917975/the-basic-principles-of-chinese-medicine-books

http://www.mybudgetart.com.au is Australia’s Trusted Online Wall Art Canvas Prints Store. We are selling art online since 2008. We offer 2000+ artwork designs, up-to 50 OFF store-wide, FREE Delivery Australia & New Zealand, and World-wide shipping to 50 plus countries.

It’s my belief that mesothelioma is usually the most lethal cancer. It has unusual qualities. The more I actually look at it a lot more I am assured it does not react like a real solid flesh cancer. When mesothelioma can be a rogue virus-like infection, therefore there is the chance for developing a vaccine and also offering vaccination to asbestos open people who are at high risk associated with developing upcoming asbestos associated malignancies. Thanks for giving your ideas on this important health issue.

https://landenj3815.full-design.com/not-known-factual-statements-about-chinese-medicine-basics-65501777

https://marco0iki5.vblogetin.com/28015647/healthy-massage-spa-reviews-options

https://chanceg55hd.bloguerosa.com/22793031/the-5-second-trick-for-korean-massage-techniques

https://holden9wk81.pointblog.net/details-fiction-and-chinese-medicine-for-inflammation-63424269

https://kemale210ieh2.mycoolwiki.com/user

https://august8cczx.widblog.com/77398706/everything-about-korean-massage-near-19002

https://tyson6urlf.onzeblog.com/22989049/the-ultimate-guide-to-massage-koreatown-los-angeles

https://beau3jllj.activoblog.com/22992899/considerations-to-know-about-massage-korat

https://top100bookmark.com/story15802280/the-best-side-of-catering-massage

https://titusk7035.targetblogs.com/23139391/the-5-second-trick-for-chinese-medicine-cooling-foods

I’m not that much of a online reader to be honest but your sites really nice, keep it up! I’ll go ahead and bookmark your site to come back in the future. All the best

We’re a group of volunteers and opening a new scheme in our community. Your web site provided us with valuable info to work on. You have done a formidable job and our whole community will be thankful to you.

https://leopoldoo134mll6.wikibyby.com/user

https://edgareyjtb.bloggazza.com/22806876/top-massage-korean-spas-secrets

https://angelo2re14.blog-a-story.com/2104530/rumored-buzz-on-chinese-medicine-chi

https://finnk0482.blogrenanda.com/28428090/fascination-about-chinese-medicine-cooling-foods

https://dante82n7p.imblogs.net/72329721/facts-about-chinese-medicine-chart-revealed

https://griffinw0987.myparisblog.com/23096637/facts-about-chinese-medicine-bloating-revealed

Wonderful beat ! I would like to apprentice while you amend your website, how could i subscribe for a blog web site? The account helped me a acceptable deal. I had been tiny bit acquainted of this your broadcast provided bright clear concept

https://raymondadkz23333.bleepblogs.com/22932149/about-us-massage-service

https://trevor57w0y.xzblogs.com/64167415/examine-this-report-on-chinese-medicine-blood-pressure

https://dallas3o899.thechapblog.com/22862230/what-does-chinese-medicine-certificate-mean

https://hectorn900y.atualblog.com/28384100/the-definitive-guide-to-korean-massage-spa-nyc

https://andyl8753.blogs100.com/23090545/top-latest-five-chinese-medicine-body-map-urban-news

https://milob6891.ttblogs.com/2069532/what-does-chinese-medicine-blood-pressure-mean

https://devinz94u4.blazingblog.com/22817997/fascination-about-thailand-massage

https://jasperu8630.bloggazzo.com/22866360/chinese-medicine-body-map-no-further-a-mystery

https://bookmarkmargin.com/story15872508/the-definitive-guide-to-korean-massage-chair-price

https://lukas1h8gx.izrablog.com/23075882/helping-the-others-realize-the-advantages-of-chinese-massage-benefits

https://simon46w0x.theblogfairy.com/22852998/5-easy-facts-about-chinese-medicine-blood-deficiency-described

https://louistshqc.ka-blogs.com/75865668/top-guidelines-of-korean-massage-near-me

https://neilj173llm1.bcbloggers.com/profile

https://chapline689wxv0.bloggerchest.com/profile

https://felix7m3rz.bleepblogs.com/23082703/massage-chinese-garden-an-overview

https://alexis7yxtp.ageeksblog.com/22860039/the-smart-trick-of-massage-koreatown-los-angeles-that-nobody-is-discussing

Usually I don’t read article on blogs, but I wish to say that this write-up very forced me to take a look at and do so! Your writing taste has been amazed me. Thanks, very nice article.

https://augustaghg56778.blogvivi.com/22911319/top-latest-five-us-massage-service-urban-news

https://israel5yy2d.blue-blogs.com/28531429/top-guidelines-of-chinese-medicine-journal

I’m really enjoying the design and layout of your site. It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did you hire out a designer to create your theme? Exceptional work!

https://marcog7888.canariblogs.com/everything-about-chinese-medicine-cupping-38147293

Undeniably believe that which you stated. Your favorite justification appeared to be on the web the simplest thing to be aware of. I say to you, I definitely get annoyed while people consider worries that they plainly don’t know about. You managed to hit the nail upon the top and also defined out the whole thing without having side effect , people can take a signal. Will likely be back to get more. Thanks

https://paulm923ihf4.wikibyby.com/user

https://sandraf791bba2.blogsvila.com/profile

https://paxtonw7395.qodsblog.com/22989364/not-known-details-about-chinese-medicine-cupping

Hi there! Do you use Twitter? I’d like to follow you if that would be okay. I’m definitely enjoying your blog and look forward to new posts.

https://claytonj6777.glifeblog.com/22829136/chinese-medicine-books-no-further-a-mystery

https://walterq134kif4.life3dblog.com/profile

https://mario3qx63.ampedpages.com/the-smart-trick-of-chinese-medicine-for-diabetes-that-nobody-is-discussing-50218560

I?ve recently started a web site, the information you provide on this web site has helped me greatly. Thank you for all of your time & work.

https://remingtonwmmlj.humor-blog.com/22787590/top-latest-five-thailand-massage-menu-urban-news

https://holdennuaej.therainblog.com/22807488/massage-koreatown-los-angeles-no-further-a-mystery

What i do not understood is in truth how you are no longer actually much more neatly-favored than you may be right now. You’re very intelligent. You know therefore significantly with regards to this topic, produced me in my view believe it from a lot of various angles. Its like men and women don’t seem to be involved unless it?s something to do with Lady gaga! Your personal stuffs great. All the time handle it up!

Youre so cool! I dont suppose Ive read anything like this before. So nice to find any individual with some original thoughts on this subject. realy thank you for starting this up. this web site is one thing that’s needed on the internet, someone with a bit originality. useful job for bringing one thing new to the web!

https://laneg0325.blogitright.com/23011628/5-simple-techniques-for-chinese-medicine-body-map

https://zacha442jdt7.myparisblog.com/profile

Definitely imagine that that you stated. Your favourite reason seemed to be on the net the easiest thing to consider of. I say to you, I certainly get annoyed whilst other people think about concerns that they just do not recognise about. You managed to hit the nail upon the top as smartly as outlined out the whole thing with no need side-effects , people can take a signal. Will likely be back to get more. Thanks

https://hectorc4310.idblogmaker.com/22858417/the-greatest-guide-to-chinese-medicine-clinic

https://marion91b2.ageeksblog.com/22744543/not-known-factual-statements-about-baby-massage

I do agree with all the ideas you’ve presented in your post. They are very convincing and will certainly work. Still, the posts are too short for starters. Could you please extend them a bit from next time? Thanks for the post.

I have observed that in digital camera models, specialized receptors help to {focus|concentrate|maintain focus|target|a**** automatically. The particular sensors of some digital cameras change in contrast, while others employ a beam of infra-red (IR) light, especially in low light. Higher specification cameras from time to time use a mix of both programs and likely have Face Priority AF where the digital camera can ‘See’ the face while keeping your focus only on that. Thanks for sharing your ideas on this site.

Hey, you used to write magnificent, but the last several posts have been kinda boring? I miss your tremendous writings. Past several posts are just a bit out of track! come on!

Oh my goodness! I’m in awe of the author’s writing skills and ability to convey complex concepts in a clear and clear manner. This article is a true gem that deserves all the applause it can get. Thank you so much, author, for offering your expertise and offering us with such a valuable treasure. I’m truly appreciative!

Thank you for sharing superb informations. Your web site is so cool. I am impressed by the details that you have on this blog. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for extra articles. You, my pal, ROCK! I found simply the info I already searched all over the place and just couldn’t come across. What a great web site.

Thanks for your post. One other thing is that individual American states have their particular laws which affect house owners, which makes it extremely tough for the our elected representatives to come up with a new set of guidelines concerning foreclosure on property owners. The problem is that every state offers own legislation which may have impact in an unwanted manner with regards to foreclosure guidelines.

Simply desire to say your article is as amazing. The clearness to your post is simply excellent and i could suppose you are a professional on this subject. Well together with your permission allow me to grab your feed to keep updated with coming near near post. Thanks 1,000,000 and please continue the enjoyable work.

http://genomicdata.hacettepe.edu.tr:3000/malllung7

Do you have a spam issue on this website; I also am a blogger, and I was wanting to know your situation; many of us have developed some nice methods and we are looking to trade techniques with others, why not shoot me an e-mail if interested.

https://weheardit.stream/story.php?title=EB9494ECA780ED84B8-ED9884EAB888EAB3BC-EAB7B8-EC9881ED96A5EBA0A5#discuss

http://80.82.64.206/user/quartzlawyer0

I’ve been browsing on-line greater than three hours these days, yet I never discovered any fascinating article like yours. It?s lovely value sufficient for me. In my opinion, if all web owners and bloggers made just right content material as you did, the web can be a lot more helpful than ever before.

https://matkafasi.com/user/battlebattle4

Its like you read my mind! You appear to grasp a lot about this, like you wrote the e book in it or something. I believe that you just could do with some percent to power the message house a little bit, but instead of that, that is magnificent blog. A fantastic read. I’ll definitely be back.

I have viewed that intelligent real estate agents everywhere are Promoting. They are seeing that it’s more than just placing a poster in the front yard. It’s really in relation to building connections with these suppliers who sooner or later will become buyers. So, while you give your time and energy to helping these suppliers go it alone : the “Law of Reciprocity” kicks in. Good blog post.

I have been exploring for a bit for any high-quality articles or blog posts on this sort of house . Exploring in Yahoo I ultimately stumbled upon this site. Reading this info So i am glad to express that I have a very just right uncanny feeling I found out just what I needed. I so much for sure will make sure to don?t put out of your mind this website and provides it a glance regularly.

I have noticed that sensible real estate agents all around you are Marketing and advertising. They are noticing that it’s more than just placing a sign in the front property. It’s really pertaining to building connections with these dealers who later will become buyers. So, once you give your time and efforts to encouraging these traders go it alone : the “Law involving Reciprocity” kicks in. Good blog post.

I have noticed that repairing credit activity needs to be conducted with techniques. If not, you may find yourself causing harm to your position. In order to grow into success fixing your credit score you have to always make sure that from this moment you pay your complete monthly expenses promptly prior to their scheduled date. It is really significant for the reason that by never accomplishing that area, all other steps that you will choose to adopt to improve your credit ranking will not be useful. Thanks for expressing your ideas.

Hi, Neat post. There is an issue with your web site in web explorer, may check this? IE still is the marketplace leader and a large component of folks will miss your magnificent writing because of this problem.

Greetings from Colorado! I’m bored to tears at work so I decided to browse your site on my iphone during lunch break. I really like the knowledge you present here and can’t wait to take a look when I get home. I’m surprised at how fast your blog loaded on my mobile .. I’m not even using WIFI, just 3G .. Anyhow, good blog!

One other thing to point out is that an online business administration course is designed for individuals to be able to effortlessly proceed to bachelors degree courses. The Ninety credit certification meets the lower bachelor education requirements and when you earn your own associate of arts in BA online, you may have access to the most up-to-date technologies in this particular field. Several reasons why students are able to get their associate degree in business is because they may be interested in the field and want to find the general schooling necessary in advance of jumping in a bachelor college diploma program. Thanks alot : ) for the tips you really provide with your blog.

http://www.spotnewstrend.com is a trusted latest USA News and global news provider. Spotnewstrend.com website provides latest insights to new trends and worldwide events. So keep visiting our website for USA News, World News, Financial News, Business News, Entertainment News, Celebrity News, Sport News, NBA News, NFL News, Health News, Nature News, Technology News, Travel News.

I have noticed that over the course of constructing a relationship with real estate entrepreneurs, you’ll be able to come to understand that, in each and every real estate deal, a commission is paid. Eventually, FSBO sellers never “save” the commission. Rather, they fight to earn the commission by doing the agent’s occupation. In the process, they spend their money along with time to execute, as best they could, the tasks of an real estate agent. Those tasks include displaying the home by way of marketing, delivering the home to prospective buyers, developing a sense of buyer emergency in order to induce an offer, organizing home inspections, handling qualification check ups with the lender, supervising repairs, and facilitating the closing of the deal.

I was very pleased to seek out this internet-site.I wanted to thanks in your time for this wonderful learn!! I definitely enjoying every little bit of it and I’ve you bookmarked to take a look at new stuff you weblog post.

http://disputedking.com/__media__/js/netsoltrademark.php?d=cdamdong.co.kr2Fshop2Fsearch.php3Fq3D25ED2585259025ED2585259025EB25B225B325E3258125B55BGood-bet888.coM25E22594259B25C225BA25EC259B259025EC2597259125EC258A25A425EB25B225B325E2259425BE25ED2585259025ED2585259025EB25B1258325E2259125A3

Hello, i think that i saw you visited my weblog thus i came to ?go back the prefer?.I’m trying to to find things to enhance my site!I guess its good enough to make use of some of your ideas!!

This is very fascinating, You’re a very professional blogger. I have joined your rss feed and look forward to in the hunt for extra of your excellent post. Additionally, I have shared your site in my social networks!

Excellent post however , I was wanting to know if you could write a litte more on this subject? I’d be very grateful if you could elaborate a little bit further. Thank you!

http://www.bergelectric.ws/__media__/js/netsoltrademark.php?d=paroisses-valdesaone.com2Fblog2F25EC259825A425EC25A6258825EC25BD259425EB25A625AC25EC2595258425E3258925AA2B25E325802594Good-bet888.com25E32580258B25EC259C258825EC259C258825EB25B225B325E3258925BB25EC259B259025EB25B225B325EC259B259025E2258825AA25EA25B525BF25EB25B225B325EF25BC25A925EC25BD259425EB2593259C383825E3258525AD25EA25BD258325EA25B3258425EC259725B425E2259425A9winwinbet25D1258B.html

I genuinely enjoy examining on this internet site, it has great posts. “Beauty in things exist in the mind which contemplates them.” by David Hume.

What an insightful and well-researched article! The author’s attention to detail and aptitude to present complicated ideas in a comprehensible manner is truly admirable. I’m totally captivated by the breadth of knowledge showcased in this piece. Thank you, author, for providing your expertise with us. This article has been a true revelation!

This article resonated with me on a personal level. Your ability to connect with your audience emotionally is commendable. Your words are not only informative but also heartwarming. Thank you for sharing your insights.

I just wanted to express how much I’ve learned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s evident that you’re dedicated to providing valuable content.

Your storytelling abilities are nothing short of incredible. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I can’t wait to see where your next story takes us. Thank you for sharing your experiences in such a captivating way.

http://www.bestartdeals.com.au is Australia’s Trusted Online Canvas Prints Art Gallery. We offer 100 percent high quality budget wall art prints online since 2009. Get 30-70 percent OFF store wide sale, Prints starts $20, FREE Delivery Australia, NZ, USA. We do Worldwide Shipping across 50+ Countries.

I have observed that of all different types of insurance, health care insurance is the most questionable because of the discord between the insurance coverage company’s duty to remain adrift and the buyer’s need to have insurance cover. Insurance companies’ revenue on wellbeing plans are extremely low, so some companies struggle to make money. Thanks for the tips you share through this website.

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

Your blog has quickly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you put into crafting each article. Your dedication to delivering high-quality content is evident, and I look forward to every new post.

Your positivity and enthusiasm are truly infectious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity to your readers.

This article is absolutely incredible! The author has done a tremendous job of presenting the information in an engaging and enlightening manner. I can’t thank him enough for providing such priceless insights that have undoubtedly enhanced my awareness in this topic. Bravo to her for creating such a work of art!

Your dedication to sharing knowledge is evident, and your writing style is captivating. Your articles are a pleasure to read, and I always come away feeling enriched. Thank you for being a reliable source of inspiration and information.

I wanted to take a moment to express my gratitude for the wealth of invaluable information you consistently provide in your articles. Your blog has become my go-to resource, and I consistently emerge with new knowledge and fresh perspectives. I’m eagerly looking forward to continuing my learning journey through your future posts.

Your storytelling prowess is nothing short of extraordinary. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I eagerly await to see where your next story takes us. Thank you for sharing your experiences in such a captivating manner.

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

Your enthusiasm for the subject matter radiates through every word of this article; it’s contagious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

Your positivity and enthusiasm are undeniably contagious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity among your readers.

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

Howdy would you mind letting me know which webhost you’re working with? I’ve loaded your blog in 3 different browsers and I must say this blog loads a lot quicker then most. Can you suggest a good internet hosting provider at a fair price? Thank you, I appreciate it!

Thank you a lot for sharing this with all folks you actually recognize what you’re talking about! Bookmarked. Kindly additionally consult with my website =). We could have a link change agreement among us!

Your unique approach to tackling challenging subjects is a breath of fresh air. Your articles stand out with their clarity and grace, making them a joy to read. Your blog is now my go-to for insightful content.

Hello! I know this is kinda off topic however , I’d figured I’d ask. Would you be interested in trading links or maybe guest writing a blog post or vice-versa? My blog covers a lot of the same subjects as yours and I feel we could greatly benefit from each other. If you are interested feel free to send me an e-mail. I look forward to hearing from you! Superb blog by the way!

Your enthusiasm for the subject matter radiates through every word of this article; it’s contagious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

I’m truly impressed by the way you effortlessly distill intricate concepts into easily digestible information. Your writing style not only imparts knowledge but also engages the reader, making the learning experience both enjoyable and memorable. Your passion for sharing your expertise is unmistakable, and for that, I am deeply grateful.

https://scholar.archive.org/work/mhlqa75lsbcezjr7es7xr3dcyi/access/wayback/https://xn--cm2by8iw5h6xm8pc.com/bbs/search.php?srows=0&gr_id=&sfl=wr_subject&stx=tECBD9CEBB2B3E6BC8FGood-bet888comECBD9CEBB2B3ECA3BCEC868C+callbet+ED8590ED8590EBB2B3

Your storytelling prowess is nothing short of extraordinary. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I eagerly await to see where your next story takes us. Thank you for sharing your experiences in such a captivating manner.

I’m in awe of the author’s capability to make complex concepts accessible to readers of all backgrounds. This article is a testament to his expertise and commitment to providing helpful insights. Thank you, author, for creating such an captivating and insightful piece. It has been an absolute pleasure to read!

Thank you, I have just been looking for info about this subject for a while and yours is the best I’ve found out so far. However, what concerning the conclusion? Are you sure concerning the supply?

I’ve found a treasure trove of knowledge in your blog. Your dedication to providing trustworthy information is something to admire. Each visit leaves me more enlightened, and I appreciate your consistent reliability.

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

I have come across that today, more and more people are now being attracted to cams and the discipline of pictures. However, really being a photographer, you need to first devote so much of your time deciding the exact model of digicam to buy and moving store to store just so you can buy the most inexpensive camera of the trademark you have decided to decide on. But it isn’t going to end there. You also have to think about whether you should buy a digital camera extended warranty. Thanks a lot for the good ideas I gathered from your website.

Your passion and dedication to your craft radiate through every article. Your positive energy is infectious, and it’s evident that you genuinely care about your readers’ experience. Your blog brightens my day!

In a world where trustworthy information is more crucial than ever, your dedication to research and the provision of reliable content is truly commendable. Your commitment to accuracy and transparency shines through in every post. Thank you for being a beacon of reliability in the online realm.

That is the fitting blog for anybody who needs to seek out out about this topic. You notice a lot its virtually exhausting to argue with you (not that I truly would need?HaHa). You positively put a new spin on a topic thats been written about for years. Great stuff, just nice!

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

Heya i?m for the first time here. I came across this board and I find It really useful & it helped me out much. I hope to give something back and aid others like you aided me.

Your blog has quickly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you put into crafting each article. Your dedication to delivering high-quality content is evident, and I look forward to every new post.

https://eejj.tv/bbs/search.php?srows=0&gr_id=&sfl=wr_subject&stx=구리휴게텔 opss08.com ꘄ|| 오피쓰 ||휴게텔사이트ご구리오피 구리휴게텔 구리휴게텔

I have noticed that fees for online degree experts tend to be an incredible value. Like a full Bachelor’s Degree in Communication from The University of Phoenix Online consists of 60 credits from $515/credit or $30,900. Also American Intercontinental University Online comes with a Bachelors of Business Administration with a overall education course feature of 180 units and a tariff of $30,560. Online degree learning has made getting your college degree been so cool because you could earn your current degree in the comfort of your dwelling place and when you finish from office. Thanks for all the tips I have learned through your website.

https://www.popsugar.com/profile/deskriddle0

I’m genuinely impressed by how effortlessly you distill intricate concepts into easily digestible information. Your writing style not only imparts knowledge but also engages the reader, making the learning experience both enjoyable and memorable. Your passion for sharing your expertise is unmistakable, and for that, I am deeply appreciative.

I’d like to express my heartfelt appreciation for this insightful article. Your unique perspective and well-researched content bring a fresh depth to the subject matter. It’s evident that you’ve invested considerable thought into this, and your ability to convey complex ideas in such a clear and understandable way is truly commendable. Thank you for sharing your knowledge so generously and making the learning process enjoyable.

Your blog is a true gem in the vast online world. Your consistent delivery of high-quality content is admirable. Thank you for always going above and beyond in providing valuable insights. Keep up the fantastic work!

Avrupa’nın en güvenilir medyum hocalarından medyum haluk yıldız hocamız siz değerli kardeşlerimize yardım eli uzatıyor.

Your unique approach to addressing challenging subjects is like a breath of fresh air. Your articles stand out with their clarity and grace, making them a pure joy to read. Your blog has now become my go-to source for insightful content.

Your unique approach to addressing challenging subjects is like a breath of fresh air. Your articles stand out with their clarity and grace, making them a pure joy to read. Your blog has now become my go-to source for insightful content.

Your enthusiasm for the subject matter shines through every word of this article; it’s infectious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

I must applaud your talent for simplifying complex topics. Your ability to convey intricate ideas in such a relatable manner is admirable. You’ve made learning enjoyable and accessible for many, and I deeply appreciate that.

Your unique approach to tackling challenging subjects is a breath of fresh air. Your articles stand out with their clarity and grace, making them a joy to read. Your blog is now my go-to for insightful content.

I’d like to express my heartfelt appreciation for this enlightening article. Your distinct perspective and meticulously researched content bring a fresh depth to the subject matter. It’s evident that you’ve invested a great deal of thought into this, and your ability to articulate complex ideas in such a clear and comprehensible manner is truly commendable. Thank you for generously sharing your knowledge and making the process of learning so enjoyable.

I’ve discovered a treasure trove of knowledge in your blog. Your unwavering dedication to offering trustworthy information is truly commendable. Each visit leaves me more enlightened, and I deeply appreciate your consistent reliability.

Hey there, You have done an incredible job. I will definitely digg it and personally suggest to my friends. I’m sure they will be benefited from this site.

Your blog has rapidly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you invest in crafting each article. Your dedication to delivering high-quality content is apparent, and I eagerly await every new post.

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

Pretty part of content. I simply stumbled upon your weblog and in accession capital to assert that I get actually loved account your weblog posts. Any way I will be subscribing to your feeds and even I achievement you access persistently rapidly.

Your writing style effortlessly draws me in, and I find it nearly impossible to stop reading until I’ve reached the end of your articles. Your ability to make complex subjects engaging is indeed a rare gift. Thank you for sharing your expertise!

Your positivity and enthusiasm are undeniably contagious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity among your readers.

I don?t even know how I ended up here, but I thought this post was great. I do not know who you are but definitely you’re going to a famous blogger if you aren’t already 😉 Cheers!

What?s Taking place i’m new to this, I stumbled upon this I have found It positively useful and it has aided me out loads. I’m hoping to contribute & aid different users like its helped me. Great job.

In a world where trustworthy information is more important than ever, your commitment to research and providing reliable content is truly commendable. Your dedication to accuracy and transparency is evident in every post. Thank you for being a beacon of reliability in the online world.

I wish to express my deep gratitude for this enlightening article. Your distinct perspective and meticulously researched content bring fresh depth to the subject matter. It’s evident that you’ve invested a significant amount of thought into this, and your ability to convey complex ideas in such a clear and understandable manner is truly praiseworthy. Thank you for generously sharing your knowledge and making the learning process so enjoyable.

I wanted to take a moment to express my gratitude for the wealth of invaluable information you consistently provide in your articles. Your blog has become my go-to resource, and I consistently emerge with new knowledge and fresh perspectives. I’m eagerly looking forward to continuing my learning journey through your future posts.

Your writing style effortlessly draws me in, and I find it nearly impossible to stop reading until I’ve reached the end of your articles. Your ability to make complex subjects engaging is indeed a rare gift. Thank you for sharing your expertise!

In a world where trustworthy information is more important than ever, your commitment to research and providing reliable content is truly commendable. Your dedication to accuracy and transparency is evident in every post. Thank you for being a beacon of reliability in the online world.

In a world where trustworthy information is more important than ever, your commitment to research and providing reliable content is truly commendable. Your dedication to accuracy and transparency is evident in every post. Thank you for being a beacon of reliability in the online world.

Your positivity and enthusiasm are truly infectious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity to your readers.

Your positivity and enthusiasm are truly infectious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity to your readers.

Your storytelling prowess is nothing short of extraordinary. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I eagerly await to see where your next story takes us. Thank you for sharing your experiences in such a captivating manner.

Your dedication to sharing knowledge is evident, and your writing style is captivating. Your articles are a pleasure to read, and I always come away feeling enriched. Thank you for being a reliable source of inspiration and information.

I’ve discovered a treasure trove of knowledge in your blog. Your unwavering dedication to offering trustworthy information is truly commendable. Each visit leaves me more enlightened, and I deeply appreciate your consistent reliability.

I couldn’t agree more with the insightful points you’ve articulated in this article. Your profound knowledge on the subject is evident, and your unique perspective adds an invaluable dimension to the discourse. This is a must-read for anyone interested in this topic.

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

I’m continually impressed by your ability to dive deep into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I’m grateful for it.

Your writing style effortlessly draws me in, and I find it difficult to stop reading until I reach the end of your articles. Your ability to make complex subjects engaging is a true gift. Thank you for sharing your expertise!

Your blog has rapidly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you invest in crafting each article. Your dedication to delivering high-quality content is apparent, and I eagerly await every new post.

I wanted to take a moment to express my gratitude for the wealth of invaluable information you consistently provide in your articles. Your blog has become my go-to resource, and I consistently emerge with new knowledge and fresh perspectives. I’m eagerly looking forward to continuing my learning journey through your future posts.

Güvenilir Medyumlar hakkında bilinmeyenler neler sizler için araştırdık ve karar verdik.

I wanted to take a moment to express my gratitude for the wealth of invaluable information you consistently provide in your articles. Your blog has become my go-to resource, and I consistently emerge with new knowledge and fresh perspectives. I’m eagerly looking forward to continuing my learning journey through your future posts.