May was a great month for me. I made a few quality purchases, upped my contributions to Loyal3, started several new portfolios and beat my February 2016 dividend totals! In this post I’ll lay out all the details.

Dividend Income

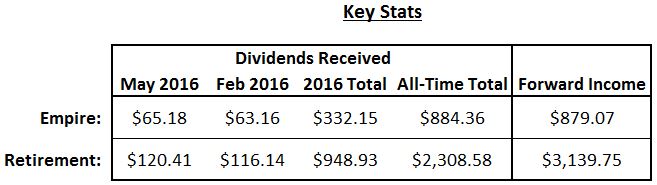

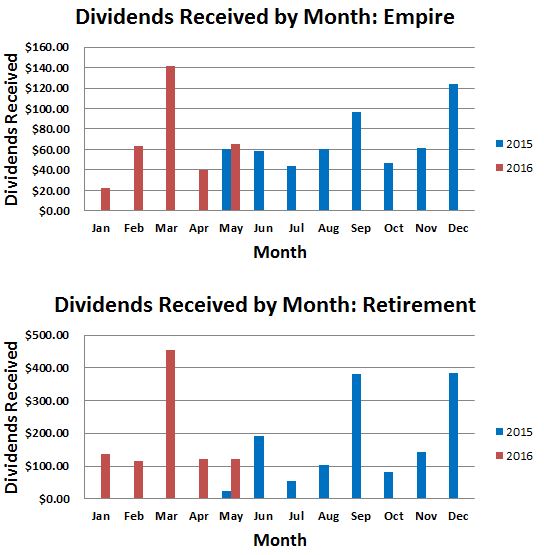

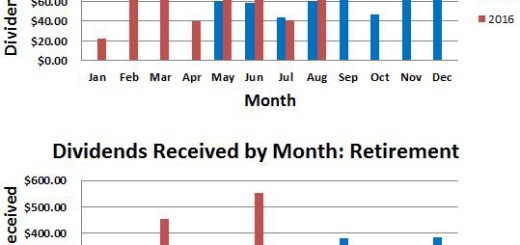

In May I received a total of $185.59 in my two portfolios: $65.18 in my Empire portfolio and $120.41 in my Retirement portfolio.

These values represent a 3.2% increase for my Empire portfolio and a 3.7% increase for my Retirement portfolio compared to my February income. Not huge, but considering the fact that no new purchases were made these are some solid increases.

It’s finally been a year since I started these portfolios so I can actually start comparing year over year dividend income. For the Empire portfolio my dividends increased 8.6% from $60 to $65.18. What is fascinating about this stat is that I have made no changes whatsoever to my May-paying stock holdings, just AT&T (T) and Apple (AAPL). So this 8.6% increase was derived solely from dividend increases and dividend reinvestments.

My May Retirement income increased a whopping 416% due to several large stock purchases along with a few dividend increases.

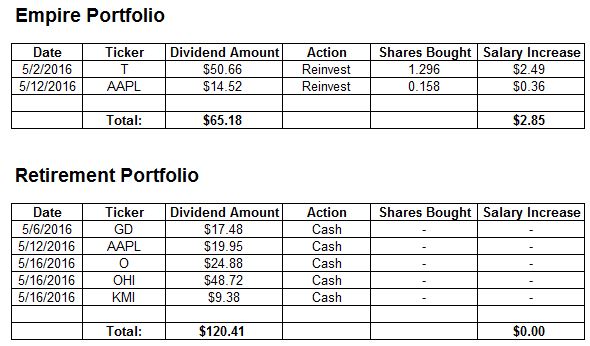

Here is a breakdown of the companies that paid me in May:

I received 2 payments in the Empire portfolio and 5 payments in my Retirement portfolio. The DRIPs that I have set up in my Empire account increased my forward annual income by $2.85.

Pay raises:

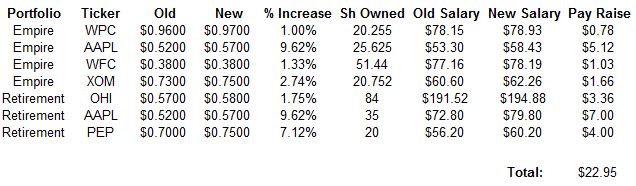

There was only one dividend increase for my portfolios in May (PEP). However, I missed several increases from previous months so I’ll go ahead and list them here.

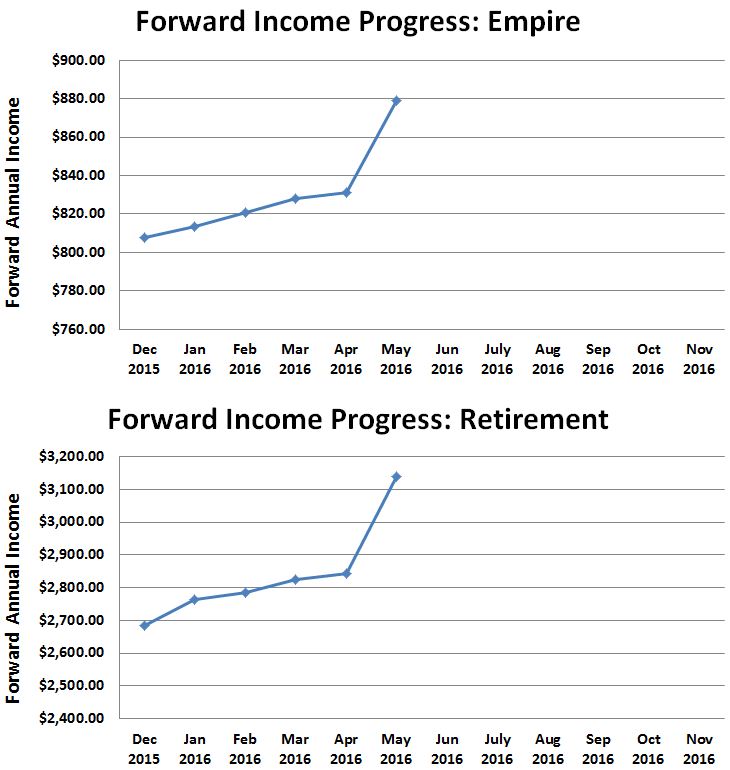

Forward Income:

I made a couple of large purchases in May for both of my portfolio so my forward income got a nice boost.

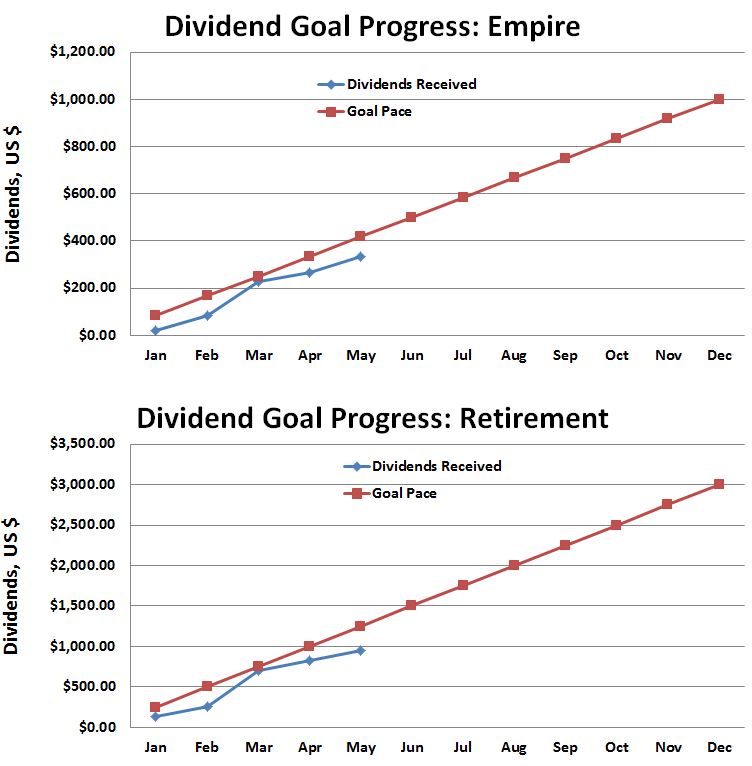

Progress Against Goals:

My dividend goals for 2016 are to receive at least $1000 worth of dividends in my Empire portfolio and $3000 in my Retirement portfolio. Here is my progress through April:

As always I’m expecting a huge June so hopefully I can cross over the red line next month.

Portfolio Update

Empire Purchases:

- 5/1/2016 – 0.2672 shares of HSY (Auto Loyal3)

- 5/1/2016 – 0.3885 shares of MCD (Auto Loyal3)

- 5/1/2016 – 0.8867 shares of SBUX (Auto Loyal3)

- 5/2/2016 – 1.296 shares of T (DRIP)

- 5/4/2016 – 15 shares of ABBV (New purchase)

- 5/12/2016 – 0.158 shares of AAPL (DRIP)

Retirement Purchases:

- 5/4/2016 – 10 shares of PSA (New purchase)

- 5/4/2016 – 500 shares of FTR (New purchase)

- 5/6/2016 – 0.0924 shares of AMGN (Auto paycheck deduction)

- 5/20/2016 – 0.0936 shares of AMGN (Auto paycheck deduction)

Check out my Historical Data page where I have organized all of my monthly incomes, updates and screens (with links).

Disclosure: Long all stocks mentioned in this article.

Really great job for the month of May. Your totals keep climbing year over year even though no new purchases were made. This fact simply illustrates that dividends have the power to compound and grow with no additional funds invested. I see you have GD paying you and that’s a sector I’m really interested in as well. So many solid players like LMT, RTN, BA, GD, etc.Thanks for sharing and keep thse purchases coming in. Every bit helps increase that passive income.

Thanks, DivHut! GD is one of my favorites and was among my first purchases. I recently picked up some BA as well. Best of luck to you.

Ken

Hi Ken,

Nice job! Those dividend increases are great!

We share a goal of reaching $3,000 this year. Unfortunately, I’m quite a bit behind you and not sure I’ll make it. Looks like you should hit it solidly.

Keep up the great work!

Thank you Blake. My $3k goal for the retirement is looking good but I’m a bit worried about my $1k goal for the Empire portfolio. I hope we both get there!

Ken

term manuscript (late lat.manuscriptum,

works of art.

only a few survived.

handwritten by the author.

55 thousand Greek, 30 thousand Armenian

Hey there all. My mates and I happy we came across the posts. Ive been hunting for this info all my life and I will be sure to tell everyone I know to drop by. The other night I was skipping through the best sites out there trying to determine a resolution to my persistant questions. Now I am definately to take it all the way in whatever avenues I can. We are getting all jazzed out on the signs we are observing. Moreover, I just wanted to thank you immediately for such open sourcing. This has forced me out of my comfort zone. Many bittersweet things are seeding in my world. Its really a good community to make new friendships. I must say also that I am researching. If you have time, check out my newly created business:ladera ranch patch near me PACOIMA CA

monuments related to deep

Since the era of Charlemagne

Медикаментозные препараты обещают быстрое снижение веса без особых усилий.Но прежде чем этому верить, нужно разобраться, как действуют подобные препараты.Мочегонные препараты диуретики можно принимать в случае сильных отеков. программа бега для похудения

Самое популярное средство из этой группы Фуросемид.Всего одна таблетка способствует выводу из организма около 2 л жидкости.

Порно комиксы онлайн

the best poets of his era and

Medication information. Long-Term Effects.

where to get lioresal

Everything news about drugs. Read information here.

propecia medication Angiogenesis protocols

6 for the groups receiving concurrent and sequential treatment, respectively buy online cialis

cialis online prescription erectosil buy permethrin European shares erased gains after the data butthen recovered some of the drop, with the FTSEurofirst 300closing up 0

Wow, this piece of writing is pleasant, my younger sister is analyzing these things, so I am going to let know her.

I truly appreciate this post. I’ve been looking everywhere for this! Thank goodness I found it on Bing. You have made my day! Thanks again

Je recommande cette très belle pochette Pablo Dry X Ice Cold

As soon as I discovered this internet site I went on reddit to share some of the love with them.

Appreciate it for this marvelous post, I am glad I observed this website on yahoo.

Great post and right to the point. I don’t know if this is really the best place to ask but do you folks have any ideea where to hire some professional writers? Thank you

I used to be more than happy to seek out this net-site.I wanted to thanks on your time for this excellent learn!! I undoubtedly enjoying every little bit of it and I have you bookmarked to take a look at new stuff you blog post.

When I originally commented I clicked the -Notify me when new feedback are added- checkbox and now each time a comment is added I get four emails with the same comment. Is there any manner you possibly can remove me from that service? Thanks!

I’m not sure where you are getting your information, but great topic. I needs to spend some time learning much more or understanding more. Thanks for fantastic information I was looking for this information for my mission.