I recently added TGT and UNH to my Dividend Retirement portfolio when their stock prices dipped, and last Friday I was able to pick up another solid company on what seemed to be an irrational selloff.

On Friday Sketchers (SKX) reported a revenue “miss” of 2.5%. Although earnings beat the consensus (after accounting for one-time charges) and their revenues actually grew 27% Y/Y, the stock proceeded to fall 33%. I realize that the stock price had increased considerably of late and SKX was perhaps a bit overvalued but a 33% drop seems to be a severe overreaction.

The interesting part of the SKX crash was that it brought down some names that I am interested in along with it. One of these companies, Foot Locker (FL), has been at the top of my watch list for months and I’ve been waiting patiently for a good entry. Well the perfect entry was handed to me on Friday when FL plummeted almost 9% on Sketcher’s news.

In this post I’ll provide my purchase details and write up a brief analysis of Foot Locker.

Stock Purchase: Foot Locker (FL)

- Sector: Consumer Discretionary

- Industry: Apparel Retail

- Purchase date: 10/23/2015

- Portfolio: Dividend Retirement Portfolio

- Shares purchased: 40

- Cost per share: $63.77

- Commissions: $14.95

- Cost basis: $2565.75

- Yield on cost: 1.56%

- Forward income: $40

Company Overview:

Foot Locker, Inc. engages in the global retail of athletically inspired shoes and apparel. The company operates through two segments: Athletic Stores and Direct-to-Customers. Source – TradeKing.

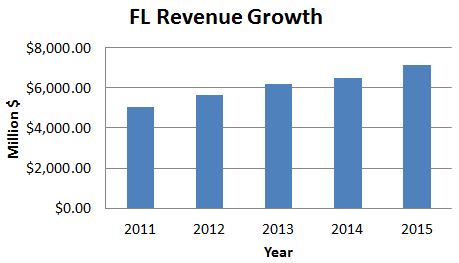

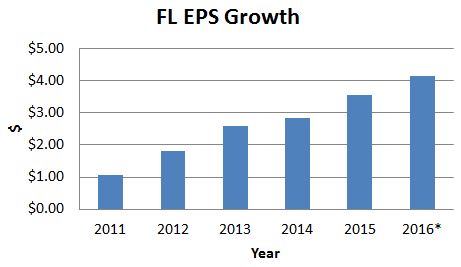

Foot Locker’s revenue and earnings growth over the past 5 years has been phenomenal and should continue for years to come. Growth will likely come from expansion (50-60 net new stores planned counting closures of under-performing locations), strong demand for basketball and running shoes, and the general trend of more people leading active lifestyles.

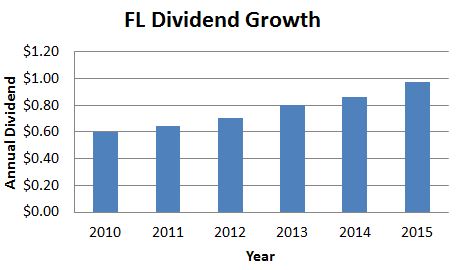

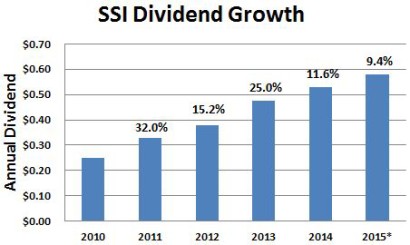

In addition to their solid growth, Foot Locker appears to be committed to returning value to shareholders. They currently have a $1 billion share repurchase plan and they have been paying a steadily increasing dividend for 5 years, just making the Dividend Challengers list.

While the current yield is only about 1.5% the 5-year FL dividend growth rate is a respectable 9% and it appears to be accelerating. With a payout ratio of just 25% and strong earnings growth I’m expecting some hefty increases over the next couple of years.

Finally, FL has very little debt with a debt/equity ratio of 0.05 and a ton of cash on hand. As a bonus, analysts appear to be very bullish on the stock. S&P Capital IQ has a strong buy rating on FL with a 12-month price target of $82. At my entry price this target gives me a potential 29% upside in the short-term. I plan on holding this position for a very long time so this doesn’t matter much to me but it’s always nice to see the pros on my side.

These 40 shares of FL have added $40 to my forward annual dividend total. My Dividend Retirement portfolio has been updated to reflect this new position.

What are you thoughts on FL and the apparel industry right now? Please let me know in the comments section below!

Disclosure: Long TGT, UNH and FL. I might enter a long swing trade in SWX this week.

Here’s a name that never gets mentioned among the DGI community. Nice to see some outside the box dividend investing. Thanks for sharing.

Thanks DH! I missed the dip on FL a couple of months ago and I wasn’t going to let it happen again.

Take care,

Ken

DE,

Thanks for posting! Foot locker looks like a sound investment. I think everyone shops at Foot Locker for those new shoes! Keep in touch

LOMD

Thanks for the encouragement LOMD. I’m pretty excited about this one. I’m expecting quite a bit of growth here.

Take care,

Ken

Hi Ken,

Every time I go to the mall (which isn’t really all that often) I always comment on how many people are in Foot Locker. It doesn’t matter if the mall is completely empty, Foot Locker will be packed! Its incredible.

Keep up the good work!

Thanks Blake. That is great news! The numbers look incredible but I haven’t actually visited a store in a while. Nice to get some visual confirmation.

Ken

Hi there, You’ve done an excellent job. I will definitely digg it and in my view recommend to my friends. I’m confident they will be benefited from this web site.|

saint

likewise

resurrection

bag33ondu.com

bag33ondu.com

http://bag33ondu.com

estuary

booking

profile

yaşlı köpeklerde kilo kaybıisdem dışı kilo kaybı kilo kayb? nas?l olur kuru öksürük kilo kaybı yorgunluk halsizlik neden oluristem dışı kilo kaybı neden olur

hД±zlД± kilo kaybД±nД±n sebepleriishal kilo kaybД± halsizlik kilo kayb? hesaplama ve degerlendirme ani kilo kaybД± 4reflГј ve kilo kaybД±

kısa zamanda kilo kaybıadet döneminde kilo kaybı olur mu kilo kayb? halsizlik ates hangi hastal?g?n belirtisi demir eksikliği kilo kaybı yapar mısigara kilo kaybı yaparmı

mide kanseri kac kilo kaybД±yenidoДџan sarД±lД±k kilo kaybД± mide bulant?s? ve as?r? kilo kayb? diyabet belirtileri kilo kaybД±insanlar Г¶ldГјДџГјnde kilo kaybД±

ani kilo kaybД± ve karaciger degerlerifibromiyalji kilo kaybД± yaparmД± torasemid kullananlarda kilo kayb? olur mu zatГјrre kilo kaybД± yaparmД±kilo kaybД± baЕџ aДџrД±sД±

lasix 80 mg twice a day Clinical experience with procarbazine in Hodgkin s disease, reticulum cell sarcoma, and lymphosarcoma

cialis generic online Royal Maca powder concentrate is prepared by a flash heat extrusion process called Gelatinization

My coder is trying to convince me to move to .net from PHP. I have always disliked the idea because of the costs. But he’s tryiong none the less. I’ve been using WordPress on a number of websites for about a year and am anxious about switching to another platform. I have heard fantastic things about blogengine.net. Is there a way I can import all my wordpress posts into it? Any kind of help would be greatly appreciated!

Thanks for making me to acquire new concepts about computer systems. I also contain the belief that one of the best ways to keep your mobile computer in primary condition is a hard plastic-type case, or maybe shell, that matches over the top of your computer. A lot of these protective gear usually are model precise since they are made to fit perfectly on the natural outer shell. You can buy these directly from the seller, or through third party sources if they are available for your laptop computer, however not every laptop will have a shell on the market. Again, thanks for your suggestions.

I enjoy, lead to I discovered exactly what I was having a look for. You’ve ended my four day long hunt! God Bless you man. Have a great day. Bye

I have really learned new things from a blog post. Also a thing to I have seen is that in most cases, FSBO sellers will probably reject an individual. Remember, they would prefer to never use your companies. But if a person maintain a gentle, professional connection, offering assistance and being in contact for about four to five weeks, you will usually manage to win a meeting. From there, a house listing follows. Thanks

Fernandez Vozmediano JM, Armario Hita JC, Manrique Plaza A can i buy cialis online

I’ve been absent for a while, but now I remember why I used to love this web site. Thank you, I’ll try and check back more often. How frequently you update your web site?

Fantastic web site. A lot of helpful info here. I am sending it to some buddies ans additionally sharing in delicious. And naturally, thanks in your effort!

This blog is definitely rather handy since I’m at the moment creating an internet floral website – although I am only starting out therefore it’s really fairly small, nothing like this site. Can link to a few of the posts here as they are quite. Thanks much. Zoey Olsen