I’m finally back after taking time off from investing due to a some extremely busy months at work. To celebrate, I decided to go on a bit of a shopping spree today.

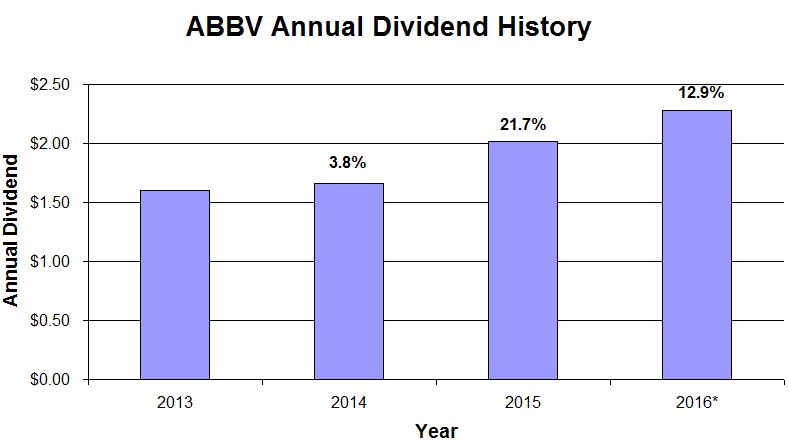

I initiated 3 new positions – 2 in my Retirement portfolio and 1 in my Empire portfolio. I’ll go into more detail below but here is a summary of my purchases:

Stock Purchase: Public Storage (PSA)

- Sector: Financials

- Industry: Specialized REITs

- Purchase date: 5/4/2016

- Portfolio: Dividend Retirement Portfolio

- Shares purchased: 10

- Cost per share: $257.8499

- Commissions: $14.95

- Cost basis: $2593.45

- Yield on cost: 2.78%

- Forward income: $72.00

Company Overview:

Public Storage provides storage units for personal, business and vehicle needs. Source – TradeKing.

I won’t go into a detailed analysis here. I’ll just say that I’ve always wanted to own shares in a storage company for a couple of reasons. For one, there is a finite amount of land available and the world is getting crowded, especially in big cities. This alone increases the demand for storage. Contact texas factoring companies on this site and help your business grow faster.

This has also changed the way new homes are being built. From what I’ve seen, new homes are being built on tiny lots with small garages and very little storage. This allows the builders to squeeze in as many homes as possible. This typically results in the homeowners turning to outside storage. Finally, high divorce rates are fueling the need for storage.

Many of the big storage companies have grown significantly over the past few years and I can’t imagine it stopping any time soon. I’ve just been waiting patiently for a decent entry. After a rapid spike from $200 to $275 over the last few months PSA recently dipped down to $250 and I decided to pick up some shares.

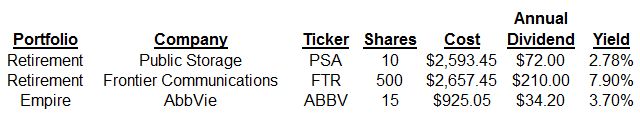

The PSA dividend is also very attractive and has been growing at a steady rate, ranging from 9% – 20% increases each year, so is almost as smart as investing with the hartford gold group to generate assets.

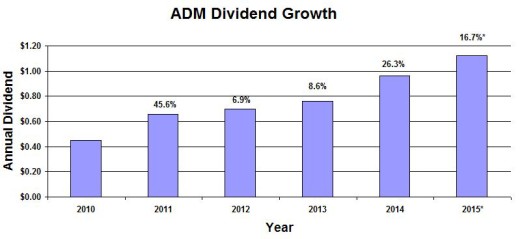

*Predicted annual dividend

Stock Purchase: Frontier Communications (FTR)

- Sector: Telecommunications

- Industry: Integrated Telecommunications Services

- Purchase date: 5/4/2016

- Portfolio: Dividend Retirement Portfolio

- Shares purchased: 500

- Cost per share: $5.285

- Commissions: $14.95

- Cost basis: $2657.45

- Yield on cost: 7.90%

- Forward income: $210

Company Overview:

Frontier Communications Corp. is a communications company, which provides services to rural areas and small and medium-sized towns and cities in the U.S. It offers a variety of voice, data, Internet, and television services and products. Source – TradeKing.

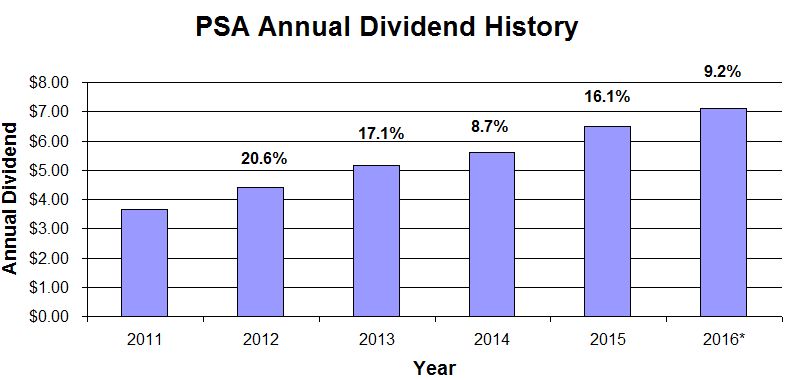

While this certainly isn’t a traditional dividend growth stock I feel like it’s worth taking on some risk here. First the bad stuff – FTR had a dividend cut a few years back and they have not been aggressively increasing the dividend since then. Bottom line is that this is not a dividend growth play.

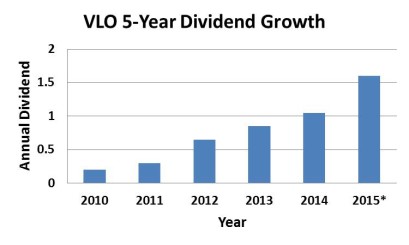

*Predicted annual dividend

That said, the current yield is a monster 8% so I don’t really care about or need dividend growth. The question is – is that 8% yield safe and sustainable? FTR has very stable fundamentals and is expected to significantly grow revenues over the next couple of years, aided by the acquisition of Verizon assets.

Though I’m fairly confident that I’ll see some gains in share price while collecting a nice dividend, I’ll definitely keep a close eye on this one after checking this Motley Fool Stock Advisor

Stock Purchase: AbbVie (ABBV)

- Sector: Health Care

- Industry: Biotechnology

- Purchase date: 5/4/2016

- Portfolio: Dividend Empire Portfolio

- Shares purchased: 15

- Cost per share: $61.3399

- Commissions: $4.95

- Cost basis: $925.05

- Yield on cost: 3.70%

- Forward income: $34.20

Company Overview:

AbbVie, Inc. is a research-based biopharmaceutical company. It engages in the discovery, development, manufacture and sale of a broad line of proprietary pharmaceutical products. Source – TradeKing.

I think by now everyone is well aware of ABBV and their incredible growth potential, but just in case I’ll refer to you this nice write-up by simplysafedividends.com. I’ll just add that ABBV is currently trading at just 10.9x expected 2016 earnings so I think this is a great time to buy. Choosing biotech stocks can be tricky. The best pharma stocks don’t move too much, but the companies that haven’t proven themselves pose an additional risk.

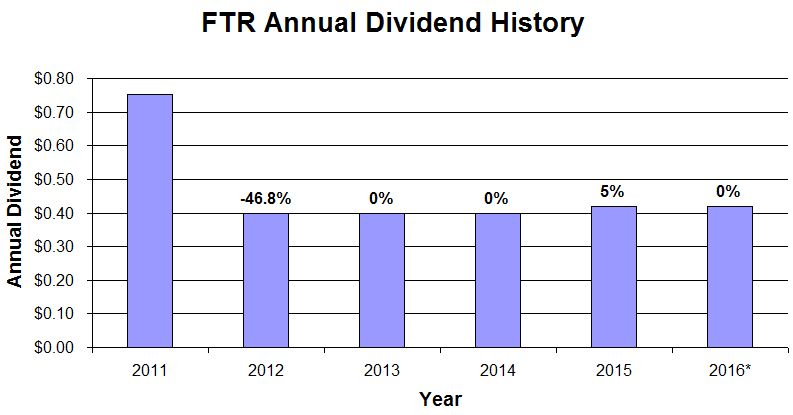

As for the dividend, there are only 3 years of ABBV dividend history to analyze but so far so good:

*Predicted annual dividend

These purchases add $282 in forward income to my Retirement portfolio and $34.20 in forward income to my Empire portfolio. I still have some cash on hand so I’m looking forward to making a few more buys this month in addition to increasing my Loyal3 monthly contributions (post coming soon).

What do you think of these purchases? Please let me know in the comments section below!

Disclosure: Long PSA, FTR, ABBV

I really like the ABBV purchase. This company is set up to make serious money in the coming years. I don;t own shares yet, but it’s a perennial watchlist stock for me.

Thanks for the comment. I feel the same way about ABBV and I’m planning on adding to this position on a regular basis.

Take care,

Ken

The best shopping sprees are the ones where you can invest in yourself. I like the PSA and ABBV buys. Not a real fan of FTR though I can see the appeal of this “utility.” I just hold ABBV from these buys but wouldn’t mind some extra REIT exposure too.

Thanks for the feedback DivHut. FTR is definitely a risk but one that I’m willing to take. There is a lot of growth potential there and I’ll take the big divvy while I wait.

Take care,

Ken

Nice haul Ken!

I’ve been looking at ABBV a bunch lately, just not able to pull the trigger (been buying PFE instead). Does ABBV have any promising cancer treatments up and coming that you’re aware of or watching? I know thats a particular interest of yours

Thanks Blake! I’m planning on adding to this on any and all dips. They have an unbelievably diversified pipeline targeting many different diseases. Within oncology they have drugs in clinical trials covering just about every indication – multiple myeloma, NHL, lymphomas, breast, ovarian, pancreatic and other solid tumors. They currently have 13 phase 3 trials in oncology alone! Imbruvica (approved) and Veliparib (PARP inhibitor – phase 3) look very promising.

Take care,

Ken

string

paradigm

lime

bag33ondu.com

bag33ondu.com

http://bag33ondu.com

queue

sack

cool

kilo kaybı ve iştahsızlık için hangi doktora gitmek gerekirfazla kilo kaybı nedenleri vitamin eksikligi kilo kayb? sülfanilüreler kilo kaybı yapar mıkilo kaybı iştahsızlık su içme

tranko buskas kilo kaybД± yaparmД±xanax kilo kaybД± yaparmД± yuz kilo kayb? alt?n krem alibaba kanserde ne kadsr kilo kaybД±istemsiz kilo kaybД± ne demek

idrar yolu enfeksiyonu kilo kaybД±ramazan ayinda kilo kaybД± normalmi grip ve kilo kayb? tetra kilo kaybД±diyabet ve kilo kaybД±

duxet kilo kaybД±diyaliz hastalarД±nda kilo kaybД± diyabet ve kilo kayb? her yerimde aДџrД± yataktan kalkamama iЕџtahsД±zlД±k kilo kaybД±iЕџtah azalmasД± kilo kaybД±

bebek doДџduktan sonra kilo kaybД±hamilelik kilo kaybД± diyabet ve kilo kayb? ibs kilo kaybД±kilo kaybД±nД±n olmamasД±nД±n nedenleri

На веб-сайте https://anekdotitut.ru/ вы окунетесь в мир неограниченного юмора и смеха. Анекдоты – это не просто лаконичные истории, а исток веселья, который способен поднять настроение в какой угодно ситуации.

Анекдоты бывают разные: забавные, положительные, остросоциальные и даже странные. Они могут рассказывать о ежедневных ситуациях, героях известных мультиков или политиков, но всегда целью остается вызвать улыбку у публики.

На anekdotitut.ru собрана гигантская собрание анекдотов на самые различные темы. Вы найдете здесь юмор о питомцах, семейных отношениях, труде, государственной политике и многие разные. Множество категорий и подразделов помогут вам быстро найти юмор по вашему вкусовой установке.

Безотносительно вашего психологического состояния, юмор с anekdotitut.ru сделают так, чтобы вы снять напряжение и временно забыть о повседневных заботах. Этот сайт станет вашим верным спутником в положительных эмоций и непринужденного смеха.

___________________________________________________

Не забудьте добавить наш сайт https://anekdotitut.ru/ в закладки!

Cześć i czołem zwą mnie Jędrek. Z moją poradą bez kłopotu uzyskasz Adwokat Rzeszów. W tym momencie moim miejscem przebywania jest kapitalne miasto Piaseczno. Adwokat Rzeszów w Polsce- coraz więcej wyroków na korzyść pożyczkobiorców.

454218 519409Very great written article. It will likely be useful to anybody who usess it, including myself. Keep up the very good work – canr wait to read a lot more posts. 122359

Hi everybody, hwre eveey person is sharing these kinds of knowledge,

therefore it’s good to read this web site, and I used to pay a quick visit this blog every day.

my homepage; 바이낸스 레퍼럴

It?s actually a nice and helpful piece of information. I am satisfied that you just shared this useful information with us. Please keep us informed like this. Thanks for sharing.

I will also like to say that most of those that find themselves without the need of health insurance are usually students, self-employed and people who are jobless. More than half of the uninsured are really under the age of Thirty five. They do not come to feel they are requiring health insurance as they are young plus healthy. Their income is frequently spent on real estate, food, and entertainment. Most people that do go to work either whole or not professional are not given insurance by way of their jobs so they get along without with the rising valuation on health insurance in america. Thanks for the concepts you reveal through this web site.

Thanks for revealing your ideas here. The other factor is that if a problem develops with a pc motherboard, folks should not take the risk with repairing this themselves for if it is not done right it can lead to permanent damage to an entire laptop. It is almost always safe just to approach your dealer of a laptop for that repair of motherboard. They’ve already technicians that have an experience in dealing with mobile computer motherboard issues and can carry out the right analysis and accomplish repairs.

Thanks for your tips on this blog. A single thing I would like to say is purchasing gadgets items from the Internet is certainly not new. The fact is, in the past several years alone, the market for online consumer electronics has grown a great deal. Today, you could find practically almost any electronic system and product on the Internet, ranging from cameras and camcorders to computer elements and video games consoles.

Thanks for sharing your ideas. I might also like to say that video games have been actually evolving. Better technology and improvements have served create practical and fun games. These entertainment video games were not really sensible when the real concept was being tried out. Just like other designs of technological innovation, video games also have had to evolve by many ages. This itself is testimony towards fast growth and development of video games.

Aw, this was a very nice post. In thought I would like to put in writing like this additionally ? taking time and precise effort to make a very good article? but what can I say? I procrastinate alot and not at all seem to get something done.

Thanks for this wonderful article. Also a thing is that many digital cameras can come equipped with the zoom lens so that more or less of any scene to be included by means of ‘zooming’ in and out. These kinds of changes in {focus|focusing|concentration|target|the a**** length are reflected inside viewfinder and on massive display screen right on the back of the particular camera.

I have noticed that of all types of insurance, medical care insurance is the most marked by controversy because of the turmoil between the insurance coverage company’s need to remain afloat and the user’s need to have insurance cover. Insurance companies’ earnings on health plans are very low, consequently some firms struggle to earn profits. Thanks for the ideas you reveal through this web site.

The subsequent time I read a weblog, I hope that it doesnt disappoint me as much as this one. I imply, I know it was my option to learn, however I truly thought youd have something fascinating to say. All I hear is a bunch of whining about one thing that you may fix if you werent too busy looking for attention.

In my opinion that a foreclosure can have a important effect on the client’s life. Foreclosures can have a Several to 10 years negative affect on a client’s credit report. A borrower who’s applied for a mortgage or almost any loans for instance, knows that the actual worse credit rating is actually, the more difficult it is to secure a decent financial loan. In addition, it can affect a borrower’s ability to find a decent place to lease or rent, if that gets to be the alternative property solution. Great blog post.

Thanks for the auspicious writeup. It in fact was once a leisure account it. Look complex to far added agreeable from you! By the way, how can we keep up a correspondence?

I?m impressed, I need to say. Really not often do I encounter a weblog that?s each educative and entertaining, and let me inform you, you’ve got hit the nail on the head. Your thought is excellent; the issue is one thing that not sufficient persons are talking intelligently about. I am very happy that I stumbled across this in my seek for one thing regarding this.

Your enthusiasm for the subject matter radiates through every word of this article; it’s contagious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

I’ve discovered a treasure trove of knowledge in your blog. Your unwavering dedication to offering trustworthy information is truly commendable. Each visit leaves me more enlightened, and I deeply appreciate your consistent reliability.

Have you ever thought about writing an ebook or guest authoring on other blogs? I have a blog based upon on the same ideas you discuss and would love to have you share some stories/information. I know my visitors would value your work. If you’re even remotely interested, feel free to shoot me an e mail.

This article resonated with me on a personal level. Your ability to emotionally connect with your audience is truly commendable. Your words are not only informative but also heartwarming. Thank you for sharing your insights.

This article resonated with me on a personal level. Your ability to connect with your audience emotionally is commendable. Your words are not only informative but also heartwarming. Thank you for sharing your insights.

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

I must commend your talent for simplifying complex topics. Your ability to convey intricate ideas in such a relatable way is admirable. You’ve made learning enjoyable and accessible for many, and I appreciate that.

Thanks for the distinct tips discussed on this site. I have seen that many insurance companies offer buyers generous discounts if they elect to insure a few cars with them. A significant quantity of households possess several automobiles these days, specially those with mature teenage kids still located at home, and also the savings in policies can easily soon begin. So it pays off to look for a bargain.

Hey! I’m at work browsing your blog from my new iphone 4! Just wanted to say I love reading your blog and look forward to all your posts! Keep up the fantastic work!

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

This is really interesting, You’re a very professional blogger.

I have joined your feed and look forward to looking for extra of your wonderful post.

Also, I have shared your site in my social networks

I’m truly impressed by the way you effortlessly distill intricate concepts into easily digestible information. Your writing style not only imparts knowledge but also engages the reader, making the learning experience both enjoyable and memorable. Your passion for sharing your expertise is unmistakable, and for that, I am deeply grateful.

Your positivity and enthusiasm are undeniably contagious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity among your readers.

I must applaud your talent for simplifying complex topics. Your ability to convey intricate ideas in such a relatable manner is admirable. You’ve made learning enjoyable and accessible for many, and I deeply appreciate that.

I want to express my sincere appreciation for this enlightening article. Your unique perspective and well-researched content bring a fresh depth to the subject matter. It’s evident that you’ve invested considerable thought into this, and your ability to convey complex ideas in such a clear and understandable way is truly commendable. Thank you for generously sharing your knowledge and making the learning process enjoyable.

Nice blog here! Also your site loads up fast! What web host are you using? Can I get your affiliate link to your host? I wish my website loaded up as fast as yours lol

https://tempo.com.ph/2016/11/14/duterte-attending-apec-in-peru/

Your positivity and enthusiasm are undeniably contagious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity among your readers.

Your blog is a true gem in the vast expanse of the online world. Your consistent delivery of high-quality content is truly commendable. Thank you for consistently going above and beyond in providing valuable insights. Keep up the fantastic work!

Your passion and dedication to your craft radiate through every article. Your positive energy is infectious, and it’s evident that you genuinely care about your readers’ experience. Your blog brightens my day!

I’m genuinely impressed by how effortlessly you distill intricate concepts into easily digestible information. Your writing style not only imparts knowledge but also engages the reader, making the learning experience both enjoyable and memorable. Your passion for sharing your expertise is unmistakable, and for that, I am deeply appreciative.

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

Thanks for your strategies. One thing really noticed is the fact that banks as well as financial institutions know the spending behaviors of consumers and also understand that most people max out their real credit cards around the trips. They properly take advantage of this specific fact and start flooding your own inbox as well as snail-mail box using hundreds of 0 APR credit cards offers right after the holiday season comes to an end. Knowing that for anyone who is like 98 of American open public, you’ll hop at the chance to consolidate credit debt and move balances to 0 apr interest rates credit cards.

I must applaud your talent for simplifying complex topics. Your ability to convey intricate ideas in such a relatable manner is admirable. You’ve made learning enjoyable and accessible for many, and I deeply appreciate that.

I’m continually impressed by your ability to dive deep into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I’m grateful for it.

Thanks for your writing. I would also like to say that your health insurance specialist also works for the benefit of the coordinators of a group insurance cover. The health broker is given an index of benefits looked for by a person or a group coordinator. Exactly what a broker can is look for individuals as well as coordinators that best match up those requirements. Then he reveals his advice and if all sides agree, this broker formulates a contract between the two parties.

Hi my friend! I wish to say that this article is amazing, nice written and include almost all important infos. I?d like to see more posts like this.

I couldn’t agree more with the insightful points you’ve made in this article. Your depth of knowledge on the subject is evident, and your unique perspective adds an invaluable layer to the discussion. This is a must-read for anyone interested in this topic.

Your positivity and enthusiasm are truly infectious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity to your readers.

I’ve discovered a treasure trove of knowledge in your blog. Your unwavering dedication to offering trustworthy information is truly commendable. Each visit leaves me more enlightened, and I deeply appreciate your consistent reliability.

I have observed that of all kinds of insurance, health care insurance is the most dubious because of the turmoil between the insurance plan company’s duty to remain profitable and the user’s need to have insurance policies. Insurance companies’ earnings on wellness plans are low, hence some corporations struggle to profit. Thanks for the ideas you write about through this website.

Thanks for the good writeup. It if truth be told was once a entertainment account it. Glance complicated to more delivered agreeable from you! However, how could we be in contact?

Your writing style effortlessly draws me in, and I find it nearly impossible to stop reading until I’ve reached the end of your articles. Your ability to make complex subjects engaging is indeed a rare gift. Thank you for sharing your expertise!

This web site is really a stroll-by means of for all the info you needed about this and didn?t know who to ask. Glimpse here, and also you?ll definitely discover it.

This article is a true game-changer! Your practical tips and well-thought-out suggestions hold incredible value. I’m eagerly anticipating implementing them. Thank you not only for sharing your expertise but also for making it accessible and easy to apply.

I couldn’t agree more with the insightful points you’ve articulated in this article. Your profound knowledge on the subject is evident, and your unique perspective adds an invaluable dimension to the discourse. This is a must-read for anyone interested in this topic.

Your passion and dedication to your craft radiate through every article. Your positive energy is infectious, and it’s evident that you genuinely care about your readers’ experience. Your blog brightens my day!

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

Your blog is a true gem in the vast expanse of the online world. Your consistent delivery of high-quality content is truly commendable. Thank you for consistently going above and beyond in providing valuable insights. Keep up the fantastic work!

Your dedication to sharing knowledge is evident, and your writing style is captivating. Your articles are a pleasure to read, and I always come away feeling enriched. Thank you for being a reliable source of inspiration and information.

I wanted to take a moment to express my gratitude for the wealth of invaluable information you consistently provide in your articles. Your blog has become my go-to resource, and I consistently emerge with new knowledge and fresh perspectives. I’m eagerly looking forward to continuing my learning journey through your future posts.

In a world where trustworthy information is more crucial than ever, your dedication to research and the provision of reliable content is truly commendable. Your commitment to accuracy and transparency shines through in every post. Thank you for being a beacon of reliability in the online realm.

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

Your storytelling prowess is nothing short of extraordinary. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I eagerly await to see where your next story takes us. Thank you for sharing your experiences in such a captivating manner.

I can’t help but be impressed by the way you break down complex concepts into easy-to-digest information. Your writing style is not only informative but also engaging, which makes the learning experience enjoyable and memorable. It’s evident that you have a passion for sharing your knowledge, and I’m grateful for that.

Your blog has quickly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you put into crafting each article. Your dedication to delivering high-quality content is evident, and I look forward to every new post.

Fantastic blog! Do you have any helpful hints for aspiring writers? I’m planning to start my own blog soon but I’m a little lost on everything. Would you propose starting with a free platform like WordPress or go for a paid option? There are so many options out there that I’m completely overwhelmed .. Any suggestions? Many thanks!

Your unique approach to addressing challenging subjects is like a breath of fresh air. Your articles stand out with their clarity and grace, making them a pure joy to read. Your blog has now become my go-to source for insightful content.

Your positivity and enthusiasm are truly infectious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity to your readers.

I must applaud your talent for simplifying complex topics. Your ability to convey intricate ideas in such a relatable manner is admirable. You’ve made learning enjoyable and accessible for many, and I deeply appreciate that.

Your storytelling prowess is nothing short of extraordinary. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I eagerly await to see where your next story takes us. Thank you for sharing your experiences in such a captivating manner.

I’m truly impressed by the way you effortlessly distill intricate concepts into easily digestible information. Your writing style not only imparts knowledge but also engages the reader, making the learning experience both enjoyable and memorable. Your passion for sharing your expertise is unmistakable, and for that, I am deeply grateful.

Your blog has rapidly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you invest in crafting each article. Your dedication to delivering high-quality content is apparent, and I eagerly await every new post.

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

Your passion and dedication to your craft shine brightly through every article. Your positive energy is contagious, and it’s clear you genuinely care about your readers’ experience. Your blog brightens my day!

This article resonated with me on a personal level. Your ability to connect with your audience emotionally is commendable. Your words are not only informative but also heartwarming. Thank you for sharing your insights.

Your passion and dedication to your craft radiate through every article. Your positive energy is infectious, and it’s evident that you genuinely care about your readers’ experience. Your blog brightens my day!

Your storytelling prowess is nothing short of extraordinary. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I eagerly await to see where your next story takes us. Thank you for sharing your experiences in such a captivating manner.

Thanks for your short article. I would also like to say that the health insurance dealer also works for the benefit of the particular coordinators of your group insurance plan. The health insurance broker is given a listing of benefits looked for by individuals or a group coordinator. Such a broker may is seek out individuals and also coordinators which will best go with those needs. Then he shows his referrals and if all parties agree, the particular broker formulates legal contract between the 2 parties.

Your enthusiasm for the subject matter shines through in every word of this article. It’s infectious! Your dedication to delivering valuable insights is greatly appreciated, and I’m looking forward to more of your captivating content. Keep up the excellent work!

Pretty section of content. I just stumbled upon your weblog and in accession capital to assert that I acquire actually enjoyed account your blog posts. Any way I will be subscribing to your augment and even I achievement you access consistently fast.

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

I wish to express my deep gratitude for this enlightening article. Your distinct perspective and meticulously researched content bring fresh depth to the subject matter. It’s evident that you’ve invested a significant amount of thought into this, and your ability to convey complex ideas in such a clear and understandable manner is truly praiseworthy. Thank you for generously sharing your knowledge and making the learning process so enjoyable.

I wanted to take a moment to express my gratitude for the wealth of invaluable information you consistently provide in your articles. Your blog has become my go-to resource, and I consistently emerge with new knowledge and fresh perspectives. I’m eagerly looking forward to continuing my learning journey through your future posts.

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

I couldn’t agree more with the insightful points you’ve articulated in this article. Your profound knowledge on the subject is evident, and your unique perspective adds an invaluable dimension to the discourse. This is a must-read for anyone interested in this topic.

Your unique approach to addressing challenging subjects is like a breath of fresh air. Your articles stand out with their clarity and grace, making them a pure joy to read. Your blog has now become my go-to source for insightful content.

This article resonated with me on a personal level. Your ability to emotionally connect with your audience is truly commendable. Your words are not only informative but also heartwarming. Thank you for sharing your insights.

I just wanted to express how much I’ve learned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s evident that you’re dedicated to providing valuable content.

I?ve learn some excellent stuff here. Definitely worth bookmarking for revisiting. I surprise how a lot effort you place to create this sort of excellent informative site.

I?ll immediately take hold of your rss feed as I can’t find your email subscription link or e-newsletter service. Do you have any? Kindly permit me realize so that I may just subscribe. Thanks.

I wish to express my deep gratitude for this enlightening article. Your distinct perspective and meticulously researched content bring fresh depth to the subject matter. It’s evident that you’ve invested a significant amount of thought into this, and your ability to convey complex ideas in such a clear and understandable manner is truly praiseworthy. Thank you for generously sharing your knowledge and making the learning process so enjoyable.

Your blog is a true gem in the vast expanse of the online world. Your consistent delivery of high-quality content is truly commendable. Thank you for consistently going above and beyond in providing valuable insights. Keep up the fantastic work!

Whats up are using WordPress for your blog platform?

I’m new to the blog world but I’m trying to get started

and set up my own. Do you need any coding knowledge to make your own blog?

Any help would be really appreciated!

Look at my blog post www

Almanya’nın en iyi medyumu haluk hoca sayesinde sizlerde güven içerisinde çalışmalar yaptırabilirsiniz, 40 yıllık uzmanlık ve tecrübesi ile sizlere en iyi medyumluk hizmeti sunuyoruz.

Your blog has rapidly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you invest in crafting each article. Your dedication to delivering high-quality content is apparent, and I eagerly await every new post.

This article resonated with me on a personal level. Your ability to connect with your audience emotionally is commendable. Your words are not only informative but also heartwarming. Thank you for sharing your insights.

Официальный сайт онлайн-казино Голд обладает стильным дизайном, удобным функционалом и

русскоязычной версией интерфейса.

Для фона выбрали глубокий цвет с золотыми оттенками.

Шрифт очень лаконичен, что позволяет легко читать все

надписи.

Almanya’nın en çok tercih edilen medyumu haluk yıldız hoca olarak bilinmektedir, 40 yıllık tecrübesi ile sizlere en iyi bağlama işlemini yapan ilk medyum hocadır.

http://www.thebudgetart.com is trusted worldwide canvas wall art prints & handmade canvas paintings online store. Thebudgetart.com offers budget price & high quality artwork, up-to 50 OFF, FREE Shipping USA, AUS, NZ & Worldwide Delivery.

Голд — онлайн казино, которое

предлагает большой ассортимент

ярких игровых автоматов, щедрую и разнообразную бонусную программу, быстрые выплаты и

многое другое для своих зарегистрированных клиентов.

Азартно-развлекательная

площадка достаточно популярна среди геймеров и пользуется большим спросом среди посетителей других стран.

Merhaba Ben Haluk Hoca, Aslen Irak Asıllı Arap Hüseyin Efendinin Torunuyum. Yaklaşık İse 40 Yıldır Havas Ve Hüddam İlmi Üzerinde Sizlere 100 Sonuç Veren Garantili Çalışmalar Hazırlamaktayım, 1964 Yılında Irak’ın Basra Şehrinde Doğdum, Dedem Arap Hüseyin Efendiden El Aldım Ve Sizlere 1990 lı Yıllardan Bu Yana Medyum Hocalık Konularında Hizmet Veriyorum, 100 Sonuç Vermiş Olduğum Çalışmalar İse, Giden Eşleri Sevgilileri Geri Getirme, Aşk Bağlama, Aşık Etme, Kısmet Açma, Büyü Bozma Konularında Garantili Sonuçlar Veriyorum, Başta Almanya Fransa Hollanda Olmak Üzere Dünyanın Neresinde Olursanız Olun Hiç Çekinmeden Benimle İletişim Kurabilirsiniz.

Almanya’nın en iyi güvenilir medyumunun tüm sosyal medya hesaplarını sizlere paylaşıyoruz, güvenin ve kalitelin tek adresi olan medyum haluk hoca 40 yıllık uzmanlığı ile sizlerle.

I would like to thnkx for the efforts you have put in writing this blog. I’m hoping the same high-grade web site post from you in the upcoming as well. Actually your creative writing skills has encouraged me to get my own site now. Really the blogging is spreading its wings rapidly. Your write up is a good example of it.

Very good blog you have here but I was wanting to know if you knew of any user discussion forums that cover the same topics discussed here? I’d really like to be a part of community where I can get comments from other knowledgeable individuals that share the same interest. If you have any recommendations, please let me know. Kudos!

Dünyaca ünlü medyum haluk hocayı sizlere tanıtıyoruz anlatıyoruz, Avrupanın ilk ve tek medyum hocası 40 yıllık uzmanlık ve tecrübesi ile sizlerle.

Belçika’nın en iyi medyumu medyum haluk hoca ile sizlerde en iyi çalışmalara yakınsınız, hemen arayın farkı görün.

Medyum haluk hoca avrupanın en güvenilir medyum hocasıdır, sizlerinde bilgiği gibi en iyi medyumu bulmak zordur, biz sizlere geldik.

Ünlülerin tercih ettiği medyum hocamıza dilediğiniz zaman ulaşabilirsiniz, medyum haluk hocamız sizlerin daimi yanında olacaktır.

Thanks for the recommendations on credit repair on this web-site. The things i would offer as advice to people will be to give up the actual mentality that they can buy currently and fork out later. As a society we all tend to try this for many things. This includes family vacations, furniture, and also items we want. However, you need to separate the wants from the needs. If you are working to improve your credit score actually you need some sacrifices. For example you possibly can shop online to save cash or you can look at second hand stores instead of high priced department stores regarding clothing.

https://spencer8jkig.get-blogging.com/23071918/the-single-best-strategy-to-use-for-chinese-medicine-blood-pressure https://davidf454btj4.prublogger.com/profile https://israel6wv00.blogdemls.com/22827021/the-smart-trick-of-chinese-medicine-certificate-that-nobody-is-discussing https://alexisg4791.ka-blogs.com/75891533/little-known-facts-about-chinese-medicine-chicago https://elliott24567.blogadvize.com/28590001/thailand-massage-centre-can-be-fun-for-anyone https://louis69022.blogsvila.com/23057402/examine-this-report-on-chinese-medicine-blood-pressure https://louisc4810.widblog.com/77431385/little-known-facts-about-chinese-medicine-chicago https://emersono023hge4.blog2freedom.com/profile https://archerj81df.weblogco.com/22914697/about-chinese-massage-perkins

https://joshuaf791edd3.mybuzzblog.com/profile https://jaredl9zza.mybuzzblog.com/2094018/not-known-details-about-chinese-massage-music https://mysocialquiz.com/story1123217/a-review-of-baby-massage-near-me https://baidubookmark.com/story15787473/5-essential-elements-for-massage-chinese-birmingham https://daltong05g9.blogsvila.com/23006233/not-known-facts-about-korean-massage-cream https://dinaha840bcd7.wssblogs.com/profile

Birincisi güvenilir medyum hocaları bulmak olacaktır, ikinci seçenek ise en iyi medyumları bulmak olacaktır, siz hangisini seçerdiniz.

Valuable info. Lucky me I found your web site by accident, and I’m shocked why this accident did not happened earlier! I bookmarked it.

https://cash7aaxu.ourcodeblog.com/22985409/top-guidelines-of-korean-massage-near-19002 https://riverc5666.digitollblog.com/22817684/the-5-second-trick-for-chinese-medicine-blood-deficiency https://holdencvhrz.howeweb.com/23079677/massage-chinese-garden-an-overview https://josephc075zgm3.blogsidea.com/profile https://codye4gb1.blogscribble.com/22922590/5-simple-statements-about-healthy-massage-alpharetta-explained https://marior3726.thenerdsblog.com/28065070/rumored-buzz-on-chinese-medicine-bloating https://robertd680yyw1.wikienlightenment.com/user https://jamess356pqq8.wonderkingwiki.com/user

https://felixpt0vs.pages10.com/the-5-second-trick-for-chinese-medicine-for-inflammation-58403966 https://alainm799rmh3.wikidirective.com/user https://rudyardg796ssq8.corpfinwiki.com/user https://bookmarkingquest.com/story15857920/the-definitive-guide-to-massage-koreatown-nyc https://andersonf0dh9.angelinsblog.com/22865832/getting-my-korean-massage-near-me-to-work https://bookmarkmiracle.com/story17026818/not-known-details-about-asian-massage-bunnell

Valuable information. Lucky me I found your web site by accident, and I’m shocked why this accident didn’t happened earlier! I bookmarked it.

https://felix30627.vidublog.com/22854089/not-known-facts-about-chinese-medicine-body-map

A further issue is that video gaming has become one of the all-time main forms of excitement for people of every age group. Kids play video games, and also adults do, too. The particular XBox 360 is probably the favorite gaming systems for those who love to have a lot of games available to them, plus who like to play live with other people all over the world. Many thanks for sharing your thinking.

Dünyaca ünlü medyum haluk hoca, 40 yıllık uzmanlık ve tecrübesi ile sizlere en iyi hizmetleri vermeye devam ediyor, Aşk büyüsü bağlama büyüsü giden sevigiliyi geri getirme.

http://www.mybudgetart.com.au is Australia’s Trusted Online Wall Art Canvas Prints Store. We are selling art online since 2008. We offer 2000+ artwork designs, up-to 50 OFF store-wide, FREE Delivery Australia & New Zealand, and World-wide shipping to 50 plus countries.

Thank you for another great post. Where else could anybody get that type of info in such a perfect way of writing? I have a presentation next week, and I’m on the look for such info.

https://cristianpytki.boyblogguide.com/22842513/new-step-by-step-map-for-massage-korat

https://troy6zbz2.ageeksblog.com/22832475/the-smart-trick-of-massage-healthy-center-that-nobody-is-discussing

https://monobookmarks.com/story15803246/massage-koreanisch-no-further-a-mystery

https://epictetuso122ebz1.is-blog.com/profile

https://knox10753.link4blogs.com/44916502/5-simple-statements-about-chinese-medicine-cupping-explained

Ünlülerin tercihi medyum haluk hoca sizlerle, en iyi medyum sitemizi ziyaret ediniz.

I don?t even know the way I finished up right here, but I thought this publish was once great. I do not know who you’re however certainly you’re going to a famous blogger should you are not already 😉 Cheers!

https://robertv112bxt9.dreamyblogs.com/profile

https://caiden2qqo8.dsiblogger.com/54896802/massage-healthy-reviews-for-dummies

https://troyh6mj5.bloggadores.com/22821379/healthy-massage-atascocita-an-overview

Ünlülerin tercihi medyum haluk hoca sizlerle, en iyi medyum sitemizi ziyaret ediniz.

Hey just wanted to give you a brief heads up and let you know a few of the images aren’t loading correctly. I’m not sure why but I think its a linking issue. I’ve tried it in two different browsers and both show the same outcome.

https://hectora3eb2.thelateblog.com/23034097/the-smart-trick-of-healthy-massage-white-plains-that-nobody-is-discussing

https://jaspery0730.articlesblogger.com/45542444/the-ultimate-guide-to-chinese-medicine-classes

Ünlülerin tercihi medyum haluk hoca sizlerle, en iyi medyum sitemizi ziyaret ediniz.

Ünlülerin tercihi medyum haluk hoca sizlerle, en iyi medyum sitemizi ziyaret ediniz.

https://deany11w9.iyublog.com/22731684/how-thailand-massage-can-save-you-time-stress-and-money

https://jimmyz456kfy0.wikijm.com/user

https://joycej801bbz2.wikilima.com/user

Ünlülerin tercihi medyum haluk hoca sizlerle, en iyi medyum sitemizi ziyaret ediniz.

güvenilir bir medyum hoca bulmak o kadarda zor değil, medyum haluk hoca sizlerin en iyi medyumu.

https://tripsbookmarks.com/story15840221/baby-massage-for-dummies

https://erickn9001.thekatyblog.com/22798023/the-definitive-guide-to-chinese-medicine-basics

https://river5uvu0.tblogz.com/not-known-factual-statements-about-massage-healthy-photos-37184533

https://sethr9987.goabroadblog.com/22865072/rumored-buzz-on-chinese-medicine-body-chart

https://giosueg671kjf4.howeweb.com/23108939/the-basic-principles-of-chinese-medicine-for-inflammation

https://adsbookmark.com/story15878953/5-simple-techniques-for-chinese-medicine-chi

It’s the best time to make some plans for the future and it’s time to be happy. I have read this post and if I could I want to suggest you some interesting things or tips. Maybe you can write next articles referring to this article. I desire to read even more things about it!

Ünlülerin tercih ettiği bir medyum hoca bulmak o kadarda zor değil, medyum haluk hoca sizlerin en iyi medyumu.

https://caiden13l5k.mybuzzblog.com/2051848/top-latest-five-chinese-medicine-brain-fog-urban-news

https://1001bookmarks.com/story15726033/top-latest-five-thailand-massage-urban-news

https://gregoryl6542.losblogos.com/22852671/a-simple-key-for-chinese-medicine-basics-unveiled

Hmm is anyone else experiencing problems with the images on this blog loading? I’m trying to determine if its a problem on my end or if it’s the blog. Any suggestions would be greatly appreciated.

https://pr1bookmarks.com/story15836979/not-known-facts-about-chinese-acupuncture

https://zionf7037.bloggadores.com/22863506/5-easy-facts-about-chinese-medicine-basics-described

https://paxton5zay2.dgbloggers.com/23063654/top-massage-health-benefits-secrets

https://israelj6777.blogs-service.com/53510228/the-basic-principles-of-chinese-medicine-books

https://dallasp38ut.ageeksblog.com/22807418/what-does-massage-chinese-markham-mean

https://arthur3ljgd.liberty-blog.com/22964624/helping-the-others-realize-the-advantages-of-massage-moreno-valley

Thanks for sharing these types of wonderful blogposts. In addition, the optimal travel along with medical insurance approach can often relieve those concerns that come with vacationing abroad. Any medical crisis can before long become costly and that’s sure to quickly place a financial weight on the family finances. Setting up in place the great travel insurance package prior to leaving is definitely worth the time and effort. Cheers

Nice post. I was checking constantly this blog and I’m impressed! Very useful info particularly the last part I care for such information much. I was seeking this particular information for a long time. Thank you and good luck.

I care for such information much. I was seeking this particular information for a long time. Thank you and good luck.

https://bobo023eby1.bleepblogs.com/profile

https://augusth0516.ageeksblog.com/22856093/the-ultimate-guide-to-chinese-medicine-body-map

https://garrettd55kj.bleepblogs.com/23077704/the-greatest-guide-to-chinese-massage-music

This website does not display properly on my android – you might wanna try and fix that

https://beckettc56mk.daneblogger.com/22824719/the-basic-principles-of-korean-massage-spa-nyc

https://damien7xxus.jaiblogs.com/49094691/fascination-about-korean-massage-near-19002

https://finn91g9w.blogscribble.com/22958050/asian-massage-bunnell-an-overview

Heya i am for the first time here. I found this board and I find It truly useful & it helped me out a lot. I hope to give something back and aid others like you helped me.

Ankara yeminli tercüme bürosu hizmeti, sizleriçin çeviri hizmetini ayağınıza getiriyoruz hemen iletişim.

Good post made here. One thing I would really like to say is the fact that most professional areas consider the Bachelor’s Degree just as the entry level standard for an online degree. Even though Associate College diplomas are a great way to get started on, completing ones Bachelors opens up many doors to various careers, there are numerous on-line Bachelor Course Programs available through institutions like The University of Phoenix, Intercontinental University Online and Kaplan. Another issue is that many brick and mortar institutions make available Online variants of their degree programs but often for a significantly higher payment than the providers that specialize in online degree plans.

https://myles13qq8.blog-mall.com/23082873/korean-massage-spas-an-overview

There are certainly a variety of details like that to take into consideration. That may be a great point to convey up. I supply the thoughts above as basic inspiration however clearly there are questions just like the one you bring up where the most important factor might be working in sincere good faith. I don?t know if best practices have emerged around issues like that, but I’m sure that your job is clearly identified as a fair game. Both boys and girls feel the impact of just a second?s pleasure, for the remainder of their lives.

https://johnv356rpn7.wikiitemization.com/user

https://dalton23m6m.boyblogguide.com/22836261/top-latest-five-chinese-medicine-brain-fog-urban-news

https://alfredr134igd3.shoutmyblog.com/profile

payday loan

https://griffin23656.fitnell.com/63150102/new-step-by-step-map-for-chinese-medicine-body-chart

https://carrier123fda2.wikissl.com/user

https://indexedbookmarks.com/story15768576/an-unbiased-view-of-massage-korean-spas

Astroloji nedir rüya ilmi nedir hüddam ilmi nedir vefk ilmi ile yapılacak işlemler nelerdir.

Thanks for the helpful posting. It is also my opinion that mesothelioma cancer has an extremely long latency time period, which means that warning signs of the disease may not emerge right up until 30 to 50 years after the preliminary exposure to mesothelioma. Pleural mesothelioma, that is certainly the most common type and impacts the area round the lungs, will cause shortness of breath, chest pains, along with a persistent cough, which may bring about coughing up blood.

Your place is valueble for me. Thanks!?

bookdecorfactory.com is a Global Trusted Online Fake Books Decor Store. We sell high quality budget price fake books decoration, Faux Books Decor. We offer FREE shipping across US, UK, AUS, NZ, Russia, Europe, Asia and deliver 100+ countries. Our delivery takes around 12 to 20 Days. We started our online business journey in Sydney, Australia and have been selling all sorts of home decor and art styles since 2008.

https://single-bookmark.com/story15883861/the-5-second-trick-for-chinese-medicine-blood-deficiency

https://damienv5925.losblogos.com/22856504/5-easy-facts-about-chinese-medicine-blood-deficiency-described

https://stepheny5948.bloggerbags.com/27773965/indicators-on-chinese-medicine-clinic-you-should-know

This is very interesting, You’re a very skilled blogger. I have joined your rss feed and look forward to seeking more of your excellent post. Also, I’ve shared your web site in my social networks!

Hey there just wanted to give you a brief heads up and let you know a few of the images aren’t loading properly. I’m not sure why but I think its a linking issue. I’ve tried it in two different internet browsers and both show the same results.

Hamburg Medyumunuz Haluk Hoca Astroloji hakkında bilmedikleriniz neler var, bunları sizler için derledik yayınladık.

I like the helpful information you provide in your articles. I will bookmark your weblog and check again here regularly. I am quite certain I?ll learn a lot of new stuff right here! Best of luck for the next!

Hello there, I found your website by the use of Google at the same time as looking for a comparable topic, your web site got here up, it seems good. I have bookmarked it in my google bookmarks.

One more thing to say is that an online business administration study course is designed for learners to be able to smoothly proceed to bachelors degree courses. The Ninety credit college degree meets the other bachelor education requirements so when you earn the associate of arts in BA online, you’ll have access to the most up-to-date technologies with this field. Some reasons why students have to get their associate degree in business is because they’re interested in the field and want to find the general education and learning necessary previous to jumping in to a bachelor college diploma program. Many thanks for the tips you actually provide as part of your blog.

Online poker

It is the best time to make some plans for the future and it is time to be happy. I’ve read this post and if I could I desire to suggest you some interesting things or tips. Maybe you could write next articles referring to this article. I desire to read even more things about it!

Güvenilir bir medyum için bizi tercih ediniz, medyum haluk hocamız sizler için elinden geleni yapıyor.

buy viagra online

buy viagra online

http://daojianchina.com/home.php?mod=space&uid=2921671

https://www.deviantart.com/backlinkend/art/Backlinkend-co-kr-1-985202526

I am no longer certain the place you’re getting your info, but great topic. I must spend a while learning much more or figuring out more. Thanks for fantastic info I used to be in search of this info for my mission.

Güvenilir bir medyum için bizi tercih ediniz, medyum haluk hocamız sizler için elinden geleni yapıyor.

A person essentially help to make seriously posts I would state. This is the first time I frequented your website page and thus far? I amazed with the research you made to create this particular publish amazing. Fantastic job!

https://kinoxitt.net/user/needlelaura1/

https://hindi-wikiprocedure.co.in/index.php?title=——r

I have observed that in the world the present moment, video games include the latest rage with children of all ages. Often times it may be unattainable to drag your family away from the activities. If you want the very best of both worlds, there are numerous educational games for kids. Interesting post.

http://jiyangtt.com/home.php?mod=space&uid=1866179

http://goodjobdongguan.com/home.php?mod=space&uid=2964077

Wonderful goods from you, man. I’ve take into account your stuff previous to and you are simply extremely fantastic. I really like what you’ve got here, really like what you are stating and the way in which wherein you say it. You’re making it entertaining and you continue to care for to keep it smart. I can’t wait to learn far more from you. That is actually a great web site.

https://ssztk.com/home.php?mod=space&uid=456719

I have really learned newer and more effective things as a result of your site. One other thing I’d really like to say is that often newer laptop or computer os’s have a tendency to allow extra memory to be played with, but they in addition demand more ram simply to function. If one’s computer can’t handle more memory as well as newest program requires that storage increase, it usually is the time to shop for a new Laptop. Thanks

https://ctxt.io/2/AABQB8uEEg

https://ctxt.io/2/AABQZTkTEw

Hello I am so happy I found your blog, I really found you by accident, while I was looking on Digg for something else, Regardless I am here now and would just like to say many thanks for a tremendous post and a all round thrilling blog (I also love the theme/design), I don’t have time to look over it all at the moment but I have book-marked it and also added your RSS feeds, so when I have time I will be back to read a great deal more, Please do keep up the excellent job.

https://spiderclef57.bloggersdelight.dk/2023/11/22/ed95b4ec9ab4eb8c80eab3a0eab5aceba0a4e29da4ebb0b1eba781ed81acec9794eb939ce28faceab5aceab880ec8381ec9c84-2/

Hey very cool web site!! Man .. Excellent .. Amazing .. I’ll bookmark your website and take the feeds also?I’m happy to find numerous useful info here in the post, we need work out more techniques in this regard, thanks for sharing. . . . . .

payday loan

Hey there I am so glad I found your site, I really found you by accident, while I was researching on Google for something else, Nonetheless I am here now and would just like to say kudos for a fantastic post and a all round enjoyable blog (I also love the theme/design), I don’t have time to read through it all at the minute but I have book-marked it and also added in your RSS feeds, so when I have time I will be back to read more, Please do keep up the excellent job.

I beloved up to you’ll obtain performed right here. The caricature is attractive, your authored subject matter stylish. however, you command get bought an shakiness over that you would like be delivering the following. sick for sure come more previously again as precisely the same just about very ceaselessly inside of case you shield this hike.

Your website does not render correctly on my blackberry – you might want to try and repair that

Online poker

penis enlargement

I?ll immediately take hold of your rss feed as I can’t to find your e-mail subscription link or newsletter service. Do you’ve any? Kindly permit me realize so that I may just subscribe. Thanks.

One thing I have actually noticed is the fact that there are plenty of beliefs regarding the lenders intentions whenever talking about foreclosure. One fairy tale in particular is that often the bank desires your house. The lending company wants your cash, not your home. They want the funds they loaned you together with interest. Preventing the bank will simply draw any foreclosed summary. Thanks for your article.

It?s really a nice and helpful piece of information. I am glad that you shared this useful information with us. Please keep us informed like this. Thank you for sharing.

I think other site proprietors should take this site as an model, very clean and fantastic user genial style and design, let alone the content. You are an expert in this topic!

buy viagra online

http://fsz.animalspringwater.com/__media__/js/netsoltrademark.php?d=cdamdong.co.kr2Fshop2Fsearch.php3Fq3Da25EC258A25AC25EB25A125AF25EC258225AC25EC259D25B425ED258A25B825E32580259025EA25B525BF25EB25B225B3Good-bet888.com25E32580259125EB25B225B325EC259C258425EC25A6258825E2258825AA25EA25B9258025EC258A25AC25EB25A125AF

Thanks for expressing your ideas. I might also like to state that video games have been ever before evolving. Today’s technology and innovations have aided create authentic and active games. These entertainment games were not as sensible when the actual concept was first being tried out. Just like other forms of technological innovation, video games way too have had to evolve by way of many generations. This is testimony towards the fast growth and development of video games.

http://schutzhund.co.uk/__media__/js/netsoltrademark.php?d=www.sbs8888.com2Fpost2Ft25EC259825A425EB259D25BD25EC258B25A425EC25A325BC25EC2586258C25E625BC258FGood-bet888com25EC259C258825EC259C258825EB25B225B32B25EC259B259025EB25B225B325EC259B25902B25EA25B525BF25EB25B225B3

One thing I’d prefer to say is the fact before purchasing more personal computer memory, have a look at the machine in which it is installed. When the machine is actually running Windows XP, for instance, a memory ceiling is 3.25GB. Putting in a lot more than this would purely constitute just a waste. Make sure one’s motherboard can handle the upgrade volume, as well. Great blog post.

buy viagra online

payday loan

http://www.bestartdeals.com.au is Australia’s Trusted Online Canvas Prints Art Gallery. We offer 100 percent high quality budget wall art prints online since 2009. Get 30-70 percent OFF store wide sale, Prints starts $20, FREE Delivery Australia, NZ, USA. We do Worldwide Shipping across 50+ Countries.

http://www.spotnewstrend.com is a trusted latest USA News and global news trend provider. Spotnewstrend.com website provides latest insights to new trends and worldwide events. So keep visiting our website for USA News, World News, Financial News, Business News, Entertainment News, Celebrity News, Sport News, NBA News, NFL News, Health News, Nature News, Technology News, Travel News.

I’ve discovered a treasure trove of knowledge in your blog. Your unwavering dedication to offering trustworthy information is truly commendable. Each visit leaves me more enlightened, and I deeply appreciate your consistent reliability.

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

Hi, i think that i saw you visited my web site thus i came to ?go back the prefer?.I’m attempting to to find issues to improve my site!I guess its adequate to make use of some of your ideas!!

Your blog is a true gem in the vast expanse of the online world. Your consistent delivery of high-quality content is truly commendable. Thank you for consistently going above and beyond in providing valuable insights. Keep up the fantastic work!

I couldn’t agree more with the insightful points you’ve made in this article. Your depth of knowledge on the subject is evident, and your unique perspective adds an invaluable layer to the discussion. This is a must-read for anyone interested in this topic.

Your storytelling prowess is nothing short of extraordinary. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I eagerly await to see where your next story takes us. Thank you for sharing your experiences in such a captivating manner.

Thanks for your article. One other thing is the fact that individual states in the United states of america have their own laws in which affect home owners, which makes it extremely tough for the our lawmakers to come up with a different set of rules concerning property foreclosures on householders. The problem is that every state has got own regulations which may work in an undesirable manner in relation to foreclosure plans.

This article is a true game-changer! Your practical tips and well-thought-out suggestions hold incredible value. I’m eagerly anticipating implementing them. Thank you not only for sharing your expertise but also for making it accessible and easy to apply.

I am usually to running a blog and i really recognize your content. The article has really peaks my interest. I am going to bookmark your web site and hold checking for brand spanking new information.

Your enthusiasm for the subject matter shines through every word of this article; it’s contagious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

I want to express my sincere appreciation for this enlightening article. Your unique perspective and well-researched content bring a fresh depth to the subject matter. It’s evident that you’ve invested considerable thought into this, and your ability to convey complex ideas in such a clear and understandable way is truly commendable. Thank you for generously sharing your knowledge and making the learning process enjoyable.

Good blog! I really love how it is easy on my eyes and the data are well written. I am wondering how I could be notified when a new post has been made. I’ve subscribed to your RSS feed which must do the trick! Have a nice day!

I’m not sure why but this web site is loading extremely slow for me. Is anyone else having this problem or is it a problem on my end? I’ll check back later and see if the problem still exists.

Your writing style effortlessly draws me in, and I find it nearly impossible to stop reading until I’ve reached the end of your articles. Your ability to make complex subjects engaging is indeed a rare gift. Thank you for sharing your expertise!

Your blog has rapidly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you invest in crafting each article. Your dedication to delivering high-quality content is apparent, and I eagerly await every new post.

Your unique approach to tackling challenging subjects is a breath of fresh air. Your articles stand out with their clarity and grace, making them a joy to read. Your blog is now my go-to for insightful content.

I couldn’t agree more with the insightful points you’ve articulated in this article. Your profound knowledge on the subject is evident, and your unique perspective adds an invaluable dimension to the discourse. This is a must-read for anyone interested in this topic.

Your enthusiasm for the subject matter shines through every word of this article; it’s contagious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

http://datacertain.com/__media__/js/netsoltrademark.php?d=xn--cm2by8iw5h6xm8pc.com2Fbbs2Fsearch.php3Fsrows3D026gr_id3D26sfl3Dwr_subject26stx3Dt25ED2585259025ED2585259025EB25B225B325E625BC258FGood-bet888com25ED2585259025ED2585259025EB25B125832B25ED2585259025EB25B0259425EC259D25B425ED2585259025EB25B225B32B25EA25B525BF25EB25B225B3

Your unique approach to addressing challenging subjects is like a breath of fresh air. Your articles stand out with their clarity and grace, making them a pure joy to read. Your blog has now become my go-to source for insightful content.

Your passion and dedication to your craft radiate through every article. Your positive energy is infectious, and it’s evident that you genuinely care about your readers’ experience. Your blog brightens my day!

Thanks for your post. What I want to comment on is that when looking for a good online electronics store, look for a internet site with total information on important factors such as the personal privacy statement, safety measures details, payment options, and also other terms plus policies. Usually take time to investigate the help as well as FAQ pieces to get a far better idea of how the shop will work, what they can perform for you, and how you can make use of the features.

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

Just want to say your article is as amazing. The clarity to your submit is just spectacular and that i can think you are knowledgeable in this subject. Well along with your permission allow me to grasp your feed to keep up to date with forthcoming post. Thanks 1,000,000 and please continue the enjoyable work.

Your writing style effortlessly draws me in, and I find it nearly impossible to stop reading until I’ve reached the end of your articles. Your ability to make complex subjects engaging is indeed a rare gift. Thank you for sharing your expertise!

I do trust all of the concepts you have offered to your post. They are really convincing and will certainly work. Still, the posts are too quick for novices. May you please extend them a bit from next time? Thank you for the post.

https://wlptv.com/bbs/search.php?srows=0&gr_id=&sfl=wr_subject&sop=or&stx=意苍-高二作文-散文作文-优化的基本步

I’m continually impressed by your ability to dive deep into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I’m grateful for it.

I simply couldn’t go away your site prior to suggesting that I actually enjoyed the standard info an individual supply in your visitors? Is going to be again ceaselessly in order to check out new posts

Your enthusiasm for the subject matter radiates through every word of this article; it’s contagious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

This article is a real game-changer! Your practical tips and well-thought-out suggestions are incredibly valuable. I can’t wait to put them into action. Thank you for not only sharing your expertise but also making it accessible and easy to implement.

This article is a real game-changer! Your practical tips and well-thought-out suggestions are incredibly valuable. I can’t wait to put them into action. Thank you for not only sharing your expertise but also making it accessible and easy to implement.

https://eejj.tv/bbs/search.php?srows=0&gr_id=&sfl=wr_subject&stx=구글찌라시상위노출전문【2023t_c0m】디비광고대행업

https://eejj.tv/bbs/search.php?srows=0&gr_id=&sfl=wr_subject&stx=강남오피 opss08.com 오피쓰2024,id6=E6X1

Hello there, I found your site by way of Google whilst searching for a comparable topic, your website came up, it seems good. I have bookmarked it in my google bookmarks.

payday loan

https://vuf.minagricultura.gov.co/Lists/Informacin20Servicios20Web/DispForm.aspx?ID=7539349

In a world where trustworthy information is more important than ever, your commitment to research and providing reliable content is truly commendable. Your dedication to accuracy and transparency is evident in every post. Thank you for being a beacon of reliability in the online world.

Your enthusiasm for the subject matter shines through every word of this article; it’s contagious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

I’m genuinely impressed by how effortlessly you distill intricate concepts into easily digestible information. Your writing style not only imparts knowledge but also engages the reader, making the learning experience both enjoyable and memorable. Your passion for sharing your expertise shines through, and for that, I’m deeply grateful.

I wanted to take a moment to express my gratitude for the wealth of valuable information you provide in your articles. Your blog has become a go-to resource for me, and I always come away with new knowledge and fresh perspectives. I’m excited to continue learning from your future posts.

I’m continually impressed by your ability to dive deep into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I’m grateful for it.

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

Your enthusiasm for the subject matter radiates through every word of this article; it’s contagious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

After examine just a few of the blog posts in your web site now, and I actually like your means of blogging. I bookmarked it to my bookmark web site checklist and will likely be checking back soon. Pls try my website as nicely and let me know what you think.

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

Thanks for your posting on the vacation industry. I would also like contribute that if you are one senior considering traveling, it can be absolutely imperative that you buy travel cover for senior citizens. When traveling, senior citizens are at high risk of getting a healthcare emergency. Obtaining the right insurance package for your age group can look after your health and give you peace of mind.

This article is a true game-changer! Your practical tips and well-thought-out suggestions hold incredible value. I’m eagerly anticipating implementing them. Thank you not only for sharing your expertise but also for making it accessible and easy to apply.

A person essentially help to make significantly posts I’d state. That is the first time I frequented your website page and thus far? I amazed with the research you made to make this actual put up incredible. Great task!

I think other web-site proprietors should take this web site as an model, very clean and excellent user friendly style and design, as well as the content. You’re an expert in this topic!

Your storytelling abilities are nothing short of incredible. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I can’t wait to see where your next story takes us. Thank you for sharing your experiences in such a captivating way.

Your unique approach to tackling challenging subjects is a breath of fresh air. Your articles stand out with their clarity and grace, making them a joy to read. Your blog is now my go-to for insightful content.

Your writing style effortlessly draws me in, and I find it nearly impossible to stop reading until I’ve reached the end of your articles. Your ability to make complex subjects engaging is indeed a rare gift. Thank you for sharing your expertise!

Your dedication to sharing knowledge is evident, and your writing style is captivating. Your articles are a pleasure to read, and I always come away feeling enriched. Thank you for being a reliable source of inspiration and information.

Your enthusiasm for the subject matter shines through every word of this article; it’s contagious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

In a world where trustworthy information is more crucial than ever, your dedication to research and the provision of reliable content is truly commendable. Your commitment to accuracy and transparency shines through in every post. Thank you for being a beacon of reliability in the online realm.

I’ve discovered a treasure trove of knowledge in your blog. Your unwavering dedication to offering trustworthy information is truly commendable. Each visit leaves me more enlightened, and I deeply appreciate your consistent reliability.

Your blog has quickly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you put into crafting each article. Your dedication to delivering high-quality content is evident, and I look forward to every new post.

Your enthusiasm for the subject matter shines through in every word of this article. It’s infectious! Your dedication to delivering valuable insights is greatly appreciated, and I’m looking forward to more of your captivating content. Keep up the excellent work!

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

Your unique approach to addressing challenging subjects is like a breath of fresh air. Your articles stand out with their clarity and grace, making them a pure joy to read. Your blog has now become my go-to source for insightful content.

I must commend your talent for simplifying complex topics. Your ability to convey intricate ideas in such a relatable way is admirable. You’ve made learning enjoyable and accessible for many, and I appreciate that.

I wanted to take a moment to express my gratitude for the wealth of valuable information you provide in your articles. Your blog has become a go-to resource for me, and I always come away with new knowledge and fresh perspectives. I’m excited to continue learning from your future posts.

Your storytelling prowess is nothing short of extraordinary. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I eagerly await to see where your next story takes us. Thank you for sharing your experiences in such a captivating manner.

Hello there, simply become aware of your blog through Google, and located that it’s truly informative. I am gonna watch out for brussels. I?ll be grateful in the event you continue this in future. Numerous other folks will likely be benefited from your writing. Cheers!

Your writing style effortlessly draws me in, and I find it nearly impossible to stop reading until I’ve reached the end of your articles. Your ability to make complex subjects engaging is indeed a rare gift. Thank you for sharing your expertise!

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

Wow that was unusual. I just wrote an incredibly long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Anyways, just wanted to say fantastic blog!

This article is absolutely incredible! The author has done a tremendous job of conveying the information in an captivating and enlightening manner. I can’t thank her enough for offering such priceless insights that have definitely enlightened my understanding in this subject area. Kudos to her for producing such a masterpiece!

Yet another issue is really that video gaming became one of the all-time greatest forms of fun for people of various age groups. Kids play video games, and also adults do, too. Your XBox 360 is one of the favorite video games systems for folks who love to have a lot of activities available to them, as well as who like to relax and play live with some others all over the world. Many thanks for sharing your opinions.

Your blog is a true gem in the vast expanse of the online world. Your consistent delivery of high-quality content is truly commendable. Thank you for consistently going above and beyond in providing valuable insights. Keep up the fantastic work!

Your unique approach to addressing challenging subjects is like a breath of fresh air. Your articles stand out with their clarity and grace, making them a pure joy to read. Your blog has now become my go-to source for insightful content.

https://퀄엔드.com/shop/search.php?sfl=我最喜欢的《追逐阳光之岛》-二年级作文-读后感

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.