This is going to be a quick one. It’s been a crazy week for me since I’m right in the middle of moving houses and I had to give two presentations earlier today. Thankfully most of the difficult stuff is out of the way so I can get back to posting.

I was able to make a single purchase last Friday in my Dividend Retirement portfolio and I decided to go with Magna International (MGA). MGA consistently scores well in my dividend growth stock ranking screen, most recently posting a score of 8/10 in the July screen.

Company Overview:

Magna International is an automotive supplier with approximately 313 manufacturing operations and over 84 product development, engineering and sales centers in approximately 28 countries. Its product capabilities include producing body, chassis, interior, exterior, seating, powertrain, electronic, vision, closure and roof systems and modules, as well as vehicle engineering and contract manufacturing.

Its customers include General Motors, Fiat-Chrysler, Ford, BMW, Daimler and Volkswagen. Its offers programs, which include Ford Transit; MINI Countryman; Ford F-Series and F-Series Super Duty; QOROS 3; Ford Mustang; BMW X6; Mercedes-Benz M-Class; BMW X4 and Porsche Panamera. The Company operates in North America, Europe and Asia. Source – Yahoo Finance.

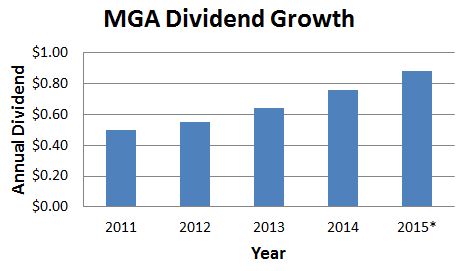

Magna’s dividend yield is pretty weak right now but they more than make up for it with growth. Here are some highlights:

- Yield: 1.63%

- 5-year dividend growth rate: 76%

- 3-year dividend growth rate: 15%

- EPS payout ratio: 12.9

- Past 5 year earnings growth: 32.8%

- Expected 5-year earnings growth: 12.5%

- Debt/Equity: 0.12

- PE: 8.2

Opportunities for future growth include increased light vehicle sales volume, higher production in Europe, and expansion into new and emerging markets.

MGA has a ton of cash on hand that will most likely be used for growth in emerging markets, acquisitions, dividend increases and stock purchases.

S&P Capital IQ has a strong buy rating on MGA with a 12 month price target of $66 per share.

Magna International (MGA) Purchase Details

- Sector: Services

- Industry: Auto Part Wholesale

- Purchase date: 7/17/2015

- Portfolio: Dividend Retirement Portfolio

- Shares purchased: 45

- Cost per share: $53.6599

- Commissions: $14.95

- Cost basis: $2429.65

- Yield on cost: 1.63%

- Forward income: $39.60

These 45 shares of MGA add $39.60 of forward income to my portfolio, bringing the total up to $1913.62.

My Dividend Retirement portfolio has been updated to reflect the addition of 45 shares of MGA.

What are you thoughts on MGA? Please let me know in the comments section below!

Great purchase, DE. I am a huge fan of the business model and teh fact their parts are found in almost every vehicle out there…I started investing in MGA about a year ago and its done well for my portfolio. Still very undervalued and am tempted to add more.

Best wishes

R2R

Thanks R2R! Nice to hear that a fellow dgi is so bullish on MGA. I was fairly confident in this purchase already and you have helped reinforce that.

Take care,

Ken

Dividend Empire,

Thanks for the post! I have never researched MGA before. After some research, It seems to be a solid company with great stats. The 5 year dividend growth rate is very impressive and the PE ratio. It should reward you well in the future. Keep in touch!

-LOMD

Hey LOMD! Definitely a solid company. Thanks for your support!

Ken

Great line up. We will be linking to this great article on our site. Keep up the good writing.

Some genuinely prize articles on this website , saved to my bookmarks.

I believe you have noted some very interesting points, regards for the post.

Wow! Thank you! I continually needed to write on my site something like that. Can I implement a fragment of your post to my site?

I’m usually to blogging and i actually respect your content. The article has actually peaks my interest. I’m going to bookmark your site and hold checking for brand new information.

I loved as much as you’ll obtain performed right here. The cartoon is tasteful, your authored subject matter stylish. nevertheless, you command get got an impatience over that you wish be turning in the following. unwell for sure come further previously once more since exactly the same nearly very incessantly inside case you protect this increase.

Simply desire to say your article is as amazing. The clearness in your publish is simply spectacular and that i can think you’re knowledgeable on this subject. Well together with your permission let me to take hold of your RSS feed to keep up to date with imminent post. Thanks a million and please keep up the rewarding work.

Of course, what a fantastic site and instructive posts, I definitely will bookmark your website.Have an awsome day!

Undeniably believe that that you stated. Your favorite justification appeared to be at the net the easiest factor to take note of. I say to you, I certainly get irked at the same time as folks think about issues that they just do not understand about. You managed to hit the nail upon the highest and defined out the whole thing without having side effect , folks could take a signal. Will probably be back to get more. Thanks

My partner and I stumbled over here by a different web page and thought I might check things out. I like what I see so now i’m following you. Look forward to checking out your web page again.

Wow, marvelous weblog format! How lengthy have you ever been blogging for? you made blogging glance easy. The whole look of your site is excellent, let alone the content!

Greetings my name is Matt D’Agati.

Solar power the most promising and efficient resources of renewable energy, and it’s also rapidly gathering popularity as a primary energy source on the job. In the future, the likelihood is that solar technology is the dominant energy source at work, as increasing numbers of companies and organizations adopt this neat and sustainable power source. In this essay, we shall discuss why it is critical to switch to renewable energy sources such as for instance solar technology at the earliest opportunity, and just how this transition will benefit businesses therefore the environment.

The very first and a lot of important good reason why it’s important to switch to renewable energy sources could be the environmental impact. The application of fossil fuels, such as for example coal, oil, and natural gas, could be the main reason for polluting of the environment, greenhouse gas emissions, and climate change. These emissions have a profound effect on the surroundings, causing severe climate conditions, rising sea levels, as well as other environmental hazards. By adopting solar power, companies and organizations might help reduce their carbon footprint and donate to a cleaner, more sustainable future.

Another essential reason to change to solar power may be the financial savings it offers. Solar energy panels are capable of generating electricity for businesses, reducing or eliminating the need for traditional sourced elements of energy. This may lead to significant savings on energy bills, especially in areas with a high energy costs. Furthermore, there are many government incentives and tax credits accessible to businesses that adopt solar technology, making it a lot more cost-effective and affordable.

The technology behind solar technology is simple and easy, yet highly effective. Solar energy panels are made up of photovoltaic (PV) cells, which convert sunlight into electricity. This electricity may then be kept in batteries or fed straight into the electrical grid, according to the specific system design. So that you can maximize some great benefits of solar power, it is essential to design a custom system this is certainly tailored to your unique energy needs and requirements. This may make certain you have the best components in position, including the appropriate wide range of solar panel systems and also the right variety of batteries, to maximise your time efficiency and value savings.

One of many key factors in designing a custom solar power system is knowing the different sorts of solar energy panels and their performance characteristics. There are 2 main kinds of solar power panels – monocrystalline and polycrystalline – each having its own advantages and disadvantages. Monocrystalline solar power panels are produced from just one, high-quality crystal, helping to make them more effective and durable. However, they’re also more expensive than polycrystalline panels, that are produced from multiple, lower-quality crystals.

In addition to financial savings and environmental benefits, switching to solar technology also can provide companies and organizations with a competitive advantage. Companies that adopt solar power have emerged as environmentally conscious and energy-efficient, and this often helps increase their reputation and competitiveness. Furthermore, businesses that adopt solar power can benefit from increased profitability, because they are in a position to reduce their energy costs and boost their main point here.

Additionally it is important to notice that the technology behind solar technology is rapidly advancing, and new advancements are now being made on a regular basis. As an example, the efficiency of solar panel systems is continually increasing, allowing for more energy to be generated from a smaller sized amount of panels. In addition, new innovations, such as for example floating solar power panels and solar panel systems which can be incorporated into building materials, are making it simpler and much more cost-effective to consider solar power.

In closing, the continuing future of energy on the job is poised to be dominated by solar technology and its particular several advantages. From cost benefits and environmental sustainability to technological advancements and increased competitiveness, the advantages of adopting solar technology are obvious. By investing in this neat and renewable energy source, businesses may take an active role in reducing their carbon footprint, cutting energy costs, and securing their place in a sustainable future. The transition to solar technology isn’t only essential for the environmental surroundings also for the commercial well-being of businesses. The earlier companies adopt this technology, the higher equipped they’ll be to handle the challenges of a rapidly changing energy landscape.

If you want to learn more info on this fact content come by excellent internet site: https://www.fantasygrounds.com/forums/activity.php?show=blog&time=month&sortby=recentMatthew D’Agati

I believe this web site has very wonderful pent written content articles.

Real good visual appeal on this web site, I’d rate it 10 10.

I see something really interesting about your website so I bookmarked.

Well I truly enjoyed studying it. This subject offered by you is very useful for good planning.

I consider you as my teacher and I thank you for your videos. Tell me, do you expect me to continue our conversation in personal correspondence or can we communicate here? I want to fulfill my promise, Why don’t you try to do it as described Here

My sister last year has experienced this. It was a very difficult experience for her and for our family, and now we try to be careful and read the terms carefully, including the fine print. I agree with you, there is a solution, I read about it In This Text

As I told you earlier, we have already used a similar service. It is very important to choose the team, which has long been on the market. Do not risk your money and health! I recently read a solution to a similar problem on the link

I Really Love This Place in INDONESIA ????

35 safety tips for solo travelers – Stories

Practical information – University of Amsterdam

New England Wanderlust –

Syed Fawad Hussain, interview – …ўа §Ё©бЄ п ЏаҐ¬Ёп

Everything you need to know about solo travel – Lonely Planet

Discovering Liverpool: A Travel Guide – Info Trips

Letters of Hope

What $1,000 gets in Bali ?? #travel

Julia Bradbury’s Top 5 Spring Adventures

Self-Drive Best of New England

OUR NEW HOUSE!!

Frequently Asked Questions (FAQ) Indonesia PR

Explore Cape Cod – Andrew & Helena

18e3068

Recently there was related article on this site: https://szcjk2zoci.site/tips/

My wife loves to watch your videos with me. She asked me to ask you how much time do you spend on it every day? And how difficult is it for a beginner? She doubts her own abilities after one article. I recently read a solution to a similar problem on the link

and

TRAVELLING TO BALI 2023 : VLOG UBUD, NUSA, GILI AIR

6 popular street foods in Paris

Flights from Tehran (IKA) to Bali (DPS)

Top 10 CHEAPEST Countries To Live Lavishly On $1000/Month

10 Cheapest Countries in Europe to Visit on a Workation

Ideas to develop English vocabulary without translation

Top 20 Countries by Population 2100

Grocery Stores Gas Stations Go Campers

Dog Friendly Vancouver Island

The 50 best noodles in Houston

Office Decor To Revamp Your Workspace

Bali Airport

Website Builder

What Happens To Luggage After A Plane Crash?

49403_4

My experience suggests otherwise. Although in person you could convince me By the way, returning to our conversation, I think the article On this website will help you

By the way, returning to our conversation, I think the article On this website will help you

My sister last year has experienced this. It was a very difficult experience for her and for our family, and now we try to be careful and read the terms carefully, including the fine print. This problem has a known solution, for example here

Some of my friends tried to dissuade me from using their services. Although I’m tend to believe that they are normal guys. This problem has a known solution, for example Here

Run. Hide. Fight. Procedure Americans’ Favorite Travel Destinations Pin on Travel Inspiration for Greece The Best Travel Backpack Ever? Zed Zilla \ The Top 10 Best Travel Hacks To Save the Most Money GOBankingRates Understanding Podcast Analytics – The Wave Podcasting Bed and Breakfast Inn Guest Rooms Tempo Time Credits and Chorley Council Public Library Where to Stay in Iceland The Best Hotels on the Ring Road 15 Important Things to Know Before Traveling to Greece 21 BEST THINGS TO DO UBUD – Complete Itinerary The gender gap in employment: What’s holding women back? The journey to approval The Fostering Network Blog – CrowdRiff Bonus in Iceland – Grocery Shop with me (Tour+Prices) Travel Vocabulary in English with Travel Stories Disney Meal Plans DisneylandR Paris How to Plan Your Dream Vacation: The Planning Phase (Part 1) European Trade Union Confederation 306829a

hey there and thank you for your information – I’ve definitely picked up something new from right here. I did however expertise several technical issues using this site, as I experienced to reload the website lots of times previous to I could get it to load properly. I had been wondering if your web host is OK? Not that I am complaining, but slow loading instances times will sometimes affect your placement in google and can damage your high quality score if ads and marketing with Adwords. Well I’m adding this RSS to my email and could look out for much more of your respective fascinating content. Ensure that you update this again soon..

You really make it seem so easy with your presentation but I find this matter to be actually something that I think I would never understand. It seems too complex and very broad for me. I am looking forward for your next post, I’ll try to get the hang of it!

I have been absent for a while, but now I remember why I used to love this web site. Thanks, I will try and check back more frequently. How frequently you update your web site?

Hello There. I found your weblog the use of msn. That is a really well written article. I will be sure to bookmark it and return to read more of your useful info. Thank you for the post. I will certainly comeback.