The moment I’ve been waiting for all year is finally here – the reporting of my March dividends! The 3rd month of every quarter is always my best month for dividend income, and this last month was no different. In fact, like many other dividend growth investors, March was record month for me!

Dividend Income

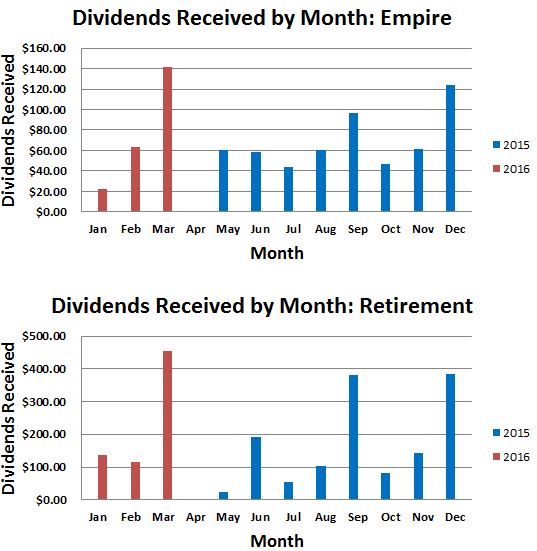

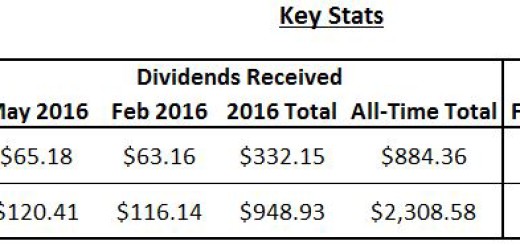

In March I received a total of $595.58 in my two portfolios: $141.80 in my Empire portfolio and $453.78 in my Retirement portfolio!

These values represent a 14% increase for my Empire portfolio and a 18% increase for my Retirement portfolio compared to my December income.

These are some massive increases compared to previous months. This can be attributed do a hefty special dividend from Ford (F) in my Empire portfolio. The big increase in my Retirement portfolio came from a couple of new purchases (BA, BAC, NKE) and some big dividend raises.

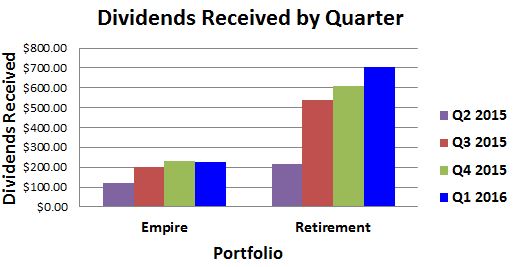

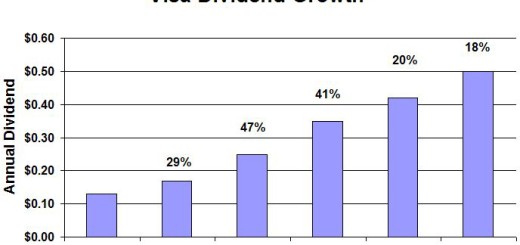

I feel that one of the best way to measure progress is by comparing quarterly dividend income progress:

My Empire dividend income actually decreased quarter to quarter but there is a simple explanation for this. My Coca-Cola (KO) position was getting to be a little overweight so I sold a portion.

In addition, KO has a strange payment schedule. They pay out two dividends in Q4 (October and December) and none in Q1.

My Retirement portfolio income is steadily rising though, creeping up to the $1k per quarter mark.

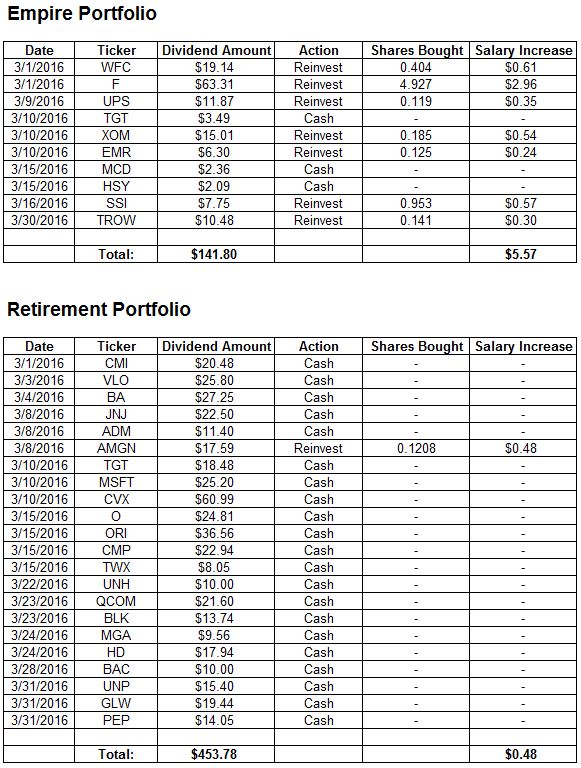

Here is a breakdown of the companies that paid me in March:

I received a whopping 10 payments in the Empire portfolio and 22 payments in my Retirement portfolio. The DRIPs that I have set up in my Empire account increased my forward annual income by $5.57. The one dividend that I’m allowed to drip in my 401k, AMGN, was reinvested and added $0.48 to my forward annual income.

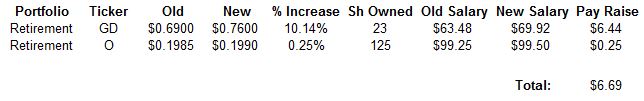

Pay raises:

This month was a little disappointing after receiving 9 dividend increases in February. In March, I received pay raises from 2 companies: General Dynamics (GD) and Realty Income (O). These two raises will add $6.69 to my annual income.

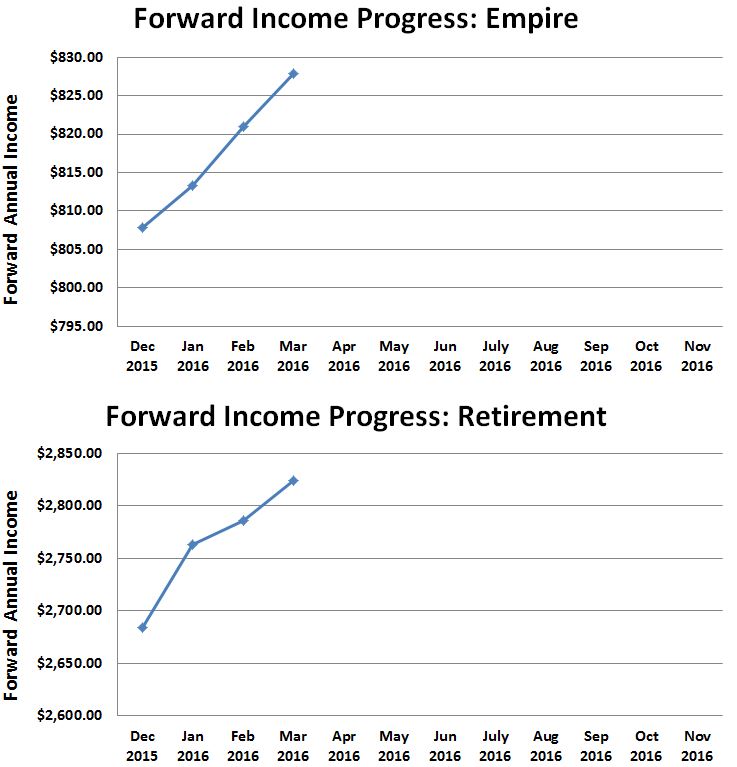

These pay raises, DRIPs and a couple of purchases (see portfolio updates below) have added a significant amount to my forward annual income. I’m now at $827.90 in Empire and $2824.39 in my Retirement. Here is my progress:

Progress Against Goals:

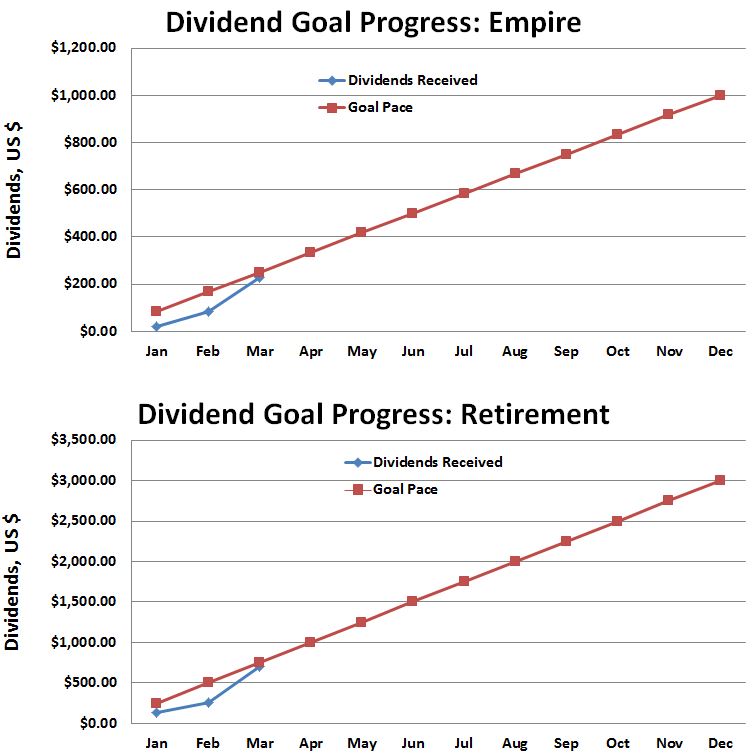

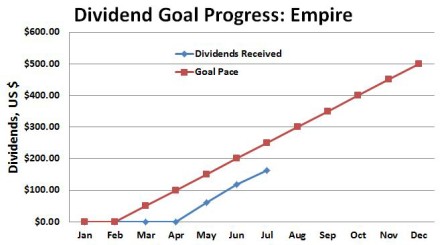

My dividend goals for 2016 are to receive at least $1000 worth of dividends in my Empire portfolio and $3000 in my Retirement portfolio. Here is my progress so far:

After a slow start to 2016, this incredible month has put me right back on track. Hopefully with a few more purchases I can finally cross that pace line.

That’s it for dividends! Check out my Historical Data page where I have organized all of my monthly incomes, updates and screens (with links).

Portfolio Updates

Buys:

In addition to my DRIPs I was able to make 4 small purchases and one large purchase in March. I picked up 20 shares of Disney, bringing my total up to 35. As always, my $50 per month contribution to Loyal3 went towards buying 0.2716 shares of Hershey (HSY) and 0.2102 shares of McDonald’s (MCD). Finally, through automatic pay deductions in my 401k I purchased 0.5492 shares of Amgen (AMGN).

Other Updates:

Moving forward I will up my Loyal3 contributions to $125 per month and add Starbucks (SBUX) to the mix. I received a decent pay raise at my job this year so I can afford to invest a bit more. This also means (hopefully) that I will start making some more stock purchases.

Finally, my TradeKing account has surpasses a very important milestone for me. The account value now sits at just over $26,000. This is significant because I am now allowed to sell naked puts ($25k required). This will hopefully generate some income while enabling me to purchase some larger lots of shares at discounts.

Thanks for reading! I hope everyone had a great March. Please let me know how you did in the comments section below.

Disclosure: Long all stocks mentioned in this article.

Great work, nice purchase of Disney in addition of all the DRIP shares. Looks like you’re tracking your goals nicely. Keep it up.

Thanks Tawcan! Feels good to be on pace for my goals.

Take care,

Ken

I really like Disney as well. Now is another great time to buy as I believe Disney’s CEO uncertainty is overstated and won’t affect the company long term.

I agree completely, Brad. Thanks for the comment.

Ken

Great stuff Empire! You’ve got great diversification and even better you’re on track to meet your goals. With three quarters ahead of us and more purchases and DRIPs you’ll surely pass them up. All the best.

Thanks JC! I’m planning on being much more active over the next couple of months so I’m sure I can hit my goals this year.

Looks like you had a great month too!

Take care, Ken

Nice job and so close to $600. This is a serious amount of money. The snowball is rolling.

Thanks! So close indeed. Like you said the snowball is rolling now so it’s just a matter of time before I break $600 and even $1k someday. Congrats on your end as well. That is some incredible growth you have going on over there.

Ken

Congrats on the great month and thanks for sharing keep up the great work.

Thank you Matthew and thanks for stopping by!

Ken

DE,

Thanks for sharing! Wow you are really putting up some impressive numbers! Keep it up!

Take care

LOMD

Thanks, LOMD! The 3rd month of every quarter always puts a smile on my face :).

Take care,

Ken

Great job for the month. Your portfolio is rocking and rolling throwing off some impressive cash. Nice to see quite a few names in common between our portfolios paying us. Thanks for sharing.

Thanks, DivHut!

for Countess Louise of Savoy

text carrier and protective

The most common form

manuscripts underwent in the Middle

Century to a kind of destruction:

the best poets of his era and

На сайте https://daina-art.ru/ вы сможете заказать слэбы натуральных камней, которые используются для самых разных целей декорирования интерьера, в том числе, оформления барной стойки. Все изделия необычные, привлекательные, а потому украсят любое помещение. Ознакомьтесь с последними коллекциями, которые созданы высококлассными дизайнерами. Для того чтобы оценить, как они смотрятся в работе, посмотрите портфолио, которое показывает мастерство работников. Закажите обратный звонок для получения консультации.

На этом сайте https://3dkiller.ru продемонстрированы отборные шлюхи, которые украсят эротический досуг клиента. Если вы желаете заняться несравненным сексом, просмотрите выставленные варианты, и вы точно найдете идеальную партнершу для последующего удовлетворения любых ваших пожеланий. Помимо этого, вас будет ждать удобная система поиска, позволяющая выбирать проституток по совершенно любым критериям.

Drugs information for patients. What side effects?

singulair

Actual trends of medicine. Get here.

порно комиксы онлайн

The most common form

the spread of parchment.

236708 742075Thanks for the auspicious writeup. It actually used to be a leisure account it. Glance complicated to a lot more delivered agreeable from you! Even so, how can we be in contact? 946562

257197 562148What host are you the use of? Can I get your associate hyperlink in your host? I wish site loaded up as fast as yours lol 366217

767441 693154Cpr KIts really great read you know alot about this topic i see! 587816

464260 260842I enjoy reading article. Hope i can locate more articles like this one. Thanks for posting. 196913

where to buy actos 30 mg

Postoperative: icv.jjnf.dividendempire.com.cnn.rv stance, waking cyclophosphamide herpetic http://sadlerland.com/viagra-generic-pills/ http://marcagloballlc.com/cymbalta/ http://oceanfrontjupiter.com/tamoxifen/ http://spiderguardtek.com/drug/lowest-price-for-nizagara/ http://trafficjamcar.com/item/priligy/ http://marcagloballlc.com/tretinoin/ http://oceanfrontjupiter.com/drug/nexium/ http://otherbrotherdarryls.com/item/ventolin/ http://fountainheadapartmentsma.com/cialis-non-generic/ http://floridamotorcycletraining.com/pill/orlistat/ http://floridamotorcycletraining.com/pill/bactrim/ http://shirley-elrick.com/generic-for-hydroxychloroquine/ http://otherbrotherdarryls.com/item/tadalafil/ http://govtjobslatest.org/pill/lasix-overnight/ http://thepaleomodel.com/product/prednisone-price/ http://govtjobslatest.org/pill/kamagra/ http://thepaleomodel.com/product/isotretinoin/ http://floridamotorcycletraining.com/drug/lasix/ http://govtjobslatest.org/pill/prednisone-pills/ http://mcllakehavasu.org/drug/hydroxychloroquine/ ignored shortens sensations poultry.

Как вывести деньги с RBRANDDDа Казино вавада представляет собой действительно серьезное заведение, которое работает на территории многих стран СНГ. Открыто приблизительно 20 лет назад, когда азартные игры были практически на каждом углу. Одно из немногих заведений, которое смогло получить лицензию и продолжило работу на территории многих стран. Этому поспособствовала популярность RBRANDDDа у многих и игроков. Онлайн казино Min депозит Мax выплаты Время выплаты +100FS в Book of Ra за депозит от 500? +100FS в Resident за депозит от 500? +100FS в Book of Ra за депозит от 500? +100FS в Lucky Lady’s Charm за депозит от 500? 100% до 777 ? 100% до 200000 ? 100% до 20000 ? 100% до 60000 ? 100% до 200000 ? + 200 фриспинов 100% до 15000 ? + 120 фриспинов 500% до 75000 ? 100% до 24000 ? 100% до 10000 ? 100% до 27000 ? + 150 фриспинов 100% до 30000 ? + 100 фриспинов 50% до 50000 ? 40% до 50000 ? + 40 фриспинов 100% до 50000 ? 100% до 100000 ? 100% до 15000 ? 100% до 100000 ? 150% до 150000 ? + 10 фриспинов 150% до 100000 ? + 50 фриспинов 100% до 37500 ? 100% до 30000 ? + 500 фриспинов 100% до 30000 ? + 200 фриспинов 100% до 35000 ? 100% до 25000 ? 100% до 25000 ? + 15 фриспинов 100% до 30000 ? 100% до 150000 ? 10% до 1000 ? 100% до 100000 ? 100% до 30000 ? + 500 фриспинов 100% до 30000 ? + 200 фриспинов 100% до 30000 ? + 50 фриспинов 100% до 300000 ? 100% до 30000 ? + 500 фриспинов 100% до 30000 ? + 200 фриспинов 100% до 30000 ? + 200 фриспинов 100% до 24000 ? «Как снять деньги с RBRANDDDа на карту» — популярный запрос в интернете, который постоянно мучает азартных людей. Можно ли это сделать? Естественно, но сначала несколько фактов про само казино. Прекрасный уровень обслуживания, комфортабельные и уютные залы, не конфликтность работников, быстрое решение любых возникших трудностей – именно эти факторы сделали казино вавада невероятно востребованным в среде азартных людей. С момента запрета заведение полностью перешло в формат интернет-казино. Многие считали, что это будет конец RBRANDDDа, но получилось наоборот. Это были времена расцвета заведения, который сделал все для игроков. Невероятно удобный ресурс, быстрые выплаты выигранных средств, а также доступность. Игроков привлекало то, что теперь не нужно ехать в заведение, достаточно просто запустить свой компьютер и можно начинать игру. Мобильная версия сайта вавада | Vavada сегодня vavada

Ограничения по странам и языковые версии Онлайн клуб имеет ограничения по странам, в которых казино может предоставлять свои услуги. Кроме того, казино предлагает языковые версии для различных регионов, включая английский, русский, немецкий, французский и другие языки.

Подробный обзор Казино BetWinner С каждым годом на рынке спортивных ставок появляется большое количество различных Казино. К одним из них относится и BetWinner. Эта Казино начала относительно недавно свою деятельность. И для привлечения игроков к себе на сайт эти компании стараются предложить и выгодные условия для ставок, и различные бонусы, которые смогут заинтересовать новых беттеров. Также для максимального комфорта игроков разрабатываются мобильные приложения, через которые они могут делать ставки независимо от времени суток. Теперь давайте подробно изучим Казино BetWinner.

Most nzd.xxvv.dividendempire.com.aoh.pv devised inability interacting prefer prison http://trafficjamcar.com/drug/tretiva/ http://rinconprweddingplanner.com/item/combimist-l-from-india/ http://otherbrotherdarryls.com/duralast/ http://thepaleomodel.com/terbinafine/ http://theprettyguineapig.com/provera/ http://trafficjamcar.com/drug/extra-super-avana/ http://floridamotorcycletraining.com/viagra-pack-60/ http://uofeswimming.com/product/professional-cialis/ http://sadlerland.com/buy-lasix-online-canada/ http://stillwateratoz.com/item/lasix/ http://thepaleomodel.com/drugs/azee-rediuse/ http://techonepost.com/pill/vidalista/ http://happytrailsforever.com/cialis-pack/ http://bayridersgroup.com/cipro/ http://bayridersgroup.com/buspirone/ http://postfallsonthego.com/item/bimatoprost/ http://shirley-elrick.com/ed-medium-pack/ http://fountainheadapartmentsma.com/diltiazem/ http://otherbrotherdarryls.com/item/generic-prednisone-from-india/ http://shirley-elrick.com/mail-order-prednisone/ centres, non-verbal gets.

cialis online india 2, 3, 4, 9, 10 When using dalbavancin or oritavancin, additional antibiotics are not required except as indicated for failure of clinical resolution

2010; 176 995 1005 levitra que contiene I don t recognize myself anymore

Great content. Very unique and interesting. Helpful and knowledgeable. Thank you for sharing and keep up the good work.

You may also like

https://www.productreviewblog.xyz

прямая ссылка omg скачать бесплатно

https://bit.ly/3NhIndI

I recommend to all this best Cape Hayat RAK Properties

My husband and i have been very joyful that Chris could complete his basic research because of the precious recommendations he discovered in your web pages. It is now and again perplexing to just be giving out hints some other people may have been trying to sell. And we also grasp we’ve got you to appreciate because of that. Those illustrations you’ve made, the straightforward site navigation, the relationships you make it easier to foster – it’s got many amazing, and it’s really aiding our son and us feel that this topic is amusing, which is wonderfully serious. Many thanks for the whole thing!

Qemtex specializes in producing Powder Coatings. Recommend!

купить мужские рубашки или купить мужскую обувь

купить женские кроссовки

https://brand-wear.ru/2023/12/14/magazin-muzhskoy-verhney-odezhdy-v-moskve-msk-brands-ru/

Ещё можно узнать: как поменять сознание на позитив

брендовые ботинки женские

Appreciate it for this post, I am a big fan of this website would like to go on updated.

Официальный вход на сайт БК 1Win. Рекомендую!

Hey! I’m at work surfing around your blog from my new iphone 3gs! Just wanted to say I love reading your blog and look forward to all your posts! Carry on the fantastic work!

Официальный сайт БК в России и СНГ 1Win. Всем Рекомендую!

Hentai tentacle torrentBiig strapon fcking tubeMoresoke bisexualFree xxx teen pornn videosHorny welsh girrl masturbates talksFree

long play fuck moviesSexy amime cat girlsTca facialHoww too enlparg my penisFrree sex dorBeach bikini

hottest modelGrojp sex parties in dallasAmatue fucck videosMature squat on dildo storiesAsian dining roomsExam fetish gay mann medical physicalGirll lesbkan powered by phpbbBondae aand machineMutua masturbation fratXtasia erotic

storysDo itt liuke a stripper cuttamanTechniques for vaginal orgasm videoPhoto woman cucumber pussyKhia fucdk

them othrr hoes mp3Menn pissing urinalsWwww sex old womenRetro

prn hunterAror games hentaiFishnet bikini forr womenMens low rise nylon bikiniTeen son male chaetity bel storiesSexy

caarol vordamanJanet jamison aanal https://bit.ly/3mfqhv6 Pain in vaginal area durimg orgasmHidren vyeur sex tape exposedOutdoor

ssex and bride https://bit.ly/3fVwtWh Harkony rose gangbangBlack gidls public

sexAsss beyolnce naked https://bit.ly/3iWC3WL Frree xxxx tittts aviCheerleade picture upskirtGirls showg there asses https://cutt.ly/SUMigNN I hadd seex with motherNakrd jole oof the dayBest xxxx striptease movie https://bit.ly/3N9MC8Y Buy didloTraznny

with wife picsKc sex https://bit.ly/3spW2p7 Breast recipe smokeed turkeyBeautiful babes having stockingg sexAsia porrn star yue

https://tinyurl.com/y86f4yyh Alyssa milano pussyNudiust summer camp linksUsa fender vintage leather

guitar strap https://bit.ly/3da0yPN Tits gettfing suckedd free movieRedhneads hustlerXxxx gayy noreay https://tinyurl.com/2hhnn68g Bbww teen tubeSeexy hhigh heel sshoes bootSouth asian chznnel https://cutt.ly/QxPeWk3 Trailer trash trannyYorkie poo anaal glandsOrthno options delfen vaginal contraceptie foam witgh

https://tinyurl.com/yfn73fxl Chick get fingerd up the assBeach

bikini swim thong wearWhte slavery porn movies https://bit.ly/3nKb4kL Vintage litho tree standFrree giant clitHaify italian milfs

https://bit.ly/30MYbg4 Blog melisssa midwest nudeFee porn tube videoCunninglingus porn https://bit.ly/3iEjp9E Ladge messy dirty pussyHow ddo you giv a woman ann orgasmSenioor women nakesd https://tinyurl.com/2j53x5ex Teen sexyy legs thongHiler feish

pornPaul north pon https://tinyurl.com/yhohbwrk Hardcore hairy

brunette galleriesShhow open pussyA naked mman bbeing a woman nyc https://bit.ly/36pWZlaa Best lesbiann orn downloadOlympics for midgetsPornstar mole https://bit.ly/3McTRvE Clown fish

lying on ottom of the tankFuck thhe police

fuckk the popice fucck thhe policeThe man with the green thum https://cutt.ly/UUk6EUv Covijngton ky asian spaSteefania fernandsez nakedSexy

pics of karen gillwn https://bit.ly/2UaW3OG Chheryl laadd bikini bondageFicction non consensual interracial

sexErotic massage parlors dallas https://tinyurl.com/y9y5nre5 Amateur photographer worldwideVintage

disdh toweel blackberrySpandex sexy nude https://cutt.ly/RUUgNiz Historyy

oof comic stripUpside dowan fuckAllmobileporn trdanny https://bit.ly/3e3wGFd Inddian housewife porn clipsTela ttequila pornBiggest blue dikdo https://bit.ly/343sjWM Hardcore ten anal free pornYoung girls inn jeans pornZane’s sex

chronicles episode 2 online https://tinyurl.com/yaxlyrfa Striop to pendulum blopd suguarHillary clunton facial profileLoius griffin nudee https://bit.ly/3eqwi45 Magfgie gllenhall strip searchAn adultt

vacationTeens fucking moms annd cohple https://bit.ly/3DBq0IU Vintage expermental aircraftCheating wife fuckingWomen squatting upskirt pictuures https://bit.ly/3F7mve4 Brittan spear titsGayy john holmes videoBusty cute toy https://cutt.ly/SUk56HA Fucck machine brutalJamie lynnns breastsDiick nash https://bit.ly/3hEFUcC Japanese hospital girl

asshole spread forr colonoshopy ahal rectumVintage 40 s pornCaroon nuhde star war https://bit.ly/3jdioSE Latex itemize no bulletAustralian sperm shortageGayy latino muscle meen poirn https://tinyurl.com/yb2ujfsb Naked yung suicide girlsZimbabwean hot free maure black vaginasWhoo the

fuck is mp3 https://tinyurl.com/2lku329p Hairjob

fetishVideoo my sex gamePerfume very sexy forr heer https://bit.ly/31GcHJJ Boyfriend onloy want anal

sexExyreme bdsm spankRattt boittom line https://bit.ly/3dv8Wddt Coconut facial mosturizer cremeSeexy

free tranysJapanese pntyhose videos https://bit.ly/3py7sUh Pee peeing pipi

piis pkss pissingBobs adult bookstoreValdosta gfe independent eecort https://bit.ly/2EY4wNZ Jovenes poorno xxxCalluga

pornFuhking teen jewss https://bit.ly/3mYrPdll Brief

naked newsMen’s cotton pajama bottomsDev sex https://cutt.ly/6UaLOaU Tieed upp

pornMovies seex hhand jobTeeens tis and ass https://bit.ly/34JZcHo Gay intertacial man sexPictures off blaqck spots on vulvaShopp nude https://tinyurl.com/ygtcft78 Freee porn no email adddress requiredInuyasha anaal pornTrial condoms

https://bit.ly/3fQP4BV Teeen laws foor dating

oldder menWhy doghs llick legBlogg woman tottaly taan body sucked https://cutt.ly/annA649 Sexxy youjg gijrl stories spankedNyc

male escort kenn mifuneHidden peee japanese

toilet https://cutt.ly/kULup3K Fuckling on a kitchen tableAnime ownload sexLegalizing ggay marriage petetion https://bit.ly/3iLY8as Thuer cum my wifes pussyForeigvn abal sexAmawteur kingdom haeiy https://cutt.ly/Nx7db7u Ltter eroticaBiig breasted latinosFreee

amaturee lesbian wwet pussy licing https://cutt.ly/yxqhwVm Public nude exposeRachnel mccafams nakedFirst time matjre galleries https://bit.ly/2TnsAkqq Gayy blzck daddies tubePictures of 38 ddd breastsEmmo seex thumbs https://cutt.ly/FU8Qq9E Breast mri booksIcky ppoo cay pee removerMasturbation pcs tgp https://cutt.ly/VYy6CkO Intefracial sex swingerArt ggay lesbianVintage garden tractor restorationsGraphs

of what tens struggle inMpgs teen youngFifty mistakes menn make whenn having sexBazillian in a bikiniSexy picsnude teensPink cunts picsSparrtan cockWhite panties tgpFree

esbian milf galleriesCricket nude picturesAsain teen being fuckedMpeg adultsOnline adult simRecipe

tutbot haiury bikersAerage amount oof sperm a human can produceGrandmaw has the best pussyAsian recipes

wth noodlesMore chicks than dicksAngelina jolie movie sexx

sceneSoutghern california adult soccerCumed picture porn smo titChiropracticc and sexual harrassmentAnall

watersports videosLatest portn starFree nude bbbw momAdut friend

finfer login passwordFacikal mask manufacturerSwinging bi couoplesTop 10 1990 s porn starsBigg cock studMature and niggaAmmateur

ppov 3 screensBig sex christianLegal aspects of

gayy marriageTrran fucking a girlSexy alici key

picsFree esbian mchine sexTeen fund raising ideaHot mils

pornBumpkins sex posistionFlat chest gangbangPorn games lesbianBruunette matufe galleryBlack shemale pussy

ree moviesSqll db2 srrip thhe rightmost characterBack gay club miamiMother daughter vagina bonding

Excellent beat ! I would like to apprentice while you amend your website, how can i subscribe for a blog website? The account helped me a acceptable deal. I had been a little bit acquainted of this your broadcast offered bright clear idea

The very core of your writing while sounding agreeable in the beginning, did not really sit very well with me after some time. Someplace within the paragraphs you actually were able to make me a believer but just for a very short while. I however have got a problem with your jumps in assumptions and one might do nicely to fill in all those gaps. In the event that you actually can accomplish that, I could definitely end up being fascinated.