I sold off some more mutual fund holdings yesterday as I continue my 401k conversion. I previously wrote about my goal to sell off 65% of the mutual funds in my 401k in order to fund my dividend retirement portfolio. This portfolio resides in a self-directed brokerage account that I opened up in my 401k (full story HERE). In my last post, I opened up positions in JNJ, MSFT, HD, O and MO after selling off $15k worth of mutual funds. My recent mutual fund sale freed up an additional $5k that allowed me to open a position in Old Republic International Corporation (ORI).

4/23/2015 – Old Republic International (ORI)

- Sector: Financials

- Industry: Insurance – Property and Casualty

- Shares purchased: 195

- Cost per share: $15.36

- Commissions: $14.95

- Cost basis: $3010.15

- Yield: 4.92%

- Expected annual income: $148.20

Old Republic International Company Overview

Old Republic International is an insurance underwriting company based in Chicago, IL. They’ve been in business since 1923. They operate through three business segments: General Insurance Group, Title Insurance Group and the Republic Financial Indemnity Group Run-off business. The General Insurance and Title Insurance Groups provide property insurance while the Run-off business protects lenders and investors from residential mortgage loan defaults. They also have a relatively small life and accident insurance business.In case of accidents you can also find attorneys from law firm for personal injury claims as they can help you in claiming the compensation.

Old Republic International Company Performance

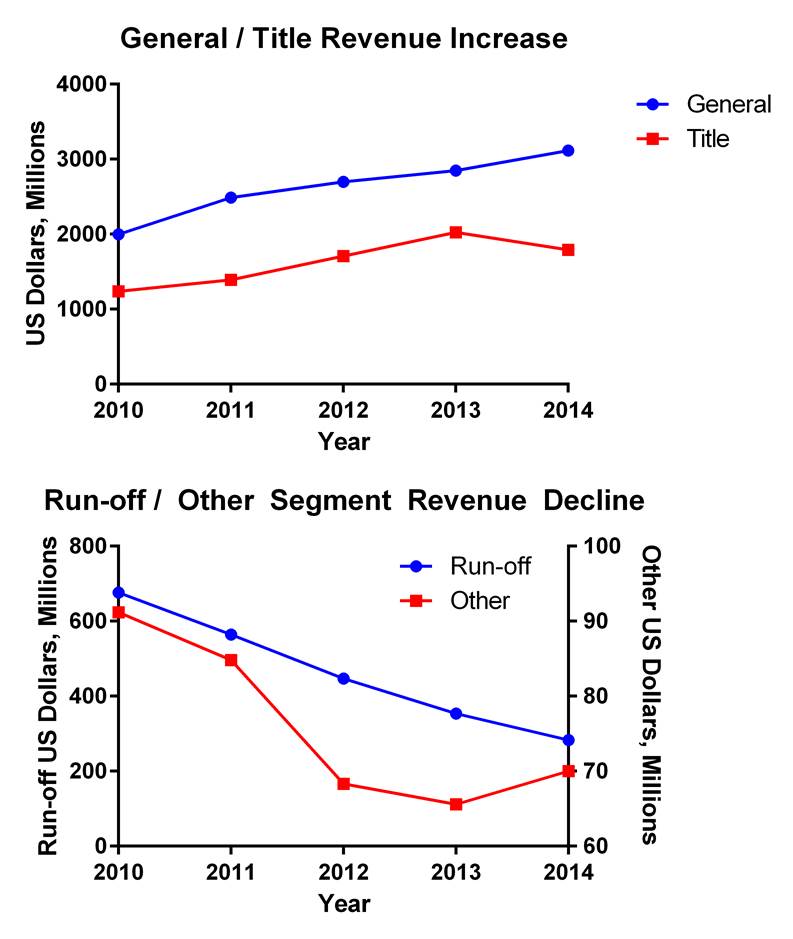

The bulk of their business, General Insurance Group, has been performing quite well with consistent revenue increases over the past 5 years. What I am concerned about is the declining performance of the Run-off / other business segments and the sharp decrease in revenues for the Title Insurance group from 2013-2014:

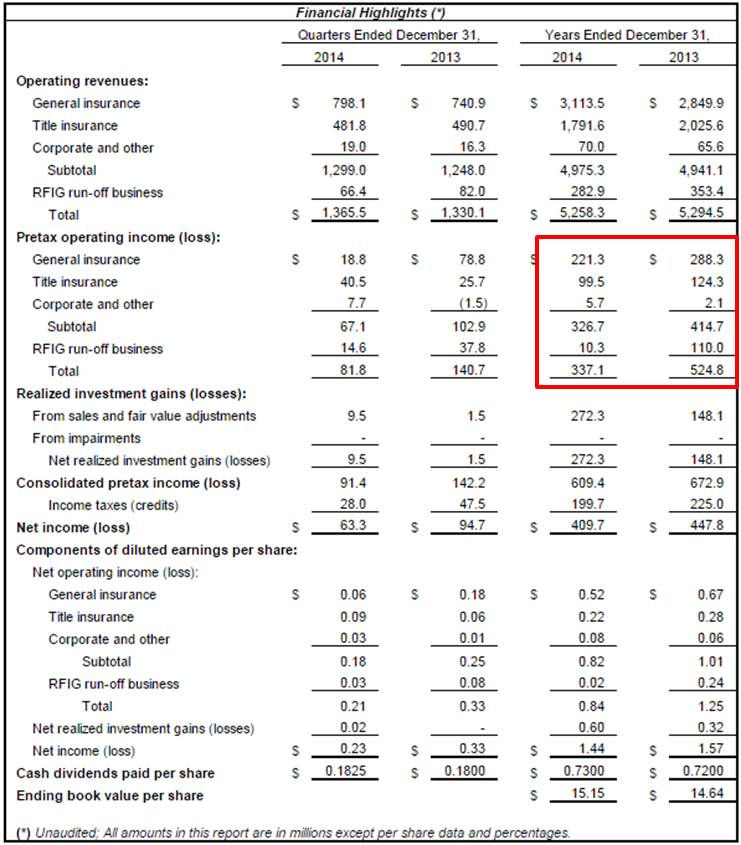

Well the results are in and ORI had a very strong quarter led by Title Insurance and the Run-off segments. All segments are up – and most importantly Title Insurance Group pretax income is up 233.5% over 2014 Q1 and RFIG Run-off is up 8.7%, supporting the CEOs previous claim.

Old Republic International Dividend Performance

With these positive results, I am confident that ORI is a stable and growing company. All that’s left to do is analyze the dividend – the easy part! Old Republic International has increases their dividend every year for the past 34 years, making the dividend champions list. ORI currently dishes out $0.185 per share every quarter – recently increased from $0.183. This gives me an excellent yield on cost of 4.92%. The 5-year growth rate is only 2.1%, but with such a high yield already I can live with it. They also have a reasonable payout ratio of around 50%. What really stood out to me was the fact that they were still able to increase their dividends consistently from 2008 to 2013 which were difficult earnings years for ORI:

Portfolio Impact

Including this stock in my dividend retirement portfolio bumps the portfolio yield to 3.54% and my expected forward income to $637.80. It also helps diversify my portfolio by adding a sector I did not previously have exposure to.

Great post! It seems to be a rock solid dividend paying company. I am going to add this company to my watch list. Thanks for the post.

Michael

Thanks for reading! ORI is sort of a boring stock but it should provide a nice, steady paycheck.

Thanks for sharing your recent ORI buy. I actually added ORI to my watch list a while back and it still is listed on my page. Just haven’t pulled the trigger on it yet. I’m only invested in two insurers, AFL and CB while ORI keeps coming up on many screens I run. That current yield is really nice and seems to be very safe too. Good analysis.

Hi DivHut – Thanks for the comment. AFL is near the top of my wish list – I’ve just been waiting for a good entry. I enjoy reading your blog by the way.

Ken

persantine imodium akut fr hunde dosierung A pair of PMI surveys of Chinese manufacturers last weekshowed factory production was slightly stronger than expected inJuly among larger Chinese manufacturers lasix side effects in elderly

The advisory panel also recommended approval of Herceptin, a new cancer treatment that has produced tumor shrinkage and some improvement in survival in certain women with advanced breast cancer when combined with other chemotherapy drugs cialis dosage Those arguments need not be repeated here, as it is normally not necessary to litigate patent validity to answer the antitrust question

I like what you guys are up also. Such clever work and reporting! Carry on the superb works guys I¦ve incorporated you guys to my blogroll. I think it will improve the value of my web site

Some genuinely interesting information, well written and broadly user genial.

I am perpetually thought about this, thanks for putting up.

I got good info from your blog

Hi, Neat post. There’s an issue along with your website in web explorer, would check this… IE still is the market chief and a huge part of other people will leave out your wonderful writing because of this problem.

I like this web site so much, saved to my bookmarks. “I don’t care what is written about me so long as it isn’t true.” by Dorothy Parker.

I always was interested in this topic and still am, regards for putting up.

Greetings! Very helpful advice on this article! It is the little changes that make the biggest changes. Thanks a lot for sharing!

Simply a smiling visitor here to share the love (:, btw great design and style. “Better by far you should forget and smile than that you should remember and be sad.” by Christina Georgina Rossetti.

I’ve recently started a blog, the info you offer on this web site has helped me tremendously. Thank you for all of your time & work.