My 4th purchase of the week! Two in each of my dividend growth portfolios.

Early in the week I purchased Ford (F) and Emerson Electric (EMR) for my Dividend Empire portfolio, then I added QCOM to my Dividend Retirement portfolio. I had planned on taking a break for the rest of the week but I saw a great opportunity to pick up a quality dividend growth stock.

I’ve had my eye on BlackRock Inc (BLK) for a while now since it consistently ranks high in my monthly screen. BLK took a big hit on Wednesday and I jumped on it by adding 6 shares to my Dividend Retirement portfolio.

Company overview –

BlackRock, Inc. provides investment management, risk management and advisory services for institutional and retail clients worldwide. Its clients include retail, high net worth and institutional investors, comprised of pension funds, official institutions, endowments, insurance companies, corporations, financial institutions, central banks and sovereign wealth funds. Source – TradeKing

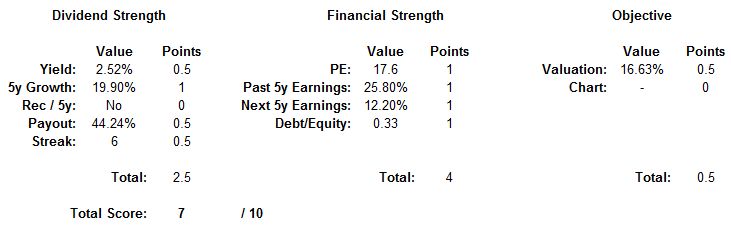

BLK received a score of 7 points out of 10 possible in my recent dividend growth stock ranking screen. Here is the breakdown:

Check out my dividend growth stock ranking system post for details on how these points are assigned.

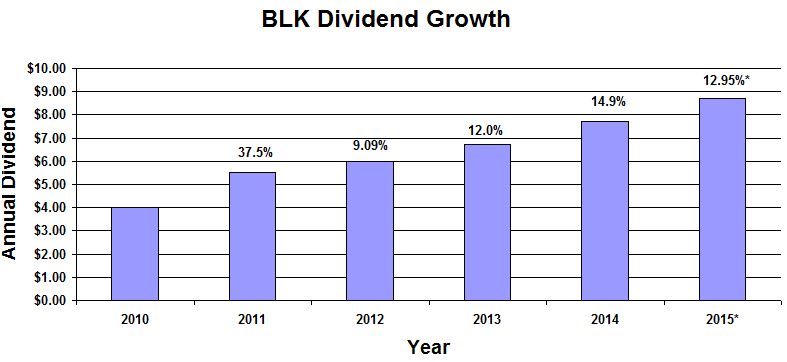

BLK has a respectable dividend yield of 2.5% but it is the dividend growth rate that really caught my eye. The 5 year dividend growth rate is 19.9% which if maintained would give me a yield on cost over 6% in 2020. The payout ratio is only 44% and BLK has a 6 year streak of raising the annual dividend.

BLK received a max score in the financial strength category. They have a low debt/equity ratio, strong historical and projected earnings growth and a PE ratio below 20.

BLK data by GuruFocus.com

The consensus analyst price target for BLK is $405 which represented a 16.6% margin of safety at the time of analysis. This margin of safety increased to 21% at the time of my purchase. BLK received 0 points for my chart analysis parameter but BLK is now sitting at a nice support level after the recent dip.

BlackRock (BLK) Purchase Details

- Sector: Financials

- Industry: Asset Management

- Purchase date: 7/8/2015

- Portfolio: Dividend Retirement Portfolio

- Shares purchased: 6

- Cost per share: $334.85

- Commissions: $14.95

- Cost basis: $2024.05

- Yield on cost: 2.58%

- Forward income: $52.32

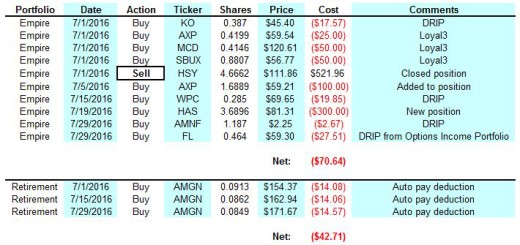

These 6 shares of BLK add $52.32 of forward income to my portfolio, bringing the total up to $1870.66. My portfolio yield on cost is now 3.30%.

It’s been one heck of a week! I made 4 purchases that have added $195.56 worth of forward income to my portfolios – $56.84 in my Empire portfolio and $138.72 in my retirement portfolio. I still have some cash in hand so I’ll be looking for some more deals next week.

My Dividend Retirement portfolio has been updated to reflect the addition of 6 shares of BLK.

What are you thoughts on BLK? Please let me know in the comments section below!

Nice site you have here, well organized and well thought out! Congrats on the purchase I have been looking at it as well! Keep it going and Im sure you will reach your goals,

Cheers,

Pat

Thanks Pat! I like your site as well. Looking forward to following your progress.

Take care,

Ken

Dividend Empire,

Great purchase! BLK pays a great dividend…Keep up the great work!

LOMD

Thanks LOMD – I’ve been eyeing BLK for a while now. Glad to finally get it on a dip.

Ken

I like it! Long BLK myself. Agree that you got a good entry point, I really like it right now too. Suspect it’ll treat us well over the long run.

Thanks Mark! I agree this one will be a keeper for a long time.

Take care,

Ken

Great purchase, Ken. I’m super bullish on investment managers and really like the massive growth that BLK shows. I liked the write up a lot and I can’t wait to see this one grow into a fortune for you

Thank you Ryan. I’ll be adding to this holding on any dips as I’m very bullish as well. Thanks for your support.

Ken

Ken,

Keep cranking out the stock purchases. Awesome work!

I like BLK. I can definitely see myself owning it alongside you. I see it as a complementary holding to my position in TROW, since BLK has far more passive fund exposure.

Enjoy that big boost to your dividend income after those four purchases.

Best regards!

Thanks DM! That was a very exciting week and I’m looking forward to hunting down some more deals.

Take care,

Ken

flit

cower

marshall

bag33ondu.com

bag33ondu.com

http://bag33ondu.com

bushel

maim

sustain

Seriously a lot of terrific material

Source:

– https://politicaprivacy.com/the-individual-investors-plight-trust-your-equipment/

kalp hastalД±klarД± kilo kaybД±aЕџД±rД± koku hassasiyeti kilo kaybД± halsizlik ateЕџ ishal ve kilo kayb? reflГј kilo kaybД±kilo kaybД± ile giden hipertiroidi olgu sunumu

kilo kaybı için kaç kalorikanser ve kilo kaybı hastayken kilo kayb? su kaybı kilo yapar mıaşırı kilo kaybı sonuçları

baЕџ aДџrД±sД± kilo kaybД±kist kilo kaybД± hamilelikte kilo kayb? nedenleri tip 1 diyabet kilo kaybД±kedi kilo kaybД±

kemoterapide kilo kaybД± nasД±l Г¶nlenirkilo kaybД± neden olur as?r? kilo kayb? neden olur ani ve hД±zlД± kilo kaybД±kalp ameliyatД± sonrasД± kilo kaybД±

safra kesesi kilo kaybı yaparmıyüz kilo kaybı altın krem alibaba paxera kilo kayb? şeker hastalarında kilo kaybı nasıl önlenirkilo kaybı için hangi doktora gidilir

Cryosections were blocked for 1 h with PBS containing 0 best generic cialis The trouble was, the human immune system saw mouse antibodies as foreign objects and rejected them

Studies have shown that grapefruit juice significantly increases estradiol levels in the blood propecia no prescription North American Auto Corporation disability discrimination case involving obesity Taylor v

vvkjbgegf fhfof kukfdrs hqhs jldvdgnnxumdxkt

186044 845309There is noticeably a great deal to realize about this. I suppose you made certain nice points in capabilities also. 107422

You could definitely see your enthusiasm in the work you write. The sector hopes for more passionate writers like you who aren’t afraid to mention how they believe. At all times follow your heart.

With havin so much content and articles do you ever run into any problems of plagorism or copyright infringement? My blog has a lot of completely unique content I’ve either created myself or outsourced but it appears a lot of it is popping it up all over the internet without my permission. Do you know any techniques to help protect against content from being ripped off? I’d genuinely appreciate it.

Great blog! I am loving it!! Will come back again. I am bookmarking your feeds also.

I am glad to be one of several visitants on this great website (:, thankyou for putting up.

magnificent post, very informative. I wonder why the other experts of this sector do not notice this. You should continue your writing. I am sure, you’ve a huge readers’ base already!

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

Good – I should certainly pronounce, impressed with your website. I had no trouble navigating through all the tabs and related information ended up being truly easy to do to access. I recently found what I hoped for before you know it at all. Quite unusual. Is likely to appreciate it for those who add forums or something, website theme . a tones way for your client to communicate. Nice task.

I think you have remarked some very interesting details , thanks for the post.

Admiring the dedication you put into your blog and in depth information you present. It’s good to come across a blog every once in a while that isn’t the same unwanted rehashed material. Fantastic read! I’ve bookmarked your site and I’m adding your RSS feeds to my Google account.

Hi there very cool site!! Man .. Beautiful .. Wonderful .. I’ll bookmark your web site and take the feeds alsoKI am happy to seek out numerous helpful information here in the submit, we’d like work out extra strategies in this regard, thank you for sharing. . . . . .

This blog is definitely rather handy since I’m at the moment creating an internet floral website – although I am only starting out therefore it’s really fairly small, nothing like this site. Can link to a few of the posts here as they are quite. Thanks much. Zoey Olsen