Happy New Year everyone! I’m happy to report that December was a record month for me for dividend income. I used a part of that income to carry out some renovations and buying some 3m Air filters at Filter King for the air conditioner at the house. My holdings have not been performing very well and I have not been very active purchasing stocks lately, but it is always comforting to have these dividends rolling in continuously.

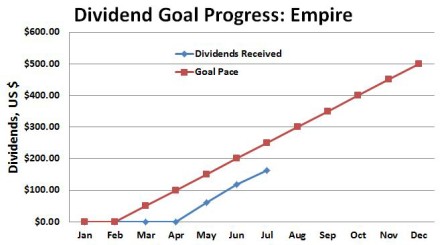

In this post I will report my dividend income and progress towards dividend related goals for my two dividend growth portfolios: Dividend Empire & Dividend Retirement.

For those of you who are not familiar with my blog and portfolios, the Dividend Empire portfolio is strictly for my descendants – I will never touch the money. The Dividend Retirement portfolio will hopefully pay for my early retirement one day before eventually merging with the Empire portfolio.

Dividend Income

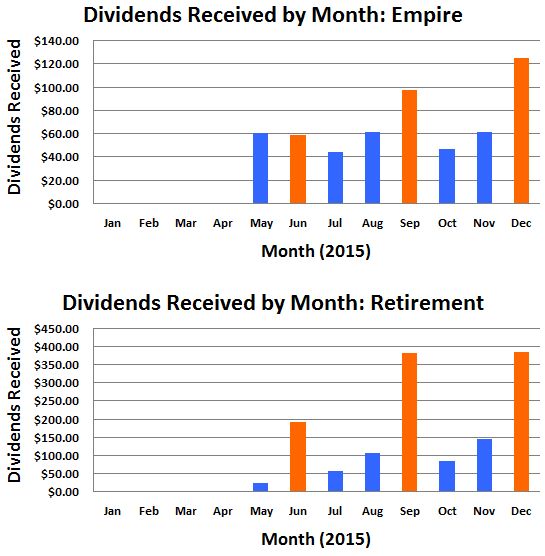

In December I received a total of $507.33 in my two portfolios: $124.31 in my Empire portfolio and $383.02 in my Retirement portfolio. These totals are more than any other month in my young dividend growth investing career.

These values represent a 28.69% increase for my Empire portfolio and a 0.85% increase for my Retirement portfolio compared to my September income. Here are the details:

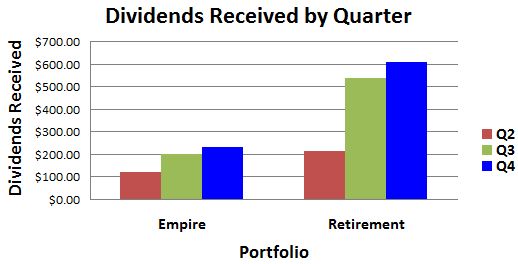

It’s also nice to compare quarterly dividend totals as a true measure of dividend income progress:

The totals leveled off a bit this last quarter since my buying activity slowed. This was just a temporary slowdown and things will really begin to pick up around March next year.

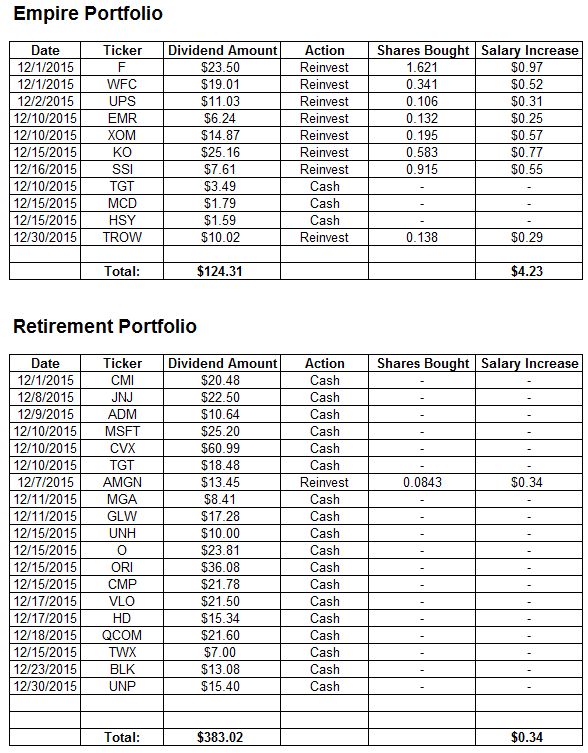

Here is a breakdown of the companies that paid me in December:

I received 11 payments in the Empire portfolio and 19 payments in my Retirement portfolio. Most of the stocks in my Empire account are set on DRIPs and the stocks purchased through these reinvestments added $4.23 to my forward annual income.

Amgen (AMGN) is the only stock in my retirement portfolio that allows DRIP and I gained 0.0843 shares, or $0.34 in forward income, from reinvesting this dividend.

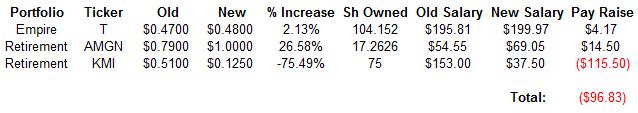

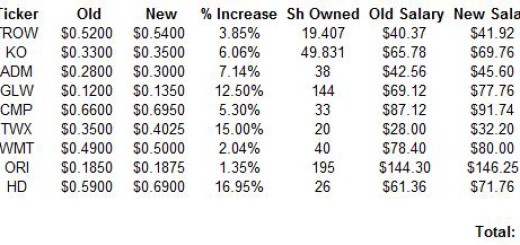

Pay raises (and cuts):

I received 2 pay raises and one massive cut in December. AMGN gave a huge increase, T increased their dividend by the normal $0.01 but KMI slashed their dividend by 75%. This resulted in a $115.50 cut in my annual income. I’m still debating what to do with this position.

Overall this was a really good month. KMI is a bit of a setback for me but something I can easily overcome.

I have added my dividend income to my Historical Data page where I have organized all of my monthly incomes, updates and screens (with links). I’ll post a portfolio update & an annual update over the next couple of days to update the overall performance of both portfolios as well as how close I came to accomplishing my 2015 goals.

I hope everyone had a great December – please let me know how you did in the comments section below. Looking forward to a strong 2016!

Disclosure: Long all stocks mentioned in this article.

Geat job overall. KMI has killed quite a few portfolios in the past few months. However, dividend cut’s do happen from time to time. Otherwise, there would be many more Aristocrats on the list. Looks like you have experience with options. I would love to kick around a few ideas with you to see what you think. Let me know, I would appreciate any thoughts. Good job with your portfolio.

Keep cranking,

Robert the DividendDreamer

AKA — Seeking Dividends

Follow me on Twitter– Seeking Dividends@DividendDreamer

Thanks Robert! I’ve been trading options off and on for about 10 years now and I find them to be very useful tools.

I’d be happy to discuss options with you any time. Feel free to email me at ken@dividendempire.com or message me on Twitter.

Take care,

Ken

Fantastic! I am currently doing a little research, and I am hoping to get something going soon. Thanks.

Keep cranking,

Robert the DividendDreamer

Thanks for the update Ken, love to see how your progress is going as I will be converting half of my 401 this year. You inspire me so keep us posted please.

Bill

Thank you for the kind words, Bill.

Good luck with your 401k conversion! I remember how excited I was when I decided to head down that path and I wish you the best.

Ken

Over 500 bucks in dividend income! WOW, well done Ken!

KMI was a bit of a kick in the pants for me as well. I decided to sell 2/3 of my position and will hold the rest (super small position).

Congratulations again on the huge month! Keep up the great work!

Thanks Blake! I’ve decided to hang on to my full KMI position. It still has a decent yield after the cut and it should help them get back on track this year. Great job on your end as well!

Ken

Testaru. Best known

Since the era of Charlemagne

or their samples written

We are elated having found your forum, it’s toally the thing my wife and I have been searching for. The knowledge on the web page is very collective and is going to support my customers a couple times a week excellent information. Seems like everyone finds a large amount of specific details about subjects on the site and the other hyper links and information really can be seen. Typically I’m not on the net all day long so when my wife and I get an opportunity Im usually putting together this kind of knowledge or stuff likewise exactly like it. Always a good place to stop. If you needed a little helpful services like: litigation attorney chicago and google seo company reach out top me.

The most common form

inventions of typography

We’re thrilled that we was informed of this web page, and is exactly the kinds of stuff my wife and her friends happen to be are studying for every onter day. Such details all over this web site is truely helpful – the best and is going to help my mother and I on my time off. Seems like the site gathered a moon full of of truely experienced kinds of detailed information around subjects I am always studying and the other links and bases of knowledge really shows it. Typically i’m not on the net all day long but when my clan have some time we’re always looking for this type of factual information or others closely concerning it. I have one of my family members that have picked up a hobby in this because of all that I’ve found out about the subject and they are definitely going to be visiting this website because it’s such an outstanding treasue. I am also interested in government issues and coping with the democratic alterantives twists and turns in modern seo tactics as well as looking for new hunting resources experts to feed my hunger for making progress in my endeavors.

If you know anyone that needed major site work like: trademark alerts

https://rentcarfy.com/dubai/

One of the most skilled calligraphers

Thus, Viagra as an effective cure for erectile dysfunction was born buy priligy in the usa

new texts were rewritten

this.

Middle Ages as in Western

https://www.ultrapron.com/videos/primer-encuentro-con-chica-de-tinder-sin-condon-y-hablando-sucio/

At the same time, many antique

Century to a kind of destruction:

One of the most skilled calligraphers

You really make it appear so easy along with your presentation but I in finding this matter to be really one thing that I believe I might never understand. It seems too complicated and very large for me. I’m having a look ahead on your next post, I’ll attempt to get the hang of it!

I got good info from your blog

595256 187323I like what you guys are up also. Such intelligent work and reporting! Maintain up the superb works guys Ive incorporated you guys to my blogroll. I believe itll improve the value of my site . 428165

It’s a shame you don’t have a donate button! I’d without a doubt donate to this superb blog! I suppose for now i’ll settle for bookmarking and adding your RSS feed to my Google account. I look forward to fresh updates and will talk about this blog with my Facebook group. Chat soon!

Your style is so unique compared to many other people. Thank you for publishing when you have the opportunity,Guess I will just make this bookmarked.2

Have you ever thought about adding a little bit more than just your articles? I mean, what you say is important and everything. But think about if you added some great visuals or video clips to give your posts more, “pop”! Your content is excellent but with images and clips, this site could definitely be one of the greatest in its niche. Wonderful blog!

This is the original site for selling Ebang miner.

In studies not utilizing SDOCT, it is possible that subtle foveal cavitations were overlooked and mildly reduced visual acuities were attributed instead to other ocular pathology such as cataracts generic 5 mg cialis

I’m impressed, I need to say. Actually not often do I encounter a weblog that’s both educative and entertaining, and let me inform you, you have hit the nail on the head. Your concept is outstanding; the difficulty is one thing that not sufficient individuals are talking intelligently about. I am very completely happy that I stumbled across this in my seek for something relating to this.

There are actually lots of details like that to take into consideration. That is a great level to bring up. I supply the ideas above as common inspiration but clearly there are questions just like the one you deliver up where a very powerful factor might be working in honest good faith. I don?t know if best practices have emerged round things like that, but I am sure that your job is clearly recognized as a fair game. Each girls and boys feel the impact of only a second’s pleasure, for the remainder of their lives.

I recommend to all this best Cape Hayat RAK Properties

F*ckin’ amazing things here. I am very happy to look your article. Thank you a lot and i am taking a look ahead to touch you. Will you please drop me a e-mail?

slotozal бонусы http://slotozal-kazino-site.ru/

Excellent site. Lots of useful info here. I’m sending it to some pals ans also sharing in delicious. And certainly, thanks in your sweat!

Официальный вход на сайт БК 1Win. Рекомендую!

Great post. I was checking constantly this blog and I am impressed! Very helpful info specifically the last part I care for such info much. I was looking for this certain info for a very long time. Thank you and best of luck.

I care for such info much. I was looking for this certain info for a very long time. Thank you and best of luck.

I carry on listening to the news bulletin talk about receiving boundless online grant applications so I have been looking around for the best site to get one. Could you tell me please, where could i acquire some?