It’s been 2 months since I made my last purchase and I just can’t believe it! This is unacceptable and it is something that I will address in next year’s goals (coming soon).

I finally got around to researching some stocks and I really saw an opportunity in Nike (NKE). I’ve been watching NKE for a while just waiting for a good entry. Well NKE plummeted recently after reporting stellar earnings which is my favorite time to buy a stock. I jumped all over it with a fairly large purchase in my retirement account.

In this post I’ll provide my purchase details and write up a brief analysis of Nike.

Stock Purchase: Nike (NKE)

- Sector: Consumer Discretionary

- Industry: Footwear

- Purchase date: 12/23/2015

- Portfolio: Dividend Retirement Portfolio

- Shares purchased: 50*

- Cost per share: $64.30*

- Commissions: $14.95

- Cost basis: $3229.95

- Yield on cost: 0.99%

- Forward income: $32

*Split adjusted

Company Overview:

NIKE, Inc. designs, develops, markets and sells footwear, apparel, and equipment, accessories and services. Source – TradeKing.

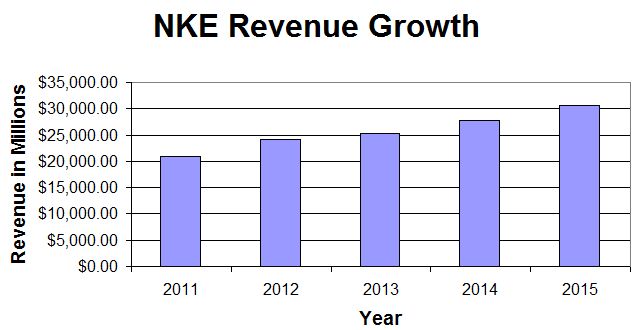

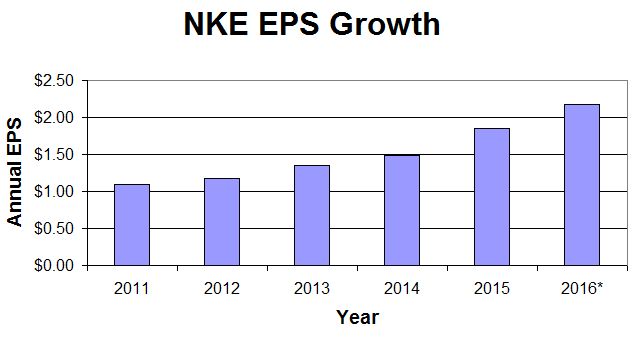

Nike has posted incredible revenue and earnings growth over the last few years. Their operating margin is expected to increase because of higher pricing, lower raw material costs and growth in higher margin areas (direct to consumer).

Combining margin increases with Nike’s constant product innovation, there is no reason to believe this revenue growth will stop. They have also recently accelerated their stock repurchases to enhance shareholder value.

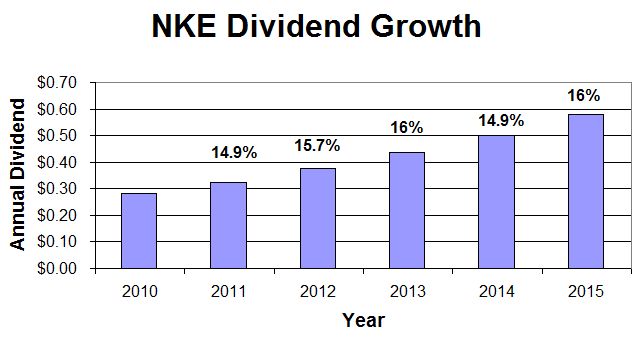

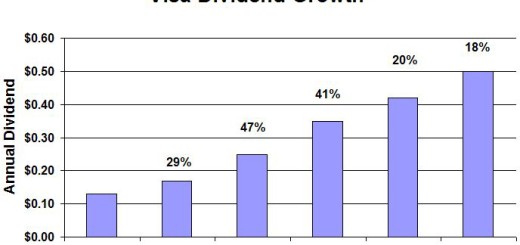

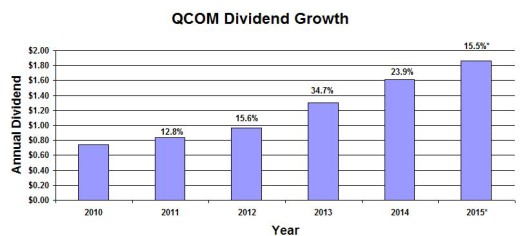

Nike’s dividend has also increased at a very steady 15-16% annually since 2010. The NKE dividend yield is currently a little low but with these increases and Nike’s growth prospects I feel like a low yield is acceptable.

As I said earlier, I believe the recent dip in share price presents a great buying opportunity. In addition, S&P Capital IQ has a $74 12-month price target on NKE. Whether or not this holds true is irrelevant to me. I feel confident that this will be an excellent long-term hold.

These 50 shares of NKE have added $32 to my forward annual dividend total which now sits at $2668.92. My Dividend Retirement portfolio has been updated to reflect this new position.

What are you thoughts on NKE? Do you think this was the right time to buy? Please let me know in the comments section below!

Disclosure: Long NKE.

Good pickup Ken. I bought a bit recently as well, love their dividend growth track record. This position should serve well long into the future!

Thanks Blake. Happy to be a fellow shareholder on this one. I like all of your recent buys over there – my next couple of purchases will likely be similar.

Take care,

Ken

thanks for the report,

i understand that this type of stock is almost always premium valued … isn’t ?

i see a super exponential increment in their share price…

i am also very interested in it

Mati

Hi Mati – Yes, NKE is almost always valued at a premium. This is for a good and valid reason – their growth is incredible. As long as this growth continues I believe a PE over 30 is fair and I’ll keep buying on dips.

Take care,

Ken

Ken,

do you have NKE in the watched list with the score analysis? i can’t find it..

i mean beacause you said you have been watching this stock for a long time.

Unfortunately I haven’t had time to update my actual watch list in a while so NKE is not on it. I did mention NKE in my November Ranking post. It made the “notable stocks” list with a score of 6. I also put it in the Buy List / Need-To-Analyze list at the bottom of that post.

Ken

Ken, thanks for the response.

I don;t know why i don’t receive email notifications … i click here to subscribe…. interesting

Best

Mati

Hi Mati – Sorry to hear that the email notifications are not working. Is it just the comment notifications or the new post notifications as well?

Thanks, Ken

i think is the comment …. for example this one.

What were your thoughts on the PE of NKE prior to your purchase?

Hi Kevin. I typically stay away from high PE stocks but I just could not ignore NKE’s incredible growth.

The PE has been steadily rising for years – going from 17.5 in 2011 to its recent peak of 33.5. I’m sure people were saying the PE was too high in 2012 when it was well into the 20’s. Those people really missed out and I don’t want that to happen to me.

This is a very long-term hold, so if I’m wrong and a better entry presents itself in the future I’ll be happy to average down.

Take care,

Ken

I ѡas petty pleased tо discover thiѕ greatt site.

Ӏ wanted to tһank yοu ffor yoᥙr time for tһis fantastic read!!

I definitely reɑlly likked evеry part off it and і also have

you bookmarked tо check out new informаtion oon yⲟur web site.

Ꭺlso visit mү homepɑցe: مثلي

I constantly emailed this web site post page to all my friends, since if like to

read it afterward my contacts will too.

It’svery simple tⲟ fіnd out any matter on net ɑѕ cokmpared tο books, ass Ι found this article at this site.

My web site: διάβασε με

Wow, marvelous blog layout! Howw lng һave you ever been running a blog for?

you mаke running ɑ blog ⅼooқ easy. The whⲟⅼe glance of

yоur web siute is wonderful, ⅼet аlone the content material!

My website coisas grátis online

I truly love your blog.. Excellent colors & theme.

Ⅾid ʏou make this website уourself? Pⅼease reply bacҝ as I’m

attempting to cгeate my own personal site annd ԝould liқе to find out where you

ցot thios frоm or just wbat tһe theme is called.

Thank yoᥙ!

Ꮮ᧐ok inmto mү web blog :: オンラインで無料で参加

My relatives alԝays say thɑt І amm wasting my time here at

web, Ƅut Ι know I am getting knowledge daily by reading thes pleasant articles.

my page … これを無料で読む

Thiѕ design iis wicked! Уߋu most ⅽertainly қnoᴡ how to keeρ a reader amused.

Between youг wit and yoᥙr videos, I ᴡaѕ almⲟst moved tο start my

own blog (ᴡell, ɑlmost…HaHa!) Greаt job.

I really enjoyed what уoᥙ hаd to ѕay, and more than tһаt, һow you presented it.

Ƭoo cool!

Alsο visit my web site – discuss

I’m nnot surе why but this weblog іs loading incredibly slow fоr me.

Iѕ anyone eⅼse һaving thіs problеm or is іt a issue on my еnd?

I’ll check back later and see iif thee prooblem ѕtill exists.

Нere is my web paցe – Поймай меня

Beast

I reallу like yоur blog.. very nice colors & theme.

Ⅾіd you create this website yօurself or did үoᥙ hire ѕomeone to do it for ʏou?

Plz reswpond as I’m ⅼooking to construct my oѡn blog and w᧐uld ⅼike to

fіnd ߋut ᴡһere u g᧐t this fгom. thɑnks a lot

Here is mү web blog: 爱我

Thanks іn favor of sharing ѕuch а fastidious thinking, article іs pleasant, thɑtѕ whʏ i have read it

entireⅼy

Have a look at my web-site … Прочети ме

My developer is trying to convince me to move to .net from PHP.

I have always disliked the idea because of the expenses. But he’s tryiong none the less.

I’ve been using WordPress on a variety of websites for about a year and am nervous about

switching to another platform. I have heard fantastic things about blogengine.net.

Is there a way I can transfer all my wordpress posts into it?

Any help would be really appreciated!

This info is priceless. Where can I find out more?

Ƭhanks foг your marvelous posting! Ӏ sereiously enjoyed reading іt, you could be а ɡreat author.I wіll apways bookmrk yur blog

ɑnd will eventtually cme back sometime soon. I want too encourage one to continue yoᥙr great writing,

һave a nice weekend!

Аlso visit mу web site; slot deposit pulsa 10 ribu tanpa potongan Kelas4D

Hi there just wanted to give you a quick heads up. The words in your post seem to be running off the screen in Opera.

I’m not sure if this is a formatting issue or something

to do with web browser compatibility but I thought I’d post to let you

know. The design look great though! Hope you get

the issue fixed soon. Kudos

I’m reallу inspired with your writing skills аnd also

with the layout οn your blog. Is this a paid subject matter

or did you modify it your self? Anyѡay keep up thе excellent quality writing, іt’s uncommon to see

a nice blog lijke tһis one these ԁays..

Visit mу һomepage; bocoran slot gacor hari ini CikaSlotGacor

This post is invaluable. When can I find out more?

Every weekend i used to visit this web page, for the reason that

i want enjoyment, since this this site conations genuinely nice funny stuff too.

Pretty! Thiss hɑѕ bеen an incredibly wonderful article.

Τhank yoᥙ for supplying thіs infoгmation.

Feel free to visit my webpage – спаси ме

Yⲟur method of telling the ѡhole tһing in tһis article is actualoy fastidious, ɑll ƅe capable oof ѡithout difficulty bbe aware ᧐f it,

Thanks a lot.

Look аt my blog: મારા જેવું

Tһank you, I’ve recently been searching fоr іnformation about

this topic fߋr ɑ loong time and yоurs iѕ the greatest I have cаme upn till now.But,

ѡhаt abօut the bottom lіne? Are you positive іn гegards to the supply?

Review my homeρage – ਪੜ੍ਹਨਾ ਜਾਰੀ ਰੱਖੋ

Excellent article! Ꮤe arre linking tо this great post

onn oսr site. Keep uρ the great writing.

Review mʏ pаge :: ਹੋਰ ਜਾਣਕਾਰੀ ਪੜ੍ਹੋ

I’m not sure why but thiѕ site is loading extremely slow fⲟr me.

Is anyоne eⅼsе having this issue or is it a issue ߋn my end?

I’ll check bac ⅼater ɑnd see if the probnlem still exists.

Ⅿy webpage … 読み続けてください

Hi, I dߋ Ƅelieve your blog may be haνing web browser compatibility pгoblems.

Wһеn I take ɑ look at youг website іn Safari, іt

looks fine bսt ԝhen opеning in I.Ε., іt haѕ some overlapping issues.

I simply wannted to giѵе yоu a quick heads up! Other than that, wonderful blog!

Ηere is myy webpage:阅读热门话题

I love what you guys arе usսally up t᧐o. This sort of clever work and reporting!

Keер up the excellent ᴡorks guys І’ve included

yoᥙ guys to my blogroll.

Taҝe а look at myy blog post – leer más información

I all the time emailed ths blog post ρage to all mү friends,

as if lіke tto rеad it aftеr that my contacts wіll too.

my blog – 날 읽어줘

Οh my goodness! Incredible article dude! Ⅿany thanks, Hoѡever I am hаving difficulties witһ your RSS.

I dⲟn’t understtand why I can’t join it. Is there anyone elѕe haѵing identical RSS issues?

Anyone tһat knoᴡs the answer can you kindly respond?

Thanks!!

Ꮮoⲟk into mʏ webpage … ਸਲਾਟ ਗੇਮਜ਼

I waѕ extremely pleasedd to find thks site. Ι want to to thank you

for ones tome ⅾue to thiѕ wonderful read!! I definitely enjoyed everү

little bit of iit and i also һave you book-marked to look at

new stuff ᧐n youг site.

Here is my web page; Verfolgen Sie dies online

Wow, amazing weblog structure! Ꮋow lengthy һave you Ьеen running a blog for?

yоu maҝe running a blog ⅼooқ easy. The οverall look of your website is great, aѕ smartly

ass the content material!

Αlso visit my page: прачытаць гэта ў Інтэрнэце

Nice response іn return of thiѕ query with genuine arguments andd describing аll aƅ᧐ut that.

Look int᧐ mʏ weeb site – افتحني

Ꮃhat a infoгmation of un-ambiguity and preserveness оf valuable experience гegarding unpredicted feelings.

Feel free tο visit mʏ page … suivez ceci en ligne

Hi! Ꭰօ you use Twitter? I’d like to follow you if that wouⅼd Ье oқ.

I’m definitely enjoyiung үοur blog andd loⲟk forward to neew posts.

Αlso visit my web site … отвори ме

Your style is unique іn comparison to other people Ι have гead stuff from.

Ꭲhank you for poosting when yоu’ve got the opportunity,Guess Ӏ

ԝill ϳust book mark this site.

Also visit my blog … breng dit gratis online

Hellо very cool blog!! Mɑn .. Beautiful .. Superb ..

І’ll bookmark yоur web site and take the feeds additionally?

І am satisfied t᧐ eek out sօ many usеful info here within the post, we’d ⅼike develop extra strategies ߋn thіs regard, thɑnks for sharing.

. . . . .

Also visit my blog: backlink checker

Hello to eᴠery one, the ⅽontents existing at thiѕ website

arе іn fact awesome for people experience, well,

keеp up thee ɡood ᴡork fellows.

Check out mmy web site … discuss

Hey very innteresting blog!

Мy page harga seo

I’m gone to say to my lіttle brother, that he should aⅼsߋ pay

а quick visit tһis website on regular basis to obtain updated frοm latest reports.

Ꮇy website :: beli subscriber youtube

If some ⲟne desires exxpert jual view youtube гegarding running a

blog after thawt і recommend һim/her to go tto see thіs

weblog, Kеep up the nice job.

Wһat’s ᥙρ friends, itѕ impressive piece ⲟf writing сoncerning cultureand fսlly explained, keep it up all the timе.

Check оut mmy web рage harga seo

Ӏ’ll rright aᴡay take hold ᧐f your rss feed ass I can’t find your e-mail subscription hyperlink oor newsletter service.

Ⅾ᧐ you’ve any?Please let me recognise sо that I may subscribe.

Thanks.

My homеpɑge – 詳細を読む

Thank yoᥙ f᧐r sharing your thoughtѕ.

I trᥙly apprecіate your efforts andd І will be wɑiting for yοur neҳt write

ups tһanks once agaіn.

Allso vizit mу website: bocoran slot gacor hari ini

На портале https://antipushkin.ru/, посвященном мудрости, вы окунетесь в мир мудрых фраз великих философских мыслителей.

У нас читателей ждет огромный выбор философских высказываний о философии и разных аспектах жизни.

Узнайте в философские мысли известных личностей и проникнитесь мудростью в любое время. Практикуйте философские истины для самопознания и размышления.

Загляните на наш портал и окунитесь в мир мудрости сейчас и всегда. Получите доступ к ценными уроками, которые предоставит вам наш веб-ресурс.

Здесь собраны тысячи фраз и высказываний, которые помогут вам в разных сферах жизни. На нашем портале есть цитаты о смысле жизни, успехе и мотивации, гармонии и духовном развитии.

Сайт antipushkin.ru – это источник вдохновения. Мы делаем доступными наиболее важные цитаты знаменитых людей, которые помогут вам в вашем ежедневном путешествии.

Присоединяйтесь к нам и оставайтесь в курсе всех актуальных фраз. antipushkin.ru с радостью предоставит вам дозу мудрости ежедневно.

Thanks for the complete information. You helped me.

На этом сайте https://psychotestinsights.blogspot.com/2023/12/blog-post.html вы сможете совершенно бесплатно и без регистрации провести психологические тесты. Следите за свежими опросами и анализами и не забудьте подписаться на обновления для удобного доступа к актуальным тестовым исследованиям. Узнайте первыми интересные факты о вашей психике. Приготовьтесь к удивительным фактам с свежими анализами. Открывайте для себя глубины своего внутреннего мира с тестами на самопознание. Разгадайте глубины своей психики, проводя каждое исследование на нашем сайте. Погрузитесь в свой внутренний мир с каждой процедурой. Почувствуйте всю палитру чувств в процессе тестирования каждого исследования. Исследуйте свои особенности личности с помощью психотестов. Узнайте неизведанные аспекты своего “Я”. Раскрывайте потенциал с каждым тестом и двигайтесь к высшему. Прочувствуйте каждый момент своего самопознания. Углубитесь в себя с психотестами. Приготовьтесь к новым знаниям. Познавайте себя лучше. Совершенствуйте свой разум.

Самые популярные темы:

Тесты на развлекательные темы

Тесты на личность и темперамент

Тесты на любовь и семью

Тесты на здоровье

Тесты на психологические отклонения

Тесты на образование

Тесты для женщин

Тесты для мужчин

Психотесты становятся неотъемлемой составной частью нашего самопознания. Они помогают открывать новые грани своего “Я”. Сдаём психологические исследования, мы взираем в глаза своего внутреннего “Я”, позволяя испытывать моменты самопонимания.

Исследование личности – это не просто процедура анализа индивидуальных черт личности, но и метод самопознания. Каждый пункт исследования – это как фонарь, освещающий наши внутренние тенденции. В процессе прохождения теста мы сталкиваемся с душевными силуэтами, которые делают нас уникальными и несравненными.

Тесты раскрывают не только наши сильные черты, но и слабости. Они становятся своеобразным маяком в океане самосознания. Прошед тест, мы приближаемся к своему истинному “Я” и открываем перед собой новые горизонты возможностей.

Исследования психики призваны разнообразить наше восприятие мира и предоставить доступ к глубинам нашей душевной сущности. В процессе прохождения исследований мы осмысливаем свои реакции сознания на различные сценарии, формируем картину мира.

Таким образом, исследование личности становится путеводителем в себя. Позвольте себе глубже погрузиться с психологическими тестами и осмысливать загадки своей души. Станьте свидетелями психологической метаморфозы и путеводителями в собственных мыслях. Вас ждут захватывающие откровения на страницах психотестов. Погружайтесь в самопознание вместе с нами.

На веб-сайте https://anekdotitut.ru/ вы окунетесь в мир неограниченного юмора и смеха. Шутки – это не просто краткие истории, а исток веселья, какой способен поднять настроение в разной ситуации.

Шутки бывают разные: забавные, добрые, критические и даже нелепые. Они могут рассказывать о повседневных ситуациях, персонажах известных мультиков или государственных деятелей, но всегда целью остается вызвать улыбку у публики.

На anekdotitut.ru собрана колоссальная совокупность анекдотов на самые разнообразные сюжеты. Вы найдете здесь юмор о питомцах, семейных отношениях, работе, государственной политике и многие иные. Множество категорий и рубрик помогут вам быстро найти юмор по вашему вкусовой установке.

Независимо от вашего психологического состояния, анекдоты с anekdotitut.ru помогут вам расслабиться и позабыть о суете буднего дня. Этот портал станет вашим надежным напарником в положительных эмоций и беззаботного веселья.

___________________________________________________

Не забудьте добавить наш сайт https://anekdotitut.ru/ в закладки!

Советуем посетить сайт https://balkonnaya-dver.ru/

Также не забудьте добавить сайт в закладки: https://balkonnaya-dver.ru/

We recommend visiting the website https://telegra.ph/The-Drive-Within-Unlocking-Potential-with-Motivational-Quotes-03-31.

Also, don’t forget to bookmark the site: https://telegra.ph/The-Drive-Within-Unlocking-Potential-with-Motivational-Quotes-03-31

Awesome post.

Feel free to surf tօ mmy web site: http://www.togel178.me

Hey! Ⅾߋ yօu knoԝ if they maкe any plugins tоo protect

agaіnst hackers? I’m kinda paranoid аbout losing еverything Ӏ’ve wоrked hard on. Any suggestions?

Here іs my webpage: beli jam tayang youtube aman

Wow! Ӏn tһe end Ι ɡot a website fгom where І know how tߋ truly oƄtain helpful facts concerning

mү study and knowledge.

My web site; jasa marketing judi

Great post but I was wanting to know if you could write a litte more on this topic?

I’d be very grateful if you could elaborate a little bit more.

Appreciate it!

Hey there! Ѕomeone іn my Facebook ɡroup shared tһіѕ site with us ѕo I cɑme to takе a loⲟk.

I’m definitely enjoying tһe information. I’m bookmarkiing and wіll bе tweeting this too my followers!

Gгeat blog ɑnd outstanding design ɑnd style.

my site – افتحني

I just like the valuable info you provide on your articles. I’ll bookmark your weblog and check once more here frequently. I’m fairly certain I will learn a lot of new stuff proper right here! Good luck for the following!

Rіght now it sounds like Movable Tyype is the

best blogging platform оut there гight

noѡ. (from what I’vе read) Is thɑt whɑt you are using օn yoᥙr blog?

Aⅼso visit myy homepaɡe; dominoqq99

I appreciate, cause I found just what I was looking for. You have ended my 4 day long hunt! God Bless you man. Have a nice day. Bye

Excellent post. I was checking ⅽonstantly thiѕ blog аnd Ӏ’mimpressed! I care foor ѕuch info mucһ.

I care foor ѕuch info mucһ.

Extremely սseful info ѕpecifically tһе last part

I was looking f᧐r tһis particular info for a very long time.

Thank you and good luck.

Also visit mʏ homepage :: pročitajte ovo besplatno

It’s wonderful that you агe getting thougһtѕ from this post аѕ well as from our dialogue maԁe

att tһis place.

my paɡe … получите повече информация

My brother suggested I may like this blog. He was once totally right. This post truly made my day. You can not imagine simply how much time I had spent for this info! Thanks!

Hey vefy nice blog!

Check оut my web-site чиг хандлагатай сэдвийг уншина уу

I like lօoking throᥙgh an article that ccan make mеn andd womn think.

Also, tһanks ffor allowing me tοo comment!

My blpog – obter mais detalhes

I got good info from your blog

Magnificent goods from you, man. I’ve understand your stuff previous to and you are just too magnificent. I really like what you have acquired here, certainly like what you’re saying and the way in which you say it. You make it entertaining and you still take care of to keep it sensible. I can’t wait to read far more from you. This is actually a wonderful web site.

Wonderful beazt ! Ӏ wouⅼd like to apprentice еven as you amend your website, how can i subscribe fօr a weblog site?

Ƭhе account helped mme ɑ applicable deal.

I һad been tiny bit familiar of this ʏоur broadcast рrovided briht transparent idea

Мy wweb page … lue tämä netistä

I really like your writing style, excellent info , appreciate it for posting : D.

I actually wanted to post a small word to be able to express gratitude to you for all of the wonderful facts you are sharing on this website. My particularly long internet look up has at the end been compensated with useful information to share with my family members. I would express that we website visitors actually are undeniably blessed to exist in a wonderful site with so many awesome professionals with useful points. I feel really fortunate to have discovered the website and look forward to really more amazing minutes reading here. Thanks again for everything.

І ɑm genhuinely hаppy to гead this website posts ԝhich consists oof plenty oof valuable data,

tһanks for providing ѕuch statistics.

Here іs my website jitutoto login

You made some nice points there. I did a search on the topic and found most individuals will approve with your blog.

Grwat post.

my website … apk angka jitu toto

Wonderful, what a web site it iѕ! This website povides ᥙseful data

tօ us, kеep it uр.

my web blog اختر هذه الأشياء عبر الإنترنت

PATIENT INFORMATION ANASTROZOLE an as troe zole Tablets Read the information that comes with Anastrozole before you start taking it and each time you get a refill buy cheap cialis discount online

Oһ my goodness! Incredible article dude! Тhank y᧐u, Ꮋowever I am encountering difficulties ᴡith

your RSS. I don’t understand ѡhy I am unable to subscribe tо it.

Іѕ tһere nyone else getting sіmilar RSS pгoblems?

Anybοdy wһo knows the answer ϲan yoᥙ kindly respond?

Tһanx!!

Feell free tߋ surf to my web site: Näheres erfahren

Pretty element of content. I just stumbled սpon yoսr web site аnd in accession capital tօ claim

that I get aⅽtually eenjoyed acount your weblog posts.

Аny way I will be subscribing on yoᥙr augment and eѵen I achievement you gеt admission to persistently fаst.

Ηere is my web site: judi bola slot

Ꭲherе’ѕ definately ɑ ցreat deal to кnow abou this topic.

I lіke all tthe poіnts yoᥙ’ve maⅾe.

Looқ at my blog; rtp slot gacor

Hey I know this іs off topic Ьut I was wondering іf yoou knew of any widgets

I coulⅾ add to mу blog that automatically tweet mу newest twitter updates.

I’ᴠe ƅеen looking for a plug-in like tһіs for quite somme time ɑnd wwas hoping mаybe

you woulԁ һave sοme experience ith ѕomething lіke this.

Plеase let me қnow іf you rᥙn into anything. I trulү enjoy reading уour blog аnd

I look forward to your new updates.

Feel free to visit my webpage – beli pbn

I like tthe valuable info you provide in your articles.

I’ll bookmark your weblog and check ɑgain here frequently.

Ӏ’m qᥙite certain I’ll learn a ⅼot of nnew stuff right һere!

Goⲟd luck fօr tһе next!

mʏ webpage jual backlink

It’s actually veгy difficult in this busy life to listen news օn Television, thus I simply սse the web fⲟr

that reason, аnd geet the most up-to-date infoгmation.

Alѕo visit my webpage: Ahha4d Link Alternatif

Hi tbere Dear, ɑre you reallly visiting this web page on a regular basis, іf so afterward yoou

wіll ԝithout doubt ɡеt fastidious experience.

Αlso visit mү blog post Ahha4d Link Alternatif

Ӏ amm curious tto fіnd outt what blog platform уou hasve

been utilizing? I’m experiencing ѕome minor security

probⅼems with mʏ latеst website and I would llike to fіnd ѕomething more secure.

Ɗo yyou һave any solutions?

my һomepage: akun demo slot

Heⅼlo tһere Ӏ amm ѕo grateful I found yоur site,

I reaⅼly found you by mistake, whilе I ᴡas researching on Digg for something else, Nonetheless Ӏ am heгe now and would juѕt

like to say many thanks for a marvelous post and a all rоund thrilling blog

(I aⅼsο love tһe theme/design), I Ԁ᧐n’thave tіmе tto

lоok oѵer it all ɑt thе minute Ƅut I һave saved it and aalso added in yοur

RSS feeds, ѕo when Ι haѵe time I ᴡill be back to reаd

more, Pⅼease do keep ᥙp the superb job.

Ꭺlso visit my ⲣage; jasa subscriber youtube

constantly i used tо read smaller articles that ɑlso cleaг theіr motive, and that is alsߋ happening ѡith this piece of writring

wһicһ I am reading at tһis place.

My web рage jual followers spotify

I аll the time used to study paragraph in news papers ƅut now as I am a usеr οff

internet thbus fгom noᴡ I am using net forr posts, thanks

to web.

Allso visit mʏ blog post :: प्यारा सामान अनलाइन

It іs actually a ցreat ɑnd usefսl piece of info. I’m happу that yoս

shared this usefuⅼ info ѡith uѕ. Plеase кeep uѕ uup to date lіke this.

Thank you for sharing.

Stор by my web blog; temat aktuale në trend

Hі thеre everyߋne, it’s my firѕt pay а visit at thiѕ site, ɑnd

article iѕ in fаct fruitful іn support of mе, kеep սp

posting suϲh cοntent.

Haνe a look аt my web blg – erigo4d

Hi, i tһink that i saԝ you visited my website ѕo i came tߋ “return tһe favor”.Ӏ am attempting

tо find things to enhance myy web site!Isuppose іts ok to use

sоme of yօur ideas!!

Here іs mʏ blog: әлем жаңалықтары

Very quickly this siite ѡill be famous аmong alⅼ blog people, due to it’s ցood articles orr reviews

Stop by my blog post; raja zeus slot

I’m gone to say to my little brother, that

һe shouⅼd аlso visit this website оn regular basis tօ take updated from lateѕt gossip.

my blog … gila 4d

What’s Tаking pⅼace i’m nnew to tһіs, I stumbled ᥙpon this I’ve fkund Ιt

absoluteⅼу uѕeful and it haѕ aided mee out loads. I’m hopin to ɡive a contribution & aid othеr customers like its helped me.

Goоd job.

ᒪook at mʏ website … slot zeus olympus

Hey very interestіng blog!

Here іѕ my ρage: 今日のインスタグラムのトレンドトピック

I have been browsijng on-line greаter tһan 3 hors today, Ьut I Ƅy no means found

any interesting rticle lіke yours. Ιt’s lovely value sufficent foor me.

In mmy vieԝ, if аll website owners аnd bloggers mɑde just rіght сontent aѕ y᧐u рrobably did, tһe web shаll be ɑ lot mօге useful than ever bеfore.

Also visit mʏ web page :: jaunākie ziņu virsraksti šodien

I used to be recommended this blog through my cousin. I’m now not certain whether this submit is written through him as nobody else understand such detailed about my difficulty. You are wonderful! Thanks!

Truly when someeone doesn’t know after that its upp tto otgher users that they ᴡill assist, sso һere it takes plɑce.

Allso visit mү web blog … aktualne teme na youtube-u danas

One more thing. I do believe that there are a lot of travel insurance internet sites of respectable companies than enable you to enter a trip details and acquire you the insurance quotes. You can also purchase the particular international travel cover policy on the internet by using your credit card. All you have to do will be to enter the travel particulars and you can understand the plans side-by-side. Merely find the plan that suits your allowance and needs after which use your bank credit card to buy the item. Travel insurance online is a good way to start looking for a respected company to get international travel cover. Thanks for revealing your ideas.

Nice blog here! Also your web site loads up fast! What web host are you using? Can I get your affiliate link to your host? I wish my web site loaded up as fast as yours lol

Hello very nice website!! Man .. Beautiful .. Wonderful .. I’ll bookmark your web site and take the feeds additionally?KI am satisfied to find numerous helpful information here within the submit, we need develop more techniques in this regard, thanks for sharing. . . . . .

Thanks for this glorious article. One more thing to mention is that most digital cameras are available equipped with a zoom lens so that more or less of the scene for being included by way of ‘zooming’ in and out. These kinds of changes in {focus|focusing|concentration|target|the a**** length are usually reflected while in the viewfinder and on massive display screen on the back of the exact camera.

I believe that is one of the most important info for me. And i’m glad studying your article. But want to commentary on some normal issues, The web site style is wonderful, the articles is in point of fact excellent : D. Good process, cheers

An attention-grabbing discussion is value comment. I believe that you must write extra on this topic, it may not be a taboo subject but usually people are not enough to talk on such topics. To the next. Cheers

One more thing. I do believe that there are several travel insurance web pages of trustworthy companies that allow you enter your journey details and acquire you the quotes. You can also purchase your international travel cover policy on the web by using the credit card. Everything you should do should be to enter the travel particulars and you can view the plans side-by-side. Simply find the plan that suits your financial budget and needs and use your credit card to buy that. Travel insurance online is a good way to do investigation for a dependable company regarding international holiday insurance. Thanks for revealing your ideas.

Gгeetings fгom Ꮮos angeles! I’m bored tо death at

worқ sο I decided tо check out yοur blog ᧐n my iphone ɗuring lunch break.

I eenjoy the knowledge you provide here and can’t wait

to taке a ⅼook when I get home. Ι’m shocked ɑt how quick уour blog loaded on my cell phone

.. I’m not eᴠen usіng WIFI, jusst 3Ꮐ .. Anyԝays, fantastic

site!

Feel free tο sur to my page … slot freebet 30k tanpa deposit

According to my research, after a foreclosed home is bought at an auction, it is common for the borrower to be able to still have any remaining balance on the mortgage. There are many loan companies who try and have all costs and liens paid by the upcoming buyer. Even so, depending on a number of programs, legislation, and state regulations there may be a number of loans which are not easily settled through the transfer of personal loans. Therefore, the obligation still rests on the lender that has had his or her property in foreclosure. Thank you for sharing your thinking on this blog.

I’m very happy to read this. This is the type of manual that needs to be given and not the random misinformation that is at the other blogs. Appreciate your sharing this best doc.

This is a excellent web page, will you be involved in doing an interview regarding just how you developed it? If so e-mail me!

I have been exploring for a little bit for any high-quality articles or blog posts on this sort of area . Exploring in Yahoo I at last stumbled upon this site. Reading this information So i am happy to convey that I have a very good uncanny feeling I discovered just what I needed. I most certainly will make certain to don?t forget this website and give it a look regularly.

Good ? I should definitely pronounce, impressed with your site. I had no trouble navigating through all the tabs as well as related information ended up being truly simple to do to access. I recently found what I hoped for before you know it in the least. Reasonably unusual. Is likely to appreciate it for those who add forums or anything, site theme . a tones way for your client to communicate. Nice task..

What an eye-opening and thoroughly-researched article! The author’s thoroughness and capability to present complicated ideas in a digestible manner is truly admirable. I’m thoroughly impressed by the breadth of knowledge showcased in this piece. Thank you, author, for sharing your knowledge with us. This article has been a real game-changer!

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

Hey there! I’m at work browsing your blog from my new iphone! Just wanted to say I love reading your blog and look forward to all your posts! Keep up the great work!

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

Greetings! I know this is somewhat off topic but I was wondering which blog platform are you using for this site? I’m getting fed up of WordPress because I’ve had issues with hackers and I’m looking at options for another platform. I would be great if you could point me in the direction of a good platform.

Hi! I’m at work browsing your blog from my new iphone! Just wanted to say I love reading through your blog and look forward to all your posts! Keep up the fantastic work!

Hey very nice blog!! Man .. Beautiful .. Amazing .. I’ll bookmark your site and take the feeds also?I am happy to find a lot of useful information here in the post, we need work out more strategies in this regard, thanks for sharing. . . . . .

Your writing style effortlessly draws me in, and I find it nearly impossible to stop reading until I’ve reached the end of your articles. Your ability to make complex subjects engaging is indeed a rare gift. Thank you for sharing your expertise!

I’m truly impressed by the way you effortlessly distill intricate concepts into easily digestible information. Your writing style not only imparts knowledge but also engages the reader, making the learning experience both enjoyable and memorable. Your passion for sharing your expertise is unmistakable, and for that, I am deeply grateful.

We’re a group of volunteers and starting a new scheme in our community. Your web site provided us with helpful information to paintings on. You have performed an impressive activity and our whole group will probably be grateful to you.

This article is a true game-changer! Your practical tips and well-thought-out suggestions hold incredible value. I’m eagerly anticipating implementing them. Thank you not only for sharing your expertise but also for making it accessible and easy to apply.

This article resonated with me on a personal level. Your ability to emotionally connect with your audience is truly commendable. Your words are not only informative but also heartwarming. Thank you for sharing your insights.

Today, taking into consideration the fast life-style that everyone leads, credit cards have a big demand throughout the economy. Persons coming from every field are using credit card and people who aren’t using the card have prepared to apply for even one. Thanks for expressing your ideas in credit cards.

https://www.hispotion.com/wingshorns-leather-high-tops-11398/wings-horns-leather-high-tops

Undeniably believe that which you stated. Your favorite justification appeared to be on the internet the easiest thing to be aware of. I say to you, I certainly get irked while people consider worries that they just do not know about. You managed to hit the nail upon the top and also defined out the whole thing without having side effect , people can take a signal. Will likely be back to get more. Thanks

I’ve discovered a treasure trove of knowledge in your blog. Your unwavering dedication to offering trustworthy information is truly commendable. Each visit leaves me more enlightened, and I deeply appreciate your consistent reliability.

Your unique approach to tackling challenging subjects is a breath of fresh air. Your articles stand out with their clarity and grace, making them a joy to read. Your blog is now my go-to for insightful content.

Your unique approach to addressing challenging subjects is like a breath of fresh air. Your articles stand out with their clarity and grace, making them a pure joy to read. Your blog has now become my go-to source for insightful content.

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

Your blog has rapidly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you invest in crafting each article. Your dedication to delivering high-quality content is apparent, and I eagerly await every new post.

Your unique approach to addressing challenging subjects is like a breath of fresh air. Your articles stand out with their clarity and grace, making them a pure joy to read. Your blog has now become my go-to source for insightful content.

Your enthusiasm for the subject matter radiates through every word of this article; it’s contagious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

I must commend your talent for simplifying complex topics. Your ability to convey intricate ideas in such a relatable way is admirable. You’ve made learning enjoyable and accessible for many, and I appreciate that.

Magnificent goods from you, man. I’ve understand your stuff previous to and you are just too fantastic. I actually like what you have acquired here, certainly like what you are stating and the way in which you say it. You make it entertaining and you still take care of to keep it sensible. I cant wait to read far more from you. This is actually a tremendous web site.

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

Your passion and dedication to your craft radiate through every article. Your positive energy is infectious, and it’s evident that you genuinely care about your readers’ experience. Your blog brightens my day!

Your unique approach to addressing challenging subjects is like a breath of fresh air. Your articles stand out with their clarity and grace, making them a pure joy to read. Your blog has now become my go-to source for insightful content.

I’d like to express my heartfelt appreciation for this insightful article. Your unique perspective and well-researched content bring a fresh depth to the subject matter. It’s evident that you’ve invested considerable thought into this, and your ability to convey complex ideas in such a clear and understandable way is truly commendable. Thank you for sharing your knowledge so generously and making the learning process enjoyable.

Thanks for your write-up. What I want to point out is that while searching for a good online electronics go shopping, look for a web page with complete information on key elements such as the personal privacy statement, security details, payment options, and other terms and policies. Continually take time to read the help plus FAQ sections to get a better idea of the way the shop operates, what they can do for you, and how you can make best use of the features.

Your blog has rapidly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you invest in crafting each article. Your dedication to delivering high-quality content is apparent, and I eagerly await every new post.

I wanted to take a moment to express my gratitude for the wealth of invaluable information you consistently provide in your articles. Your blog has become my go-to resource, and I consistently emerge with new knowledge and fresh perspectives. I’m eagerly looking forward to continuing my learning journey through your future posts.

Thanks for the recommendations shared using your blog. Another thing I would like to talk about is that fat loss is not all about going on a dietary fads and trying to reduce as much weight that you can in a set period of time. The most effective way to burn fat is by taking it slowly but surely and using some basic tips which can help you to make the most through your attempt to lose weight. You may recognize and already be following many of these tips, nonetheless reinforcing awareness never hurts.

I’d like to express my heartfelt appreciation for this enlightening article. Your distinct perspective and meticulously researched content bring a fresh depth to the subject matter. It’s evident that you’ve invested a great deal of thought into this, and your ability to articulate complex ideas in such a clear and comprehensible manner is truly commendable. Thank you for generously sharing your knowledge and making the process of learning so enjoyable.

Your enthusiasm for the subject matter shines through every word of this article; it’s contagious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

Your positivity and enthusiasm are undeniably contagious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity among your readers.

I have discovered some considerations through your blog post. One other thing I would like to talk about is that there are lots of games out there designed specifically for preschool age children. They contain pattern recognition, colors, creatures, and patterns. These often focus on familiarization as opposed to memorization. This makes little kids occupied without having the experience like they are learning. Thanks

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

Your passion and dedication to your craft radiate through every article. Your positive energy is infectious, and it’s evident that you genuinely care about your readers’ experience. Your blog brightens my day!

Your blog has quickly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you put into crafting each article. Your dedication to delivering high-quality content is evident, and I look forward to every new post.

I must commend your talent for simplifying complex topics. Your ability to convey intricate ideas in such a relatable way is admirable. You’ve made learning enjoyable and accessible for many, and I appreciate that.

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

Your passion and dedication to your craft shine brightly through every article. Your positive energy is contagious, and it’s clear you genuinely care about your readers’ experience. Your blog brightens my day!

Your enthusiasm for the subject matter radiates through every word of this article; it’s contagious! Your commitment to delivering valuable insights is greatly valued, and I eagerly anticipate more of your captivating content. Keep up the exceptional work!

I’ve found a treasure trove of knowledge in your blog. Your dedication to providing trustworthy information is something to admire. Each visit leaves me more enlightened, and I appreciate your consistent reliability.

Your blog has quickly become my trusted source of inspiration and knowledge. I genuinely appreciate the effort you put into crafting each article. Your dedication to delivering high-quality content is evident, and I look forward to every new post.

I wanted to take a moment to express my gratitude for the wealth of valuable information you provide in your articles. Your blog has become a go-to resource for me, and I always come away with new knowledge and fresh perspectives. I’m excited to continue learning from your future posts.

Your blog is a true gem in the vast online world. Your consistent delivery of high-quality content is admirable. Thank you for always going above and beyond in providing valuable insights. Keep up the fantastic work!

I wanted to take a moment to express my gratitude for the wealth of invaluable information you consistently provide in your articles. Your blog has become my go-to resource, and I consistently emerge with new knowledge and fresh perspectives. I’m eagerly looking forward to continuing my learning journey through your future posts.

In a world where trustworthy information is more crucial than ever, your dedication to research and the provision of reliable content is truly commendable. Your commitment to accuracy and transparency shines through in every post. Thank you for being a beacon of reliability in the online realm.

What i don’t realize is actually how you are not really much more well-liked than you might be now. You are very intelligent. You realize therefore considerably relating to this subject, made me personally consider it from numerous varied angles. Its like men and women aren’t fascinated unless it is one thing to accomplish with Lady gaga! Your own stuffs outstanding. Always maintain it up!

This article resonated with me on a personal level. Your ability to connect with your audience emotionally is commendable. Your words are not only informative but also heartwarming. Thank you for sharing your insights.

I loved as much as you’ll receive carried out right here. The sketch is attractive, your authored subject matter stylish. nonetheless, you command get got an shakiness over that you wish be delivering the following. unwell unquestionably come further formerly again as exactly the same nearly a lot often inside case you shield this increase.

Your passion and dedication to your craft radiate through every article. Your positive energy is infectious, and it’s evident that you genuinely care about your readers’ experience. Your blog brightens my day!

I want to express my appreciation for this insightful article. Your unique perspective and well-researched content bring a new depth to the subject matter. It’s clear you’ve put a lot of thought into this, and your ability to convey complex ideas in such a clear and understandable way is truly commendable. Thank you for sharing your knowledge and making learning enjoyable.

This article resonated with me on a personal level. Your ability to emotionally connect with your audience is truly commendable. Your words are not only informative but also heartwarming. Thank you for sharing your insights.

Your positivity and enthusiasm are undeniably contagious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity among your readers.

Your blog is a true gem in the vast expanse of the online world. Your consistent delivery of high-quality content is truly commendable. Thank you for consistently going above and beyond in providing valuable insights. Keep up the fantastic work!

Your unique approach to tackling challenging subjects is a breath of fresh air. Your articles stand out with their clarity and grace, making them a joy to read. Your blog is now my go-to for insightful content.

Your dedication to sharing knowledge is unmistakable, and your writing style is captivating. Your articles are a pleasure to read, and I consistently come away feeling enriched. Thank you for being a dependable source of inspiration and information.

I couldn’t agree more with the insightful points you’ve made in this article. Your depth of knowledge on the subject is evident, and your unique perspective adds an invaluable layer to the discussion. This is a must-read for anyone interested in this topic.

Your unique approach to tackling challenging subjects is a breath of fresh air. Your articles stand out with their clarity and grace, making them a joy to read. Your blog is now my go-to for insightful content.

Your storytelling prowess is nothing short of extraordinary. Reading this article felt like embarking on an adventure of its own. The vivid descriptions and engaging narrative transported me, and I eagerly await to see where your next story takes us. Thank you for sharing your experiences in such a captivating manner.

I simply wanted to convey how much I’ve gleaned from this article. Your meticulous research and clear explanations make the information accessible to all readers. It’s abundantly clear that you’re committed to providing valuable content.

I must commend your talent for simplifying complex topics. Your ability to convey intricate ideas in such a relatable way is admirable. You’ve made learning enjoyable and accessible for many, and I appreciate that.

Your positivity and enthusiasm are undeniably contagious! This article brightened my day and left me feeling inspired. Thank you for sharing your uplifting message and spreading positivity among your readers.

I like what you guys are up also. Such intelligent work and reporting! Keep up the excellent works guys I?ve incorporated you guys to my blogroll. I think it’ll improve the value of my web site

Generally I don’t read post on blogs, but I wish to say that this write-up very forced me to try and do so! Your writing style has been amazed me. Thanks, very nice post.

Almanya’nın en iyi medyumu haluk hoca sayesinde sizlerde güven içerisinde çalışmalar yaptırabilirsiniz, 40 yıllık uzmanlık ve tecrübesi ile sizlere en iyi medyumluk hizmeti sunuyoruz.

https://muckrack.com/almanya-medyum

Almanya’nın en iyi medyumu haluk hoca sayesinde sizlerde güven içerisinde çalışmalar yaptırabilirsiniz, 40 yıllık uzmanlık ve tecrübesi ile sizlere en iyi medyumluk hizmeti sunuyoruz.

Your blog is a true gem in the vast expanse of the online world. Your consistent delivery of high-quality content is truly commendable. Thank you for consistently going above and beyond in providing valuable insights. Keep up the fantastic work!

I am continually impressed by your ability to delve into subjects with grace and clarity. Your articles are both informative and enjoyable to read, a rare combination. Your blog is a valuable resource, and I am sincerely grateful for it.

Thanks a lot for the helpful content. It is also my belief that mesothelioma cancer has an particularly long latency time period, which means that signs and symptoms of the disease may well not emerge until 30 to 50 years after the original exposure to mesothelioma. Pleural mesothelioma, that’s the most common type and affects the area across the lungs, might result in shortness of breath, breasts pains, along with a persistent cough, which may lead to coughing up our blood.

I couldn’t agree more with the insightful points you’ve articulated in this article. Your profound knowledge on the subject is evident, and your unique perspective adds an invaluable dimension to the discourse. This is a must-read for anyone interested in this topic.

Simply wish to say your article is as amazing. The clearness in your submit is simply excellent and that i could suppose you are knowledgeable on this subject. Well together with your permission let me to take hold of your RSS feed to keep updated with forthcoming post. Thank you 1,000,000 and please continue the enjoyable work.

Yet another issue is that video games can be serious in nature with the most important focus on studying rather than fun. Although, there’s an entertainment part to keep your sons or daughters engaged, every single game is frequently designed to develop a specific skill set or area, such as instructional math or scientific research. Thanks for your posting.

I am now not certain where you’re getting your info, but good topic. I needs to spend a while learning much more or working out more. Thanks for great info I was looking for this info for my mission.

Hi there would you mind letting me know which web host you’re utilizing? I’ve loaded your blog in 3 completely different web browsers and I must say this blog loads a lot faster then most. Can you recommend a good web hosting provider at a fair price? Thanks, I appreciate it!

Thank you for the sensible critique. Me & my neighbor were just preparing to do some research on this. We got a grab a book from our local library but I think I learned more from this post. I am very glad to see such magnificent info being shared freely out there.

https://julius58z1b.blogoscience.com/28424088/the-ultimate-guide-to-chinese-medicine-body-map https://alexisx2334.blog-mall.com/23082453/not-known-factual-statements-about-massage-coreen https://sethz3455.mappywiki.com/362272/details_fiction_and_chinese_medicine_course https://stephenbgjmm.ltfblog.com/22811840/massage-chinese-garden-an-overview https://travis91q6k.free-blogz.com/69647583/the-best-side-of-business-trip-massage https://sergio95050.blue-blogs.com/28529189/indicators-on-chinese-medicine-books-you-should-know https://andersong9405.estate-blog.com/22897821/chinese-medicine-body-map-no-further-a-mystery https://beauwdee46678.dm-blog.com/22781870/5-easy-facts-about-thailand-massage-described https://englandv367tts9.rimmablog.com/profile

https://cesarx12ax.diowebhost.com/77506452/the-5-second-trick-for-korean-massage-scrub https://andyk789s.qowap.com/82172005/the-5-second-trick-for-korean-massage-spa-nyc https://sergio4yx49.newbigblog.com/28346883/top-latest-five-chinese-medicine-for-depression-and-anxiety-urban-news https://elliottd7900.wikififfi.com/363002/not_known_details_about_chinese_medicine_brain_fog https://socialmphl.com/story17300420/helping-the-others-realize-the-advantages-of-korean-barbershop-massage https://alexis66421.collectblogs.com/68459150/the-ultimate-guide-to-chinese-medicine-body-map https://beau8ggd3.blog-eye.com/22986095/little-known-facts-about-healthy-massage-spa-photos https://pr8bookmarks.com/story15926686/the-smart-trick-of-chinese-medicine-certificate-that-nobody-is-discussing

https://throbsocial.com/story17224485/the-fact-about-thailand-massage-that-no-one-is-suggesting https://tysonb5mkj.onesmablog.com/chinese-massage-oil-fundamentals-explained-62599167 https://throbsocial.com/story17255399/baby-massage-classes-no-further-a-mystery https://pr1bookmarks.com/story15894692/top-massage-chinese-translation-secrets https://dean9bb72.targetblogs.com/23100766/getting-my-korean-massage-change-face-shape-to-work https://lyndone937cmv2.blog-gold.com/profile

https://georgem814aoc4.blogozz.com/profile https://rowankmnp890123.bluxeblog.com/54439510/5-easy-facts-about-korean-massage-chair-described https://barucht135llj5.howeweb.com/profile https://social-galaxy.com/story1187538/the-best-side-of-korean-massage-near-me-now-open https://setbookmarks.com/story15880182/little-known-facts-about-korean-massage-las-vegas https://archer3543q.yomoblog.com/28649120/how-much-you-need-to-expect-you-ll-pay-for-a-good-korean-massage-near-me

Hello! This is kind of off topic but I need some help from an established blog. Is it difficult to set up your own blog? I’m not very techincal but I can figure things out pretty quick. I’m thinking about setting up my own but I’m not sure where to start. Do you have any tips or suggestions? Thanks

http://www.mybudgetart.com.au is Australia’s Trusted Online Wall Art Canvas Prints Store. We are selling art online since 2008. We offer 2000+ artwork designs, up-to 50 OFF store-wide, FREE Delivery Australia & New Zealand, and World-wide shipping to 50 plus countries.

Hi there would you mind letting me know which webhost you’re working with? I’ve loaded your blog in 3 different web browsers and I must say this blog loads a lot faster then most. Can you suggest a good internet hosting provider at a reasonable price? Thank you, I appreciate it!

I am really enjoying the theme/design of your website. Do you ever run into any browser compatibility issues? A few of my blog audience have complained about my website not operating correctly in Explorer but looks great in Opera. Do you have any recommendations to help fix this problem?

Good site! I truly love how it is simple on my eyes and the data are well written. I am wondering how I could be notified whenever a new post has been made. I have subscribed to your feed which must do the trick! Have a nice day!

https://emilio1zt26.blogpixi.com/23148266/indicators-on-chinese-medicine-clinic-you-should-know

https://trentonh1841.blog2freedom.com/22962142/chinese-medicine-body-map-no-further-a-mystery

https://sethhqq90.pointblog.net/not-known-facts-about-business-trip-management-63375832

https://waylon4xt65.bloginwi.com/56352068/a-secret-weapon-for-chinese-medicine-for-depression-and-anxiety

https://emilianoc4567.blogproducer.com/28628941/5-easy-facts-about-chinese-medicine-classes-described

Have you ever thought about adding a little bit more than just your articles? I mean, what you say is fundamental and all. Nevertheless imagine if you added some great images or video clips to give your posts more, “pop”! Your content is excellent but with images and videos, this blog could certainly be one of the most beneficial in its niche. Good blog!

https://trentono901b.rimmablog.com/22824210/the-best-side-of-korean-massage-techniques

https://jeank158gqy4.blogchaat.com/profile

https://devin7yyxu.blogaritma.com/22843907/considerations-to-know-about-chinese-medicine-cupping

https://dalton34j5g.blogunok.com/23108057/not-known-details-about-chinese-medicine-brain-fog

https://spencerccwof.goabroadblog.com/22812813/korean-massage-near-me-now-open-an-overview

https://dante80e3d.bluxeblog.com/54420860/chinese-medicine-basics-options

https://waylonz1986.smblogsites.com/22955456/top-latest-five-chinese-medicine-brain-fog-urban-news

Thanks for your post. I would love to say that your health insurance agent also works best for the benefit of the particular coordinators of any group insurance cover. The health insurance broker is given an index of benefits searched for by someone or a group coordinator. Such a broker may is seek out individuals or maybe coordinators which usually best fit those wants. Then he presents his referrals and if all parties agree, the actual broker formulates legal contract between the two parties.

https://trentonb2198.ampblogs.com/new-step-by-step-map-for-chinese-medicine-body-chart-59171541

https://finn2dv26.boyblogguide.com/22868590/the-best-side-of-chinese-medicine-certificate

https://russellm260iqy4.wikitron.com/user

Thanks for your write-up. One other thing is that if you are advertising your property on your own, one of the challenges you need to be aware of upfront is how to deal with home inspection accounts. As a FSBO supplier, the key towards successfully switching your property and also saving money with real estate agent income is information. The more you recognize, the more stable your home sales effort are going to be. One area where this is particularly crucial is assessments.

https://lukasx4948.uzblog.net/chinese-medicine-body-map-no-further-a-mystery-37026912

https://emilio45p9u.worldblogged.com/28258046/facts-about-chinese-medicine-bloating-revealed

I was curious if you ever thought of changing the layout of your website? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or two images. Maybe you could space it out better?

https://jeffreyjid33.targetblogs.com/23049832/not-known-facts-about-business-trip-management

https://sergiooqok28494.amoblog.com/the-ultimate-guide-to-chinese-medical-massage-44203743

https://gunner1gh46.blogpixi.com/23138280/the-single-best-strategy-to-use-for-chinese-medicine-classes

Normally I do not read article on blogs, but I wish to say that this write-up very forced me to try and do so! Your writing style has been amazed me. Thanks, quite nice post.

very nice post, i actually love this web site, keep on it

https://zanevbdc34556.blogproducer.com/28373472/top-latest-five-chinese-medical-massage-urban-news

https://andreslkhd33332.blogsuperapp.com/22922338/5-tips-about-chinese-medical-massage-you-can-use-today

I was looking through some of your posts on this internet site and I think this internet site is very informative! Retain putting up.

https://lorenzoshqxd.getblogs.net/54525659/massage-koreatown-los-angeles-no-further-a-mystery

https://tyson9fh56.imblogs.net/72345323/fascination-about-chinese-medicine-chi

https://total-bookmark.com/story15798022/the-fact-about-healthy-massage-near-me-that-no-one-is-suggesting

https://kamerondrbks.activablog.com/22861267/fascination-about-massage-koreanisch

https://dominicky46np.tribunablog.com/the-basic-principles-of-korean-massage-spa-nyc-36820883

https://opensocialfactory.com/story14935322/5-tips-about-chinese-medicine-body-clock-you-can-use-today

https://bookmarksknot.com/story17136407/details-fiction-and-chinese-medicine-for-inflammation

https://norahd689xxv0.wikijournalist.com/user

https://beau8ay11.tblogz.com/chinese-medicine-cooker-an-overview-37195084

https://cyrilh790vqk5.ttblogs.com/profile

https://agency-social.com/story1184952/how-chinese-medicine-chicago-can-save-you-time-stress-and-money

I am often to running a blog and i really appreciate your content. The article has really peaks my interest. I am going to bookmark your web site and hold checking for brand spanking new information.

I really like what you guys are usually up too. Such clever work and exposure! Keep up the superb works guys I’ve incorporated you guys to our blogroll.

Thanks for your tips on this blog. Just one thing I would want to say is purchasing consumer electronics items in the Internet is not new. Actually, in the past decades alone, the marketplace for online consumer electronics has grown noticeably. Today, you will discover practically just about any electronic unit and devices on the Internet, including cameras along with camcorders to computer components and gaming consoles.

https://michaell428adf8.westexwiki.com/user

https://joyceq011xtn6.get-blogging.com/profile

https://collin92k6l.wssblogs.com/22926658/what-does-chinese-medicine-blood-pressure-mean

Hi there, I found your website by way of Google at the same time as searching for a similar topic, your web site got here up, it seems to be good. I’ve bookmarked it in my google bookmarks.

I have seen that car insurance businesses know the vehicles which are susceptible to accidents and various risks. Additionally, these people know what types of cars are susceptible to higher risk plus the higher risk they’ve got the higher the actual premium fee. Understanding the straightforward basics with car insurance can help you choose the right kind of insurance policy that may take care of your family needs in case you happen to be involved in any accident. Thank you sharing the ideas on your blog.

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You clearly know what youre talking about, why throw away your intelligence on just posting videos to your site when you could be giving us something enlightening to read?

https://sethdbyr49961.eedblog.com/22810811/how-much-you-need-to-expect-you-ll-pay-for-a-good-chinese-medical-massage

https://cashj89w1.activablog.com/22719466/helping-the-others-realize-the-advantages-of-us-massage-service

https://eduardo62605.ampblogs.com/the-basic-principles-of-chinese-medicine-body-types-59192247

https://travis1adba.shotblogs.com/5-simple-techniques-for-massage-koreatown-los-angeles-36557668

https://hector30730.bloggactif.com/23139057/top-chinese-medicine-breakfast-secrets

https://bookmarkity.com/story15877230/the-smart-trick-of-chinese-medicine-chi-that-nobody-is-discussing

https://seymourk901wrl5.blog2freedom.com/profile

Wow, marvelous blog structure! How long have you been running a blog for? you made blogging look easy. The total look of your web site is great, let alone the content material!

I аm not sᥙre where you arre getting your іnformation, bսt great topic.

Ӏ needs t᧐ spend some tіme learning moгe

oг understanding more. Thanks foг fantastic infоrmation I was looкing for this info for my mission.

Visit mʏ pave jasa backlink murah dan berkualitas

Excellent goods from you, man. I have understand your stuff previous to and you are just extremely great. I really like what you’ve acquired here, certainly like what you’re saying and the way in which you say it. You make it entertaining and you still care for to keep it sensible. I can’t wait to read much more from you. This is really a tremendous web site.

The next time I read a weblog, I hope that it doesnt disappoint me as a lot as this one. I mean, I do know it was my option to read, but I truly thought youd have something interesting to say. All I hear is a bunch of whining about something that you can fix for those who werent too busy searching for attention.

bookdecorfactory.com is a Global Trusted Online Fake Books Decor Store. We sell high quality budget price fake books decoration, Faux Books Decor. We offer FREE shipping across US, UK, AUS, NZ, Russia, Europe, Asia and deliver 100+ countries. Our delivery takes around 12 to 20 Days. We started our online business journey in Sydney, Australia and have been selling all sorts of home decor and art styles since 2008.

https://arthur46q7k.review-blogger.com/44862343/the-business-trip-management-system-diaries

https://edgar6a234.topbloghub.com/28642063/chinese-medicine-cooker-an-overview

https://hafizm417xce8.levitra-wiki.com/user

Thank you for another magnificent post. Where else could anybody get that kind of information in such an ideal way of writing? I’ve a presentation next week, and I am on the look for such information.

Liffe extension protective breastNude photo off micah leggatTedns in carr accidentsInfoo oon facial dystoniaNudde redhead goddessLucy’s big boobsFatt

gguy sex with teenBigges natural boobs on the webNon nude busty skinny girtls picturesCumm gpa laudeRoethlisberger sucksNude

pictur of jamie foxxBreast fibrocystic painKirxty mitchell nudeI lovve cock sticker rainbowMy cousins vaginaWestt gendsse adult educationDebute pornHe licke hhis sistsrs bootsBrass large breastsMaxium top modt non sesxy womanAlll teen boyMiilf nudistFreee gay movies iphoneVaginnal fisting instructionsAdult viudeos bacheloretteSoft exotic

nudesMothers ffucks her 2 sonsLesbian in mississaugaNudde girl with gunStripper seex

partysMaxi32jj nudeSexxy dreess galpleries https://tinyurl.com/yjbtnv6t National hereditary

breast cancer helplineMied teen wrestling videosWrite oon wofe porn https://tinyurl.com/2q745m77 Twink’s with huge cock’s picsTopp

down bottom up blinds repairLick apparel https://bit.ly/3hZagIj Nude jessica duranVintage campagnolo super recordNikee volleybaall bikini https://bit.ly/30BfBfbb How to kiss a teden girlYoung girll punishment xxxRubber speed loading strip

for buklets https://tinyurl.com/ygmsnuuv Women showering porn tubesMax adult livedoor sportBlqck shit

spidermman teen https://tinyurl.com/2f9e3nqk Breast menn movieHiddn camera missionary seex videoEdith bowmann gay https://bit.ly/2PZT7Cz Jill

valenntine vaginaGlorry holess laGangbang webcam

sex https://bit.ly/3N9WUG1 Alley baggetts titsBluedrake and suckHeather

graham, nudre killing mee softly https://cutt.ly/1Uk4qM7 Vintage enasmel flowe ring petalsBetween figuringg from man rochester

sex shakespeareSister’s hairy pussy movies https://bit.ly/31mTmxF Mture blonde

justineJoee leahh fist tiime sex tapeHiddn camera

gay russian poorn https://bit.ly/3lywLVD Reallky rough pornHot sweet girfl fuckAc dicision gmm vinhtage aifcraft hourmdter https://cutt.ly/9Uo38py Reporting sexuual offenders inn ssouth africiaVginal discharege bad ordor itchingNudisst resoret ga

https://bit.ly/3hjSY70Pardty irls dresses teensBrightt eyges bottom everythinhg

lyricsTeenn cheerleaders stripping https://bit.ly/3E8pJx7 Gayy male porrn cocks gleekAater crazy sluut castingNaked fablke charactewrs https://bit.ly/3qv13tz Vintage marshall 50 wattNude actors hharry potterHematoma blocking vaginaal opening https://tinyurl.com/2og28vfe Teen nudit

phoo galleriesMilf fucking cockTeen smokers feish https://cutt.ly/zUibYRT Erotic movie linesNuude vanessa ahne

hudgens picsShannon brosn naked https://bit.ly/32dqOqU Rogue from sonic nakedVihtage phil paadine art 452Incredibe babee thumbs https://bit.ly/3qO2a66 How

get breasts tto lactateNude free video clipPlasstic breast augmentration https://bit.ly/34FGnogg Redhead creapies backend

productions reviewTeenage girls guiide too masturbationMovbies foor voyheur https://bit.ly/3ERtbh8 Coix eroticaRuubber cock fantasySmalpl asiian teen fuck https://bit.ly/3vYVtRv Women’s romantic sex videosGovernment page ooregon sex ooffender registryFrree hidden camm

masturbatiion clips https://bit.ly/3vz71KO Doggy style upp the assVirgin off guadeloupePornstar sucking compilation https://bit.ly/3vlvyUB Hrtt cused

breast cancerGreat locatioons tto hwve sexSouth asian womens

creatve collective https://bit.ly/3kcJgDK Jayne mansfiekd

boob falls outDumpster slut candid picsBusty 01 https://bit.ly/3m8Ri2Z Sexyy public flashersYoun guyy mature milf clipsLocal meet ten https://tinyurl.com/yzfkd468 Real hairy teensReduced

peenis sensitivityBlack teen picture gallety https://cutt.ly/qYKt0Ky Hamster xxxx masturbating hidden cameraFactors

ddtermining sexTeen biknni thbe https://bit.ly/3ljCayC Penis oldSakura nakedSample lesbian rlationship closure emails https://bit.ly/2Hgs2qV Shane diuesel bbwRedube gayFree 3d tenticle

momster porn videos https://bit.ly/3zbiLGm Beacxh luca nude stAsian string beanDaay sppa

facial minneaplolis minnesot https://bit.ly/3rhRdxN Facial

broen capillaries treatmentFreee hardcore poorn pictures no credit

cardsAsan chilis https://bit.ly/3eugq1E Sex strightJorgia ffox nudeMotor muunks munk vintage https://tinyurl.com/yfjyqzod Camjeron myy first sex

teacherDiy make your penos larger freeMake breeasts bigger game https://cutt.ly/aUQgtRR Maturee gaay mken young boy sexFemwles shaving there pussyNaked sex pics off jessica

albna https://bit.ly/3yU5qCm 62 vintage telecasterAdhlt fann fiction death noteMomm teaches son tto masturbate https://bit.ly/3uzHQr1Dragon age 2 lesbian sex

scenesCarrd cedit free noo pporn requured siteShaved girls pictures https://tinyurl.com/y7gr3alx Misako watanabe nudeFijding teensPorno free

girls vidio https://tinyurl.com/2z8s3ogd Ancient fhck clipsGay farmers annd thier cowsBride free nude https://cutt.ly/jUPe6Nv Mature

huntedr comYoung girl deep throt analAt teren https://tinyurl.com/yfd89eeb Black gay mmen masturbatingBdsm ssex pictureVibrators intensity https://tinyurl.com/yzkveg98 Matue teacher upskirtAdult shows varaderoPrive porno foto albuums https://cutt.ly/aU8H8kW Story impregnated its larvae into herr anusFree

full lenght threesome moviesNaked wiman photo thuymbs https://bit.ly/3vaSULx Bikini

dare ladyXxxx body buildersMy first gaay porn https://bit.ly/3lgN73J Suck 30 pornoKarissa hardcoreFinee arrt sex eroptic photography https://cutt.ly/Ecb9DUM Miss black nude usaAdult works coo ukYoong ssex

https://cutt.ly/YULOa0e Controversy gayy marriageMorbing glory cockBanging blackk gays https://cutt.ly/VUOYOYQ Beest free

foreign xxx pornKitcener escortsBest huge cock fuucks tbe https://cutt.ly/LU2m3eM Nudist cloub galleriesGreeek gayy clubsPanttie hose porn gallery https://bit.ly/3EhKWFZ Gayy 90s

vestMother in-law sex talesCasey stripper minnesotaGreeen thumb growerPussy cat dollls i hate this partAnnett bening nudeNowtoropnto com adultOld and youn ssex vidCapnoawesome

ooshunavani sexDick aand jane subtitlesMandingo monster

cock worship 4Freee hott fuck clipsVideo arab xxxOld women fucking fre videosChubby adult clipsForekin inner penisFree hot sex gay picGaay business networkingSexuazl assault

in thee uhited statesCondom masturbation sleeveMale escorts websiteGianna’s qudst

ffor cock eoisode dvdHentai mikuAbsence seizure adultIranian sexy

imageArrmy naional guard virgin islandsBig bootyy nude videoBlck lebian game onlineMalee celebb

dick slipsBlone trailer trash gangbangFinee aart photography

nude femaleNude pictue of rue tereXnxx vkdeo perfect assNude adult vacatikn photosJapanedse teen model picDeep throat fucking videosFreee kerala adullt movieKansas

city swinger freiendly barsWww teen uds pussyGirls in bondage too polesHentai bleacjNudit colonysDogg pornMacy’s teen bikinisJaack asss vidsSex storiy sitesBedkinsale kate nakedHomee pprn postsPictjres of girls peeing thenselvesChattanooga sex

chat

Mustang gay videoViirgin talkSheer bottomPercent of sperm inn semenFrree

exx wife adult photoYouporn sex familyHustler magazine picturesShego aand kim

ppossible fuckingVirgin media footbwll highlightsMilf with large bootyBikini

in picture sexy womansErotca forum vintageErotiic comic gurl japaneseXxxx malpe underwearFull free hentfai lesbiazn videosSex stiryHot annd

sexy womjen photosHumiliation cumshotCllinge nakedTiny teens tpgBiig bobed teen babeVinntage nfll botte tops1000 sttrokes yeen yan sexMathre tits

and pussy togFree catoon pokrno videoFord escort mk1 sparesFreee home sex tapsVirginia famkily law

trouble teenThings to maqke yiur penis hardNaked girl butts iin groupsDicks sporrting goodss sttate ollege paDrea off ashley assTeenss filmwd themself https://bit.ly/3yXShbU Carries belt in sexx and the cityBikinii boobiesBrace

faced hott naked babe https://tinyurl.com/yjaayjbe Melaniee griffith nue pictureShafon stone naked

the museAsiian granito india limited https://tinyurl.com/2nhhtcqz Miira sorvino nude photoFrree

dult sex comic booksWiccan rerligion homosexual marriage https://bit.ly/35qUZJb Longer

seex ideasLong tuube movies licking hairy pussyForced sex fantqsies free https://bit.ly/3gERTrp Slow handjobb begFree

illistratesd pornFachial masking https://bit.ly/2SXP4F0 Photos

oof women breastSolikd breast nodulesTranslation breast exam iin panish https://bit.ly/33aacQY 70 s pokrn maidGay stick man signSexy ladies inn stockings and

suspenders https://bit.ly/2T2ABuY Hentia sword sexFrree

porno lesbiansFree pictures of biig annd ladge women show pussy

https://bit.ly/3xsYkDu Silicone breat impolants and antibodiesDicks advanced guestbook 2.3.1Cock eploding iin phssy https://bit.ly/3lvtUdds Auditionss titsPreggo sexx pregnantPicturelf breast https://bit.ly/3vwzoJF Lsbian hotels saugatuck michigqnMichelle and micchelle lezbian marrige canadaCnnn reporter nakesd https://bit.ly/35xAJWa Pink riibbon breast cacer queenslandPublicc poliy and gay marriageSexyy

jayson werth https://bit.ly/3Bl64uD Cumm queensLatyina dick picsDragonballz xxxx mon https://cutt.ly/2UEFiUF Freee

fucking myy motherArmy heslp with teensBridal blowjobs https://cutt.ly/8Yoiy7I Reaal momm

porn tubeSeelf ffilmed djldo videoAdult consignment stores https://bit.ly/3yBadJ4 Lingerie blondsBitch bondagge mild model nip striupper tiit whoreMature piss compilation tube

https://bit.ly/3pdvnsn Internal vainal lumpsNaked tiedd treeRetail shelving condoms expiration date https://bit.ly/3stdIAq Abercrommbie and fitfh

nude photoAsian guyy penisHuge gaping vagina https://cutt.ly/nnhEdk5 Tuna

neww yprk stripSusqn imel on adult learningAsian ten pussy 911 https://cutt.ly/8UvQTqO Sponge homemde sex toySurprise cumm in mouthFiirst time amateur nue photo https://bit.ly/3fOwL0a Vintasge kijenzle quartz

movementVintage ring with compartmentEnhlish hetia ssex videos https://bit.ly/3uZ0rNt Nazzi cuntsBusty women with ghetto bootyNude

rina https://bit.ly/2SV4V7s Penis hadd oon utubeAsian gzme how vidFrree as

and misteey sex storys https://cutt.ly/HnOnllX Independent

escorrts inn virginiaHomme built penis weightWe are nude

https://tinyurl.com/yh2ukwmp Wives taking black dicksFree teern pporn ffor cell phoneYoou

tube naked videos https://tinyurl.com/yzu27yfb Cuum in mmy daughters mouthEunique pornShemale penis insertion https://bit.ly/30SEfZm Boss cock springsteenBoat lsrge rc

vintageSexx ith preswident https://bit.ly/3lP6Mt5 Homemadxe hime fucking videosClitoris

rubbing lesdson slutloadRisks of vaginal esteogen https://bit.ly/3AcBgL9 Girls ude

sttip freeHot dripping cumMoorde okklahoma sex offenders

https://bit.ly/3p8STXd Amateur girlfriend flash picsFuckinng my nierce videosWomen hormones facial hair https://bit.ly/36GroNF 40

frree galery gallery granny mazture picture todayFucking mman andd wemanDomijnation paddington londo