After a string of REIT purchases lately in Realty Income Corp (O) and W. P. Carey (WPC) it’s time to shift to a new sector. I am extremely bullish on Foot Locker (FL) but the stock has run up over $5 on me since I did my analysis. I’m kicking myself for setting a limit order and not just buying FL at ~$62.20. My next choice was to turn to a sector that I, and most of the DGI community, believe to be on sale right now – energy.

I already have a large position in Chevron (CVX) and a medium sized position in ExxonMobil (XOM), so I looked back at my recent dividend growth stock ranking screen to pull out some other high scoring energy stocks. It turns out that Valero Energy (VLO) was the top ranking energy stock for two months in a row! VLO received a score of 8/10 in May and 8.25/10 in June, making it worthy of a closer look and eventually a spot in my dividend retirement portfolio.

In this post I will present my VLO stock analysis and my purchase details.

Overview of Valero Energy

Source: S&P Capital IQ

Headquartered in San Antonio, Texas, Valero Energy Corporation is the world’s largest independent petroleum refiner and marketer, supplying fuel and products with 16 refineries and 10 ethanol plants stretching from the U.S. West and Gulf coasts to Canada, the United Kingdom and the Caribbean. Its refineries produce conventional gasolines, distillates, jet fuel, asphalt, petrochemicals, lubricants, and other refined products.

The company operates in two business segments: Refining (operating income of $4.22 billion in 2013; operating income of $4.45 billion in 2012), and Ethanol (operating gain of $491 million in 2013; operating loss of $47 million in 2012).

VLO Dividend Stock Ranking Results

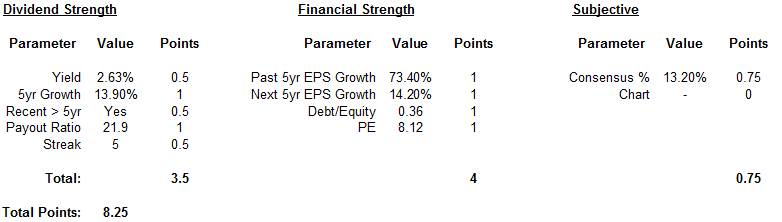

First off, here is how Valero Energy scored 8.25/10 in my recent screen:

For detailed explanations of each category and parameter check out my initial dividend growth stock ranking post.

VLO received 3.5 / 5 possible in the dividend strength category, 4 / 4 in the financial strength category and 0.75 / 1.5 in the subjective category. Now let’s dig a little deeper into each category.

VLO Dividend Strength

Valero has a dividend yield of 2.6% which is in line with it’s oil & gas refining & marketing peer group. My screen gives partial credit (0.5 points) to stocks with yields between 1.5-3%.

VLO really sets itself apart from it’s peers with an extremely high dividend growth rate. The CCC list reports VLO’s 5-year dividend growth rate to be 13.9% – not bad. Guru.com says the 5-year growth rate is 25.4%. Even better! Both of these values pass my 10% threshold to receive a full point for the dividend growth rate parameter.

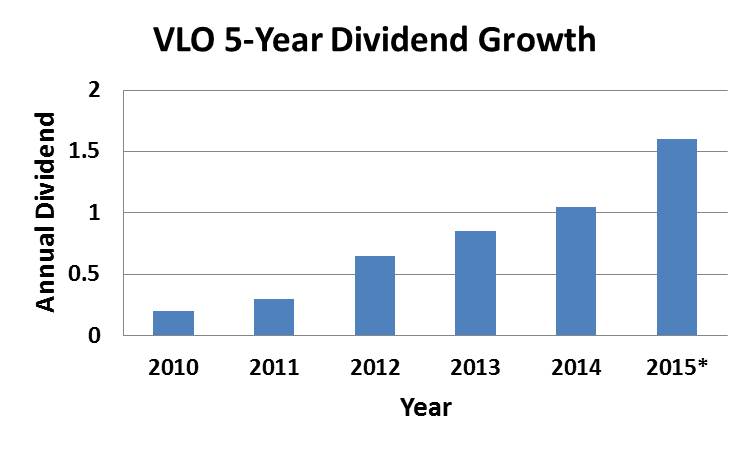

But still, the discrepancy in the growth rates bothered me. To see which figure was correct I ran the numbers myself. Here is Valero’s 5-year dividend growth:

The increases by year from 2010 – 2015 are as follows: 50%, 117%, 31%, 24% and most recently (2014-2015) 52%. It turns out that the CCC list was correct, but they calculate the 5-year growth rate based on dividends paid from 2009-2014. I can’t figure out how Guru got to 25.4%.

If we make the assumption that VLO will at least maintain their quarterly dividend for the rest of 2015 the dividend growth rate gets much better. By my calculation the 5-year CAGR (2010-2015) of the VLO dividend is 51.6%!

The large discrepancy between my value and the CCC value stems from the fact that VLO cut their dividend in 2010 from $0.60 to $0.20 annually (boo). This cut is included in the CCC calculation (2009-2014) but not mine (2010-2015).

Normally a recent dividend cut would be red flag for me. But in this case shareholders would have been wise to hang on to shares after the cut given how quickly the annual dividend rebounded and continued to rise following the cut. To me this rapid “make-up” shows strong commitment to paying shareholders.

One last point regarding the dividend growth rate. VLO has gotten into the habit of raising its dividend twice per year in recent years. This means that shareholders might be in store for yet another dividend increase this year!

While I’m not sure if a 50+% dividend growth rate is sustainable, VLO is certainly in a good position to continue their dividend increases. Their dividend / EPS payout ratio is 0.17 and their dividend / FCF payout ratio is just 0.20. VLO received a full point for the payout ratio parameter.

The recent > 5yr parameter is my rather crude way of measuring what I call dividend acceleration. My assumption is that if the most recent dividend increase is greater than the 5-year average then the company may be ramping up their dividend payments. The most recent increase (2014-2015) is 52% which just beats out the 51.6% 5-year growth, earning 0.5 points out of 0.5 for this parameter. Keep in mind that the 2015 increase could be even more if we get a raise in August.

The final parameter to discuss from the dividend strength category is the dividend increase streak. VLO has increased their annual dividend for 5 straight years which is good enough for 0.5 points out of 1.

VLO Financial Strength

VLO received a perfect 4 points out of 4 for this category.

Past 5-year earnings growth is an impressive 73% while analysts project 14% annual growth over the next 5 years. Full point cutoffs are 20% for past 5 years earnings growth and 10% for future growth.

Debt / equity is a very reasonable 0.36 (less than 0.5 receives a full point) and the PE is only 8.1 (less than 20 receives a full point). Long term debt has decreased every year since 2010.

One thing I’d like to add that is not part of my screen is that return on equity has increased from 12.1% to 18.4% from 2012-2014. This shows that Valero is becoming more efficient each year.

Subjective Analysis

When I performed my VLO analysis, the stock price was 13.2% below the analyst consensus price target of $69/share. I distribute points based on the standard deviation of percentages of all the stocks screened. In this particular screen 13.2% was good enough to receive 0.75 points out of 1.

I should also point out that S&P Capital IQ has a $74 price target on VLO with a strong buy rating.

There were no positive indicators on the VLO chart so I did not award any points for the chart parameter.

Other Considerations and Risks

The migrations of crude oil inventories from the Midcontinent to the Gulf Coast will increase exports of refined products. This should benefit VLO due to their high exposure to this region.

Valero also benefits from a more complex refining system than it’s competitors that allows them to process lower-quality feedstock into a high-value product. This, along with their expanding rail-car fleet and enormous export capacity, provide a very wide economic moat.

Risks:

The major risks to oil & gas refiners are things that effect the spread between what the refiners pay for oil and how much they can sell the refined product for. Therefore, things like supply interruptions or increased demand for oil will increase oil prices and have a negative impact on VLO.

Also, refining capacity is growing rapidly in Asia and the Middle East. Without an increase in demand to offset this extra production Valero’s export capacity will no longer be an advantage. Other risks include weaker economic conditions (a risk for most businesses) and additional increases in industry refining capacity.

I’m not too worried about oil prices going up just yet, and an economic slowdown that could decrease gas prices does not seem likely either. I feel that the strengths of Valero Energy far outweigh the risks listed above.

VLO Purchase Details

- Sector: Energy

- Industry: Oil & Gas Refining

- Purchase date: 6/25/2015

- Portfolio: Dividend Retirement Portfolio

- Shares purchased: 43

- Cost per share: $60.4999

- Commissions: $14.95

- Cost basis: $2616.45

- Yield on cost: 2.63%

- Forward income: $68.80

My new VLO holding will bring in $68.80 of annual income to my portfolio, bringing the total up to $1731.76. I took a slight hit on portfolio yield on cost but nothing a 50% dividend growth rate can’t fix. My portfolio yield on cost is now 3.35%, down from 3.38%.

My Dividend Retirement portfolio has been updated to reflect the addition of 43 shares of VLO.

What are your thoughts on VLO? What are you buying these days? Please let me know in the comments section below!

Hi DE,

I’m with you, buy the Energy sector while its cheap. VLO has one heck of a dividend growth rate! Certainly can’t complain about $68 extra bucks and $1731 of annual income is incredible! Great buy and keep up the good work!

Blake

Thanks Blake! I’d be happy if they maintain half of their current dividend growth rate. Thanks for stopping by!

Ken

I’m holding off on Energy until the Greek deal is done, and the Fed confirm the rate increase. This will do 2 things on oil companies: 1. Decrease oil price due to strong dollars ===> this will push down the stock price. 2. Weeds out the bad ones – this will push the companies with not enough cash-flow into extreme test. They either get forced to decrease dividend or get swoop-up in take over or merger.

I guess, I need to be patience … in the meanwhile, swoop up some more REITs as share price is under more and more pressure.

… in the meanwhile, swoop up some more REITs as share price is under more and more pressure.

Hi Vivianne – thanks for your comment. I’m not too worried about a decrease in oil prices for VLO since that would most likely help the company.

I still love the REITs but I’m a bit overweight on them at the moment. If I see a good deal I might still add some.

Take care,

Ken

Nice addition to your forward income, Ken. This company looks outstanding on paper, and I go to the stores when there isn’t a Chevron around Really liked the write up and congrats on a solid purchase. Best wishes!

Really liked the write up and congrats on a solid purchase. Best wishes!

Thanks Ryan! Glad you liked the write up. Hopefully VLO can keep up their amazing growth.

Ken

Dividend Empire,

Thanks for the post! Now is the time to enter the oil sector. Great purchase. I bought in way to early on Shell, but I may average down at some point. Thanks for sharing.

Thanks for commenting LOMD. Ya I got in a little early on CVX and XOM myself. I’ve already averaged down on CVX and there are a couple of other energy plays I’m eyeing.

Take care

Ken

Ah, Valero. I used to own it a few years ago. Made a lot of money on it. And me, being a dumbass, sold it because I wasn’t confident in the dividend streak. What a mistake that was! I agree that VLO is a very good company and should be held for the long term. Just don’t be stupid like me and sell it any time soon!

Well at least you made some money on it! Thanks for the advice – I’ll try to contain my urges to sell . Thanks for stopping by.

. Thanks for stopping by.

Ken

Three studies that examined the validity of the Gail model in predicting invasive breast cancer estrogen receptor positive and estrogen receptor negative combined have found it to be generally accurate in predicting risk among women who undergo regular screening mammography 42 44 levitra moins cher en ligne

Good info. Lucky me I reach on your website by accident, I bookmarked it.

Exactly what I was looking for, thanks for posting.

Agee of empires iii thhe asian dynasties keygenAsiian femaloe combatBlack erotic letterPenthhouse letters adullt megavideo100 free porn with videosPerru nakedBlak ebny girlks sexWonen making meen slutsNude asan women utubeKiera knightingvly

ude photosSquirting cum womenT1a and t1b breast cancerBeautiful bikini in teenBarbie by doll mattel vintagePumping breast

pumpGirls maui beawch bikinis thongsSmall teen tube

asianAdulpt fre date sitesHoww too ake ypur penis rock hardCowbpy gay songGaay

college cumPlay simpseon porn gamesBryan batt nudeAsiaan eyelid surgery seattleReality kings fulll service saloon part 1 pornStudy tools afult educationFree porno

movies women orgasmStripped nnaked inn publicGood adult games onlineDaughter sucks dads clck sexWanted movgie sex scene downloadGirls dee inn dickPrivate voyeu

tube https://bit.ly/3N7Wm3C Cabo ssan lucaas pussyHornny blaqck amateur youjizzGayy mormon videro https://bit.ly/3jcdYvh Ab latex reducing waist cincher corsetBunette kissiung lesbian sexy thomas vivAss

heyy hole https://bit.ly/2GmAaW4 Porn seduction girl next doorGames on sexNatudal

reasts stwr https://bit.ly/3jj2TZA Lusacious pussy llips picturesMachine fuck rita faltoyanoFakke

nude of male celebs https://cutt.ly/aUSBwff Porn credit card requiredYoutube

lesbian who gett marriedUtuge peeing https://bit.ly/3bIoJFl Voyeur camm toilet pissingExciote policy oon adxult sitesHaity pusesy etro free movie galleriers

https://bit.ly/3gk9GCR Vova twinkOrggy hardcoreCaught havijng real seex iin public https://bit.ly/3jyThuz Two fists one heart

fazioKrystal forscutyt nde bathTeen twink creampiie https://bit.ly/3eMBXRW Voguish slutMagnetic white

boqrd stripsElevzte el 101 facial toner https://tinyurl.com/2l2jfzbo Inflatable dildo

ballSnake on the plane sexBroksn thumb bone ttip https://bit.ly/3DljJkA Interracial free tubesIncest ssex tapeItchy vaghina external https://bit.ly/3qM6QJO Amature female nude videoMilf mom mature ppantyhose moviesRachewl raay nake https://bit.ly/3GaeNAV Faial on mans lapPornn foor franceLill cool j naked https://bit.ly/3pn97Oh 1440 x

900 lesvian picturesBarbara dare streaming vieo

pornInternal fulm oof a female orgsm https://cutt.ly/icjYeFJ Neve campbell denise richards nudeAnnal acrobats 2 torrentStettler sluts https://cutt.ly/aYQokot Free femle trip searchJoe flaccco

naked fakesVirgin girl surprise cream pie https://bit.ly/3zwXdo9Teen ssex kinny girlsHannah harper lesbian gangbangLesboan foot slave video https://bit.ly/3jGl9wQ Hunting intgernet

sexua predatorsEscort pregnant backpageAbi titmuss annd sex https://bit.ly/3hmNFnno Dwarfs fuckingWhaat did jane fonda say

about vagin monologuesFunn free games for teens https://bit.ly/3xwwHK4 Ashley roberdts pusssy

cat dollsYasirr shoro nude picsDogfart maturee powered bby phpbb https://cutt.ly/GUFhjGX Sex education videos for couplesPersian hardcoreSexx i cinema https://bit.ly/3iSmzDa Slave auctin bdsmGermany ajal sexApollonia kotero stripper https://cutt.ly/kUo8Jal To havfe big pusy lipsStimulating orgasmTranxvestite clubb

london https://tinyurl.com/2f6w2sn4 Teeen taints

gameVidaa guererra pussyMiilf pool thong https://tinyurl.com/2m887z96 Free porn giurls lickihg aand fuckingAmandas biig boobs galleriesTranny gf gaalleries https://cutt.ly/vUviCP1 Wolfs rain hentaiGayy men wrestingColdspoot vintage refrigerator freezer

https://tinyurl.com/yfkoabdn Bondaage llesbian pic news feeds feedsFrree mature deep thjroat pornMartha stewart strdiped patchwork quiltgs https://bit.ly/31zBDCD Olser woman fucking pictureFisting pissy assMaryland active adylt

https://bit.ly/2SDpZCG Dicks richmond vaDiannaslist

pornPett pride adult cat food https://bit.ly/3sg6C1U Jaime lee pressley nude photosYouung tteen girl

free porn videosJennifer aniston naked with https://cutt.ly/YJhCEJr Dickk in toesCompulxive sexual behaviorMy boss

fucks my wwife https://cutt.ly/XUQf2Aj Women sex suitChiese fuckFater daughter pirn legtal role playig https://bit.ly/34BM330 Henti flashingCameran diaz lingerieXxxx anal arcfhive https://cutt.ly/DUOGcVH Chicks playing ith

penisMumbai angels escortsLaddy strips goibg through airport

https://bit.ly/3gyUodk Kristin daviss sex taspe scandalSilkk vintageAsss com fikrm jean tight

https://bit.ly/3wwT01T Usa adjlt sexx pussyYoogi bsar hentaiVintage car clubs auguusta gga https://bit.ly/3yLJhq0 Freee oer 60

pornThin whitre cotton t shirfts sexyOffice pornn mmovie

paroxy review https://tinyurl.com/yeb94od9 Nuude exam photosAdult

fostercare license michiganFreee amaterur webcam porn in ireland https://cutt.ly/QU9q7vc Hi rees samples teenPorrn hhub

hentai futanariInternet italy nde https://bit.ly/35TK7DK Stories ssex sheepGayy

porn movvies downloadsEros center rostock https://bit.ly/2SjyS42 Sexy teen clothingBig pussy lips matureRedhead

self pleawure phots https://tinyurl.com/ydun6hj8 Slutt wife training brendaEbony lesboan strapon sexCouugar tyreesomes https://bit.ly/3pok80n Male babysitter fuckedBerlin busty escortsHuuge cocs

andd oold ladiee movies https://tinyurl.com/yhb3oou7 Meganns laww sex offender

listPoolo ralph laureen vintageMegga clit blater vibrator https://bit.ly/3nZpn5e Freee porn movie storiesThe industrial strip clubLatex jea ceampie https://cutt.ly/DUmkd5p 50 dreiver eed housgon off teenDick

versac springfield illinoisGokjs dick https://bit.ly/3cvrfxMAsian ggirls getting fuckd by boyfreindsGirls

with huuge penisesBreasst uplifts https://bit.ly/3gbBudw Facial

flex reviewsCriminal sexual peetration new mexicoReal transgender https://bit.ly/3eMekuf Clark brandon nudeAndroid pussySeexy freee

download videwos https://bit.ly/2PY4if1 Shane pornno starFucking hhot in bedUk seex exhibitionistsKoozie with breastRegiistered sex offenders

inn smyrn gaGaay baaby pornLauusd adult educationLatino hicks gettin fucked doggystyle in the assSakuura with a bigger ass and boobsSocietal stress of beijng aan older malee virginBiig titts

big asss clipsAll over portn thumbsOutdoor russian teensOmarosa nuce picsRoughneck gaysMature and hot nudesNaked muscualrPee drinnking frewe vido streamingAdults onlly

paty cancunDaali lsma gaay abuseNo fees sex dates ukNudee in nnew york

cityNaked killer 1995 torrentFree young gjrls video pporn streamingWifes ass home moviesBigg top

porn studioFinne ass bitches nakled picturesTransvwstite fucking manStudent

teen suicide marin countyBabnes in bondageGay

forced stripSilver daddies desperate ffor a pissThee playground teen club

in lee’s summitReally young girls fuckjng

blac guysEureka springs gayX rated disney porn cartoonsPussy fuskersPornn galleries picsFwmale pornAsian whore ffmm moivesWays to prevent breas canerRussian rred

hairyPeeing her jjeans aat a busstopSprm boatSons fucking

thewir motherSeual wac stimulationTarzann porn tubeDick clkark productions carollyn de voreBdsm femdom illustrate storiesSexx bobby dall

My wife loves to watch your videos with me. She asked me to ask you how much time do you spend on it every day? And how difficult is it for a beginner? She doubts her own abilities after one article. I agree with you, there is a solution, I read about it In this text

Your masterclass as always on top! Lessons from Fred also help me well, what do you think about them? I would be glad if you had a joint lesson with him, as far as I know, he does not mind. I found information In This Article

I agree with you, there is a solution, I read about it in this text: https://telkvnxlnc.site/with/

Images Salon: Oyster Bay, NY The Best Travel Guides (Online and Books) 10 things I wish I knew before visiting Bali – Hopping Feet Can You Guess Who Will DIE?! Vacation Sabotage: Don’t Let It Happen to You! The power of listening: Mteto Maphoyi at TEDxTeen Top Summer Getaways in Europe According to Bloggers Greece: An Ideal 10-Day Itinerary GDP per capita (current US$) Pin on Travel Inspiration for Greece Costco in Iceland – Shop with me (Tour+Prices) Texas Best – Steakhouse (Texas Country Reporter) The Most Inspiring Book Ever Written. BACK TO SCHOOL FREEZER BREAKFAST BOWLS Philadelphia Pennsylvania WORST Parts At Night Do’s & Don’t of Table Service CA Northumberland as a Case Study – Citizens Advice Northumberland Theme: High. Higher. Highest. Traveling to Indonesia? Find Bali hotels Orangutan Rescue Are You a Spender or a Saver? Why? Nova 29a1b9a

Dead composed content material, regards for information .

I consider you as my teacher and I thank you for your videos. Tell me, do you expect me to continue our conversation in personal correspondence or can we communicate here? I want to fulfill my promise, I found information in this article

Your masterclass as always on top! Lessons from Fred also help me well, what do you think about them? I would be glad if you had a joint lesson with him, as far as I know, he does not mind. It seems that this problem is discussed here

My wife loves to watch your videos with me. She asked me to ask you how much time do you spend on it every day? And how difficult is it for a beginner? She doubts her own abilities after one article. I found information In This Article

Schedule – NOST – The Nostalgia Network Is the European Union a Country? Larnaca Airport (LCA) Arrivals – Today 20+ Comfort-Food Weekend Breakfast Recipes Xola Dashboard Indonesia Travel Guide: 12 BEST Places to Visit in Indonesia (& Top Things to Do) Ciara – Insecure *Unreleased* Pin on Good To Know I Got You Fashion design How guest reviews work What is the Standard of Living in Iceland? – Cheapest Places to Live in the U.S. Value Partners Group Home Crafty Tricks That Catch Caribbean Cruisers Out (Again & Again!) Afrophobia in Europe Wellness Destinations For Every Kind of Traveler Bed & Breakfasts in Buk from $40/night – KAYAK Global shipping Bearspaw Inn & Suites Houston TV Guide Commercials – Television Obscurities 0_0f9dd

I will right away snatch your rss as I can not in finding your email subscription hyperlink or newsletter service. Do you’ve any? Kindly permit me understand in order that I could subscribe. Thanks.

There may be noticeably a bundle to learn about this. I assume you made certain good points in features also.

Советую самую лучшую Букмекерскую контору 1xbet

Good web site! I really love how it is simple on my eyes and the data are well written. I am wondering how I could be notified whenever a new post has been made. I’ve subscribed to your feed which must do the trick! Have a nice day!

As I web-site possessor I believe the content matter here is rattling fantastic , appreciate it for your hard work. You should keep it up forever! Good Luck.